Ethena Price Shows Signs of Shifting Direction

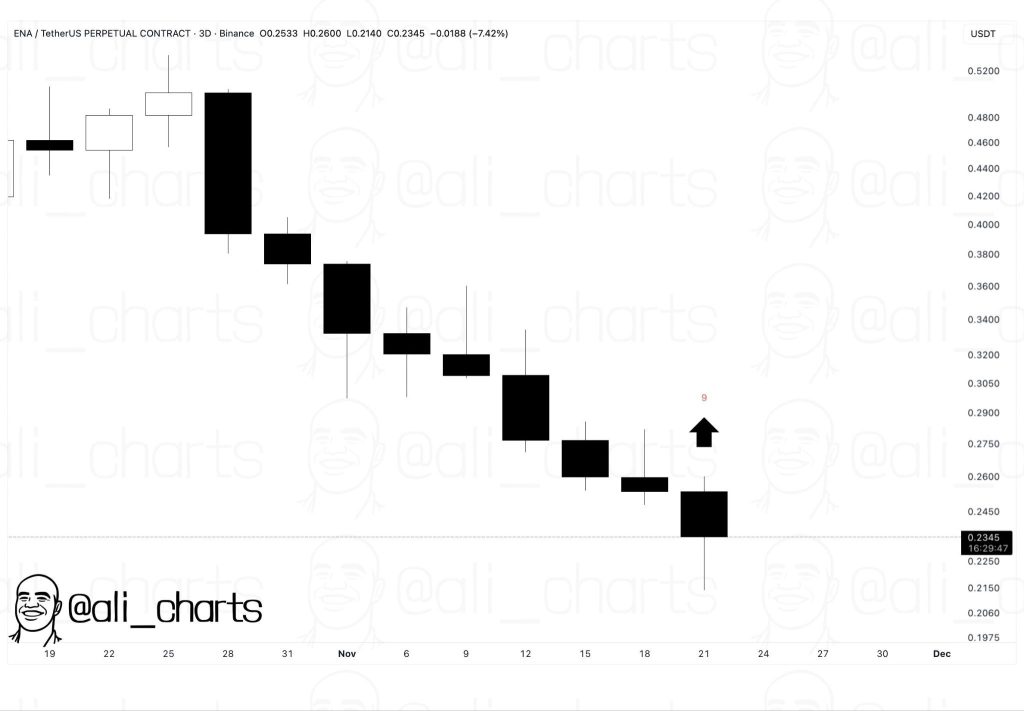

Ethena (ENA) is showing early signs of recovery, with traders beginning to express renewed interest. After a significant slide throughout November, from approximately $0.52 down to $0.23, the ENA price appears to be attempting a reversal.

The ENA chart had remained relatively stagnant for several weeks, but this trend may be changing. A key development is the emergence of a TD Sequential buy signal on the 3-day chart, as identified by analyst Ali Martinez.

For technical traders, this indicator typically suggests that a downtrend might be losing momentum, potentially signaling an upcoming reversal. While not a definitive guarantee, ENA has historically responded positively to similar signals, particularly following prolonged selloffs.

ENA Challenges Its Downtrend Resistance

The potential shift in ENA's trajectory is further supported by its current price action. The ENA price is actively challenging a significant descending trendline, a level that has previously acted as resistance since late October.

Clifton FX highlighted that the token is attempting to break above this line on the 4-hour chart, drawing considerable attention from traders.

According to Clifton, a successful and sustained breakout above this trendline could trigger a rally of 50% to 70%. Such a move could potentially drive the ENA price towards the $0.35–$0.38 range.

This price zone previously served as support earlier in the month before transitioning into resistance. Therefore, it represents a logical target if positive momentum continues to build.

However, ENA must still validate this potential breakout. Pressing against the trendline is a preliminary step; a strong and confirmed close above it is necessary to solidify the bullish case.

Support Levels Hold Firm, Offering Encouragement

A contributing factor to the growing optimism surrounding ENA is the resilience of its support levels. The ENA price recently found a floor around $0.2140 and has maintained stability at this point, which has proven to be a reliable support area multiple times this quarter.

Each instance where the price tested this level saw buyers step in, preventing further declines. This pattern typically indicates that underlying demand remains present, awaiting a catalyst to re-engage.

Trading volume also appears to be stabilizing, suggesting that panic selling may be subsiding. When the ENA price ceases to make new lows and trading activity normalizes, the market often begins to establish a base. The formation of higher lows from this point would further strengthen the bullish outlook.

Outlook for Ethena (ENA)

It is crucial to note that no definitive confirmation of a trend reversal has occurred yet. The ENA price still needs to successfully break above the descending trendline, reclaim key resistance levels, and demonstrate sustained follow-through.

A strong daily closing price would significantly boost trader confidence. Without this confirmation, any current bounce risks fading quickly.

Nevertheless, the current technical setup appears more promising than it has in recent weeks. The appearance of a fresh buy signal, coupled with improving chart structure and increasing attention from analysts, has placed ENA back on the radar for many traders.

Whether this leads to a substantial rally or a short-term recovery, it is evident that Ethena is no longer being overlooked in the market.