Bitcoin's Price Volatility

Bitcoin's price movements remained negative on Sunday, with the asset once again falling to a new six-month low of $93,000 before initiating a minor recovery. This downturn follows a brief rally just a week prior, which saw the primary cryptocurrency reach just over $107,000, driven by positive developments from the United States.

The rally from $104,000 proved to be short-lived, and the subsequent correction has been substantial. Initially, Bitcoin returned to $102,000 and saw a brief bounce, but its price trended downwards as the business week progressed. Friday marked the most significant price decline, with the cryptocurrency plummeting to $94,000 for the first time since May.

Bulls intervened and pushed the asset to nearly $97,000 on Sunday. Sideways trading persisted for most of the weekend until Sunday afternoon. At that point, Bitcoin's market situation worsened again, dipping to another six-month low of $93,000.

Since then, Bitcoin has recovered a few thousand dollars and is currently trading close to $96,000. However, market observers maintain that the overall structure of Bitcoin has shifted, indicating it has entered a new phase of a bear market. For the immediate term, its market capitalization remains just above $1.9 trillion, while its dominance over altcoins has settled at 57.2%.

Altcoin Market Performance

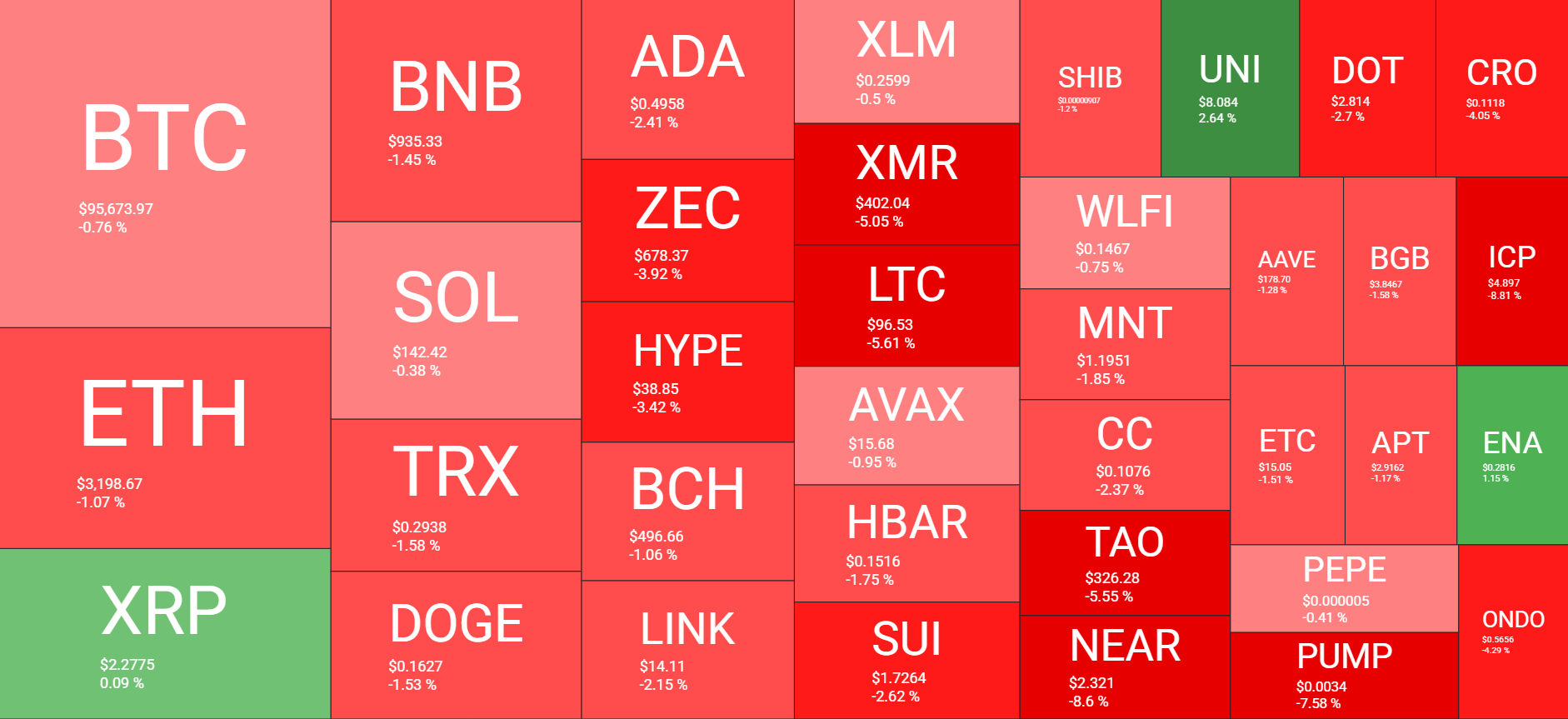

The altcoin market also experienced significant downturns. Ethereum fell sharply yesterday, dropping below $3,100 for the second time in a few days. Despite a current recovery to $3,200, ETH is still down 1% over the past 24 hours. BNB, SOL, TRX, DOGE, ADA, BCH, and LINK have registered similar losses.

HYPE and ZEC have seen price declines of over 3%. XMR, LTC, TAO, NEAR, PUMP, and ICP have charted even steeper price drops, some reaching up to 9%.

A few altcoins are showing modest gains, including UNI and ENA, but their upward movements are very limited. The total cryptocurrency market capitalization has decreased by another $40 billion daily, falling below $3.350 trillion.