Bitmine's Ethereum Holdings Surpass $12 Billion

Bitmine has significantly expanded its Ethereum holdings, now possessing over 3.126 million ETH, valued at approximately $12.47 billion. This substantial accumulation represents about 2.6% of Ethereum's total circulating supply. The company's strategy appears to be focused on building long-term reserves for staking and treasury diversification, as evidenced by the continuous increase in its ETH token count despite recent price volatility.

TOM LEE JUST BOUGHT ANOTHER $135M OF ETH

— Arkham (@arkham) October 29, 2025

2 fresh addresses just withdrew a total of $135.1M of ETH from FalconX. These movements match Bitmine’s known acquisition patterns.

Bitmine currently holds over $13 BILLION of ETH. They are targeting 5% of total supply. pic.twitter.com/BwZVEiblJP

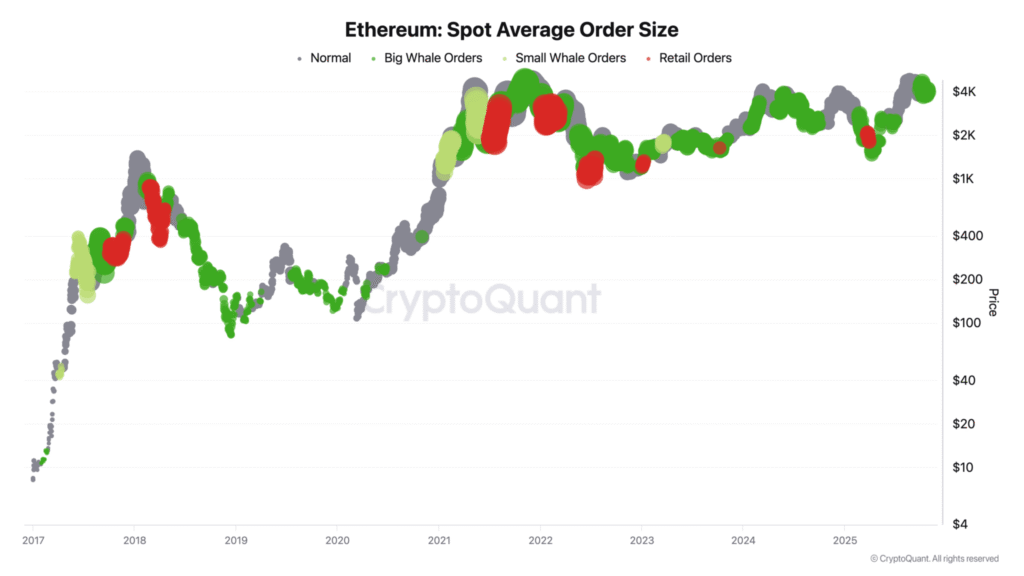

Whale Orders Indicate Renewed Institutional Confidence

On-chain data reveals a resurgence of confidence among Ethereum whales and major institutional players. Two newly created wallets, reportedly linked to Bitmine, recently withdrew $135.1 million worth of ETH from FalconX, signaling an increase in exposure to Ethereum. This accumulation activity is further supported by data from CryptoQuant, which shows an uptick in average order sizes in spot markets. Large whale orders are reportedly accounting for approximately 0.03% of total trade volume, with an average purchase price of $3,986 per ETH.

These significant orders are concentrated around the $4,000 price level, suggesting that institutional desks and high-net-worth investors are strategically positioning themselves for potential upward price movements. The presence of consistent "green clusters" in trading data further indicates ongoing accumulation rather than short-term speculative trading. This pattern of whale activity is reminiscent of consolidation phases observed in 2020 and mid-2023, both of which preceded substantial rallies in Ethereum's price.

Technical Outlook for Ethereum

Analyst Crypto Caesar highlights the importance of Ethereum maintaining its current trading range to preserve its bullish structure. The weekly chart indicates that ETH has recently retested a critical resistance zone near $4,650. A sustained move above this level could signal a potential recovery, while a failure to hold this resistance might lead to a correction towards the $3,000 mark.

$ETH – #Ethereum: It’s important that we don’t fall back into that range imo. pic.twitter.com/gzfFBY97xu

— Crypto Caesar (@CryptoCaesarTA) October 29, 2025

As of the latest reporting, Ethereum is trading around $3,976, consolidating below the significant $4,000 psychological barrier amidst increasing institutional inflows.