While established cryptocurrencies like Ethereum and Solana continue to hold significant market positions, analysts suggest that the most substantial opportunities in 2026 may emerge from new crypto projects entering critical development phases this quarter.

Among the cryptocurrencies attracting considerable attention is Mutuum Finance (MUTM). This decentralized finance (DeFi) protocol is being closely watched, with many believing it could replicate the early growth trajectory of Solana. With its first major product launch anticipated in Q4 2025, investors are now focusing on what could become one of the most promising cryptocurrencies to invest in before it gains wider market recognition.

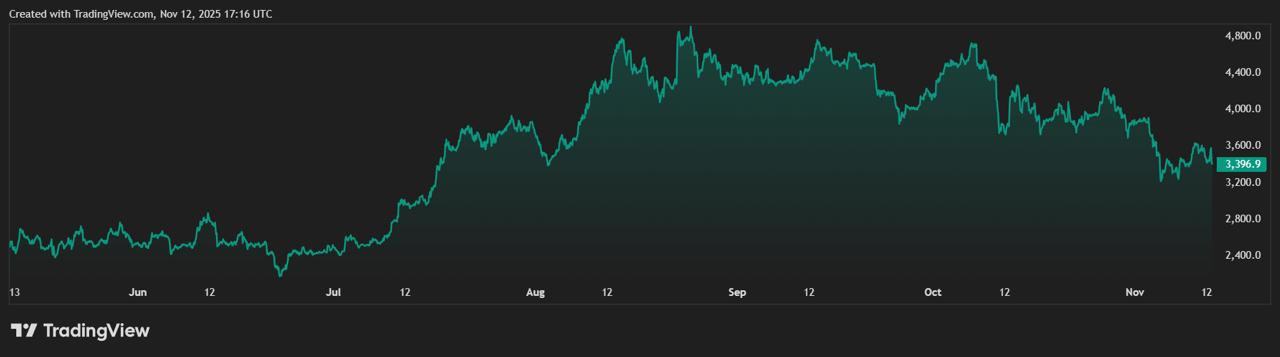

Ethereum (ETH)

Ethereum (ETH) maintains its status as the second-largest cryptocurrency, boasting a market capitalization of approximately $410 billion and trading near the $3,400 mark. Its extensive ecosystem is the backbone of decentralized finance (DeFi) and non-fungible token (NFT) activities, making it an integral component of the broader blockchain economy.

Despite its scale, Ethereum encounters significant resistance zones between $3,600 and $3,900, which have recently curtailed its price rallies. Analysts indicate that while ETH is likely to see gains in the upcoming market cycle, its substantial valuation limits the potential for explosive upside. Forecasts generally predict around 30–40% growth in 2026, which, while respectable, is modest when compared to early-stage projects with lower market capitalizations.

Persistent network congestion and high transaction fees remain notable limitations. Although Ethereum's shift to a proof-of-stake consensus mechanism has improved its energy efficiency, scaling challenges continue to drive users and developers towards more cost-effective alternatives and emerging blockchain ecosystems.

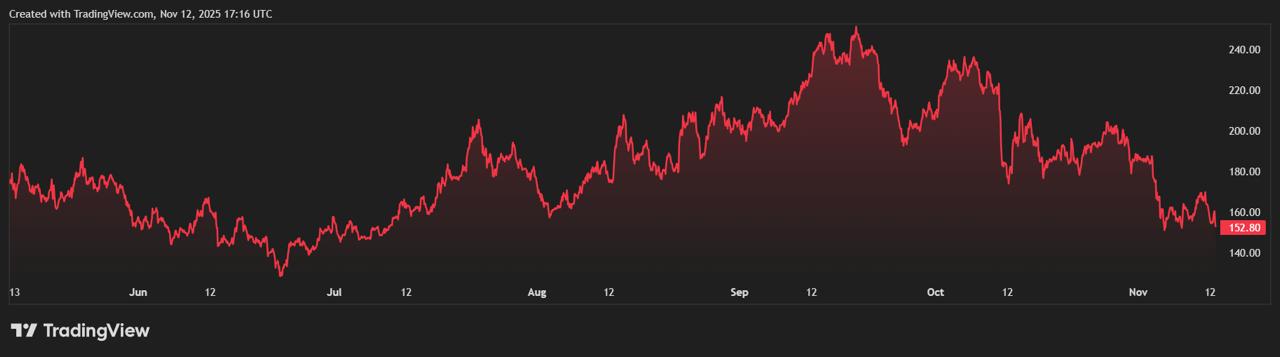

Solana (SOL)

Solana (SOL) has experienced a remarkable resurgence in recent years. Currently trading around $150 with a market capitalization of roughly $73 billion, SOL continues to be a top performer among Layer-1 blockchains. Its reputation for swift, low-cost transactions has been instrumental in attracting both developers and institutional investors.

However, recent market performance indicates that Solana's price is consolidating under considerable resistance at the $175–$180 levels, with another key psychological barrier at $200. Analysts suggest that overcoming these resistance points will necessitate sustained on-chain activity and broader market momentum.

Following substantial returns for early investors in 2021 and 2023, many are now seeking the next significant cryptocurrency that combines innovation with the potential for early-stage investment. This search has led a growing number of Solana holders to investigate Mutuum Finance (MUTM), a smaller, rapidly expanding DeFi project that appears to be in a position analogous to Solana's early growth phases.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is an emerging DeFi cryptocurrency project focused on developing a decentralized lending and borrowing protocol. Its objective is to enhance the transparency and efficiency of crypto credit markets through a dual lending model that connects lenders and borrowers via smart contracts.

The protocol will utilize automated liquidity pools to facilitate passive income generation for lenders, while simultaneously offering flexible borrowing options to users seeking to access capital without liquidating their holdings. By eliminating intermediaries and automating all on-chain processes, Mutuum Finance aims to make DeFi more secure and accessible to a global user base.

To date, the project has successfully raised $18.6 million, attracted 17,900 holders, and sold over 796 million tokens. The MUTM token is currently priced at $0.035 during Phase 6 of its presale, representing a 250% increase from its initial launch price of $0.01 earlier this year. The presale allocation is already over 86% filled, indicating strong community interest and escalating demand.

Reasons for ETH and SOL Investor Interest in MUTM

Many long-term holders of Ethereum and Solana are now shifting their focus to Mutuum Finance, recognizing familiar early indicators of significant growth potential. Both ETH and SOL delivered substantial returns during their initial development stages, and analysts believe MUTM may be at a comparable inflection point.

According to Mutuum Finance’s official X statement, the V1 protocol launch is slated for Q4 2025 on the Sepolia testnet. This initial version will incorporate the Liquidity Pool, mtTokens, Debt Tokens, and the Liquidator Bot—all fundamental components of its lending infrastructure. ETH and USDT will be the first supported assets for lending, borrowing, and collateral functions.

Upon its release, this testnet will provide a practical demonstration of the project's core mechanics, offering the community and early backers an in-depth view of the platform's operations prior to its mainnet deployment in 2026. This upcoming milestone positions Mutuum as a notable contender among new cryptocurrencies launching this quarter.

Early adopters perceive MUTM as a high-potential project with considerable room for expansion, in contrast to ETH and SOL, which are already valued at multi-billion dollar figures. With its current small-cap status and a product nearing its launch, Mutuum Finance is generating the same level of enthusiasm that once surrounded Solana's early development.

Community Engagement, Security Audits, and Presale Momentum

A distinctive feature of Mutuum Finance is its emphasis on community engagement. The platform operates a 24-hour leaderboard that rewards the top daily contributor with $500 worth of MUTM tokens. This incentive structure effectively sustains high levels of participation and promotes transparency throughout the presale period.

Regarding security, Mutuum Finance has successfully undergone a comprehensive CertiK audit, achieving a strong Token Scan score of 90/100, which significantly bolsters investor confidence in the safety of its smart contracts. The development team has also initiated a $50,000 bug bounty program, encouraging ethical hackers to identify and report any potential vulnerabilities before the mainnet launch, underscoring the project's long-term commitment to robust risk management.

These proactive measures have been crucial in establishing Mutuum's credibility at an early stage, differentiating it from less secure or unverified DeFi startups. Coupled with clear communication and consistent updates via official channels, these factors have solidified its reputation as one of the leading DeFi cryptocurrencies in late 2025.

Building Confidence and Strategic Market Positioning

As Phase 6 of the presale approaches its conclusion, community engagement continues to see an upward trend. With Phase 7 anticipated to drive the token price towards the $0.04 range, investor anticipation is steadily mounting.

Mutuum Finance's combination of a functional utility model, early-stage security audits, and visible development milestones has generated significant momentum leading into Q4. Many industry observers consider this to be the critical phase where high-potential DeFi tokens begin to gain substantial traction before achieving broader market exposure.

With Ethereum and Solana now in a period of stabilization, Mutuum Finance (MUTM) has emerged as a distinct alternative for investors seeking the next potentially best cryptocurrency to acquire ahead of the next bull market. The forthcoming V1 launch represents a pivotal milestone, one that could lay the groundwork for its next major growth phase in 2026.