BitMine Technologies, a crypto treasury company led by Tom Lee, has purchased 7,660 Ethereum (ETH), valued at approximately $29.28 million, from Galaxy Digital, a digital assets and data center firm. This transaction was identified through data from Arkham Intelligence and occurred within the last 24 hours.

The purchase was executed via Galaxy Digital’s over-the-counter (OTC) trading desk. This method allows for private transactions, designed to mitigate significant price fluctuations that can occur on public exchanges.

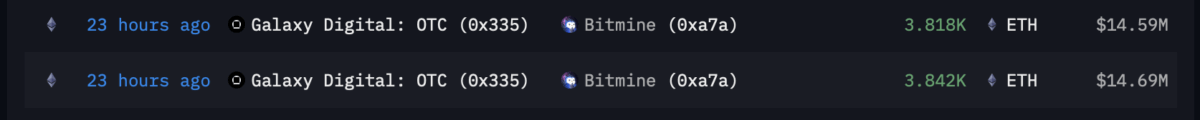

Arkham data indicates that Galaxy Digital transferred the ETH in two separate transactions, with batches of 3,818 and 3,842 ETH sent to BitMine’s primary wallet. The average purchase price was around $3,823 per ETH, a figure closely aligned with Ethereum's trading price at the time of the transaction.

BitMine's "Alchemy of 5%" Strategy

This substantial acquisition is in line with BitMine's strategic objective, known as the "Alchemy of 5%." This initiative, spearheaded by Chairman Thomas Lee, aims to accumulate up to 5% of Ethereum's total circulating supply, which currently stands at approximately 120 million tokens.

Currently, BitMine holds an estimated 2.8% of the total ETH in circulation. This holdings are valued at roughly $12.24 billion, positioning BitMine as the world's largest corporate holder of Ethereum.

The company began its aggressive accumulation of ETH earlier in 2025. In October alone, BitMine acquired over 200,000 ETH, a purchase valued at $800 million. More recently, the company successfully raised $365 million in capital by selling 5.22 million shares at a premium price. BitMine's chosen method of purchasing ETH through OTC deals helps it avoid the volatility inherent in open market exchanges.

Market Sentiment and ETH Price Outlook

While large institutions like BitMine are actively increasing their Ethereum holdings, smaller traders appear to be adopting a more cautious stance. Data from the prediction market on Kalshi reveals a decline in the probability of Ethereum reaching $5,000 by the end of 2025. This probability has fallen to 31%, down from 40% in the previous month.

This shift in sentiment is partly attributed to uncertainty surrounding the Federal Reserve's potential interest rate cuts this month. Following the FOMC meeting in October, Fed Chair Jerome Powell indicated that the current state of the economy has not significantly changed to warrant further rate reductions.

Ethereum is currently trading at $3,879. This represents a modest 0.27% decrease over the past 24 hours. The cryptocurrency concluded the month of October with a 13% decline.

Despite this prevailing skepticism, crypto analyst Ted Pillows suggests that a rebound in Ethereum's price could occur if more significant buyers emerge. He commented on the potential impact of large-scale purchases:

“Bitmine bought $29,280,000 in $ETH today. They are consistently buying $200M-$300M in Ethereum each week. We need a few more buyers like that, and ETH reversal could happen.”

Pillows shared these remarks in a post on X (formerly Twitter).