The Terra ecosystem is once again commanding global attention.

LUNC, USTC, and LUNA have entered one of their most aggressive and psychologically charged market phases since the 2022 collapse. In just a few days, LUNC surged more than 222%, USTC followed in sympathy, and on-chain activity accelerated to levels not seen in years.

But this rally did not begin with a chart breakout.

It began with a moment.

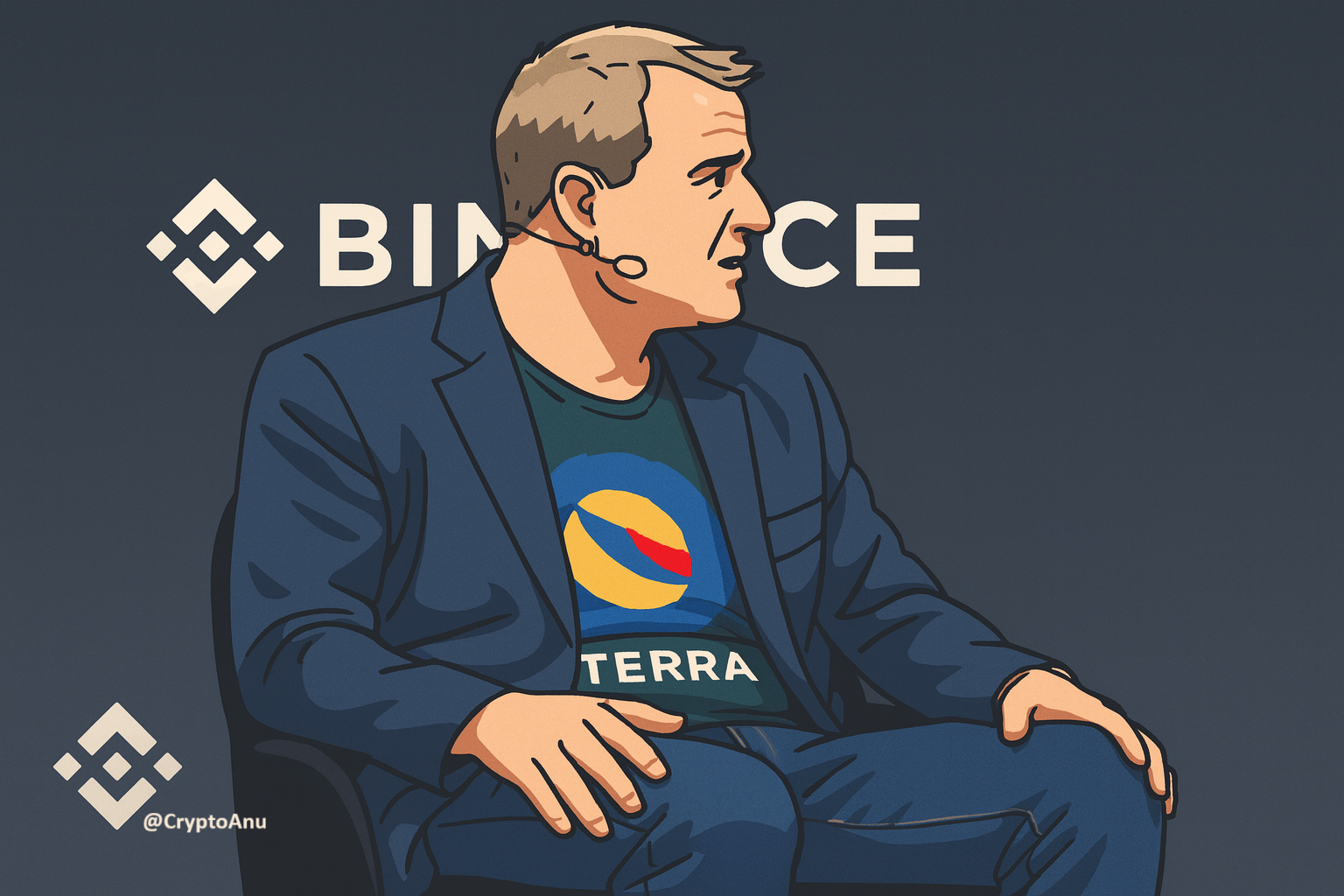

A major crypto figure stepped onto a global stage — wearing a $LUNC shirt. No announcement. No promotion. No official endorsement. Just a silent symbol placed in front of millions of eyes.

Days later, the Terra ecosystem exploded.

Coincidence, or narrative ignition?

This article breaks down the full mechanics behind the rally: the burn-driven supply shock, the liquidity surge, market psychology, liquidation structure, community momentum, and the powerful catalyst of Do Kwon’s approaching sentencing.

The Shirt That Restarted the Conversation

In crypto, symbolism matters more than statements.

Markets don’t always react first to data — they often react first to attention. The appearance of a globally recognized crypto figure wearing a $LUNC shirt instantly reactivated a narrative most had written off as finished.

There was:

- •No sponsorship visible

- •No official message

- •No press release

Yet within hours, social mentions accelerated, trading desks took notice, and dormant Terra watchers returned.

The market didn’t react to the person. It reacted to what the symbol represented:

A forgotten ecosystem being silently placed back into the spotlight.

Narratives don’t start with indicators. They start with moments.

The True Fuel: A Historic Supply Shock

While the shirt ignited attention, burn mechanics ignited price.

As of now:

- •426–431 billion LUNC permanently burned

- •Nearly 850 million burned in a single week

- •Roughly 7.5–8% of the total supply erased

This is no longer symbolic burning. It is now mathematically impactful.

In a market where liquidity is still relatively thin, shrinking circulating supply magnifies every wave of demand. With staking increasing alongside active burns, the effective available float tightens further — creating true supply pressure.

For the first time since Terra’s collapse, burns are directly altering market structure.

Liquidity Returns with Force: Volume Surges up to 9x

Price expansion without volume is fragile.

This time, volume arrived first.

Across multiple centralized and perpetual exchanges:

- •Spot volume spiked sharply

- •Perpetual contracts saw aggressive reactivation

- •Whale-sized order flow returned

Some platforms recorded up to 9x increases in daily trading volume, levels that have not been seen since the chaos of 2022.

This was not retail chasing candles. This was liquidity repositioning.

Markets move in three phases: Attention → Positioning → Expansion.

Terra is now firmly in phase two.

On-Chain Fundamentals Are Quietly Strengthening

Beneath the price action, the chain itself is in far better condition than during previous speculative spikes.

Key improvements include:

- •More active governance participation

- •Validator restructuring and security improvements

- •Rising staking participation

- •Gradually increasing wallet activity

- •Expanding developer and Layer-2 involvement

Unlike many prior Terra rallies, this move is not detached from on-chain progress. The ecosystem is slowly regaining operational maturity.

Why This Is Not a Simple Short Squeeze

One of the most important technical signals of this rally is what did not happen:

Liquidations remained relatively low compared to the magnitude of the price expansion.

This matters enormously.

Short-squeeze driven rallies tend to:

- •Explode quickly

- •Collapse violently

- •Leave no structural support behind

This rally is different.

It is being driven primarily by net buying pressure, not forced liquidations. That makes the move inherently more durable and less fragile than past Terra spikes.

The Largest Psychological Catalyst: Do Kwon’s Sentencing

Markets are not driven by math alone. They are driven by uncertainty.

And Terra has carried one of the darkest unresolved narratives in crypto history for over three years.

Do Kwon’s sentencing is now only days away — the final chapter of:

- •A $40B collapse

- •Global regulatory shockwaves

- •Arrests, extraditions, and legal battles

- •Years of uncertainty hanging over the ecosystem

For markets, this matters less because of the sentence itself — and more because of what it represents:

Closure.

Historically, markets react strongly when long-standing uncertainty resolves. Capital avoids ambiguity. It floods into clarity.

Regardless of whether the outcome is harsh or lenient, the legal overhang ends. And that alone reactivates capital.

The Return of the Terra Narrative

Crypto runs on narratives, not balance sheets.

Right now, Terra has multiple powerful storylines converging simultaneously:

- •Massive token burns

- •A comeback after total destruction

- •Community-led rebuilding

- •Whale liquidity returning

- •Legal resolution approaching

- •Retail rediscovering the ecosystem

This is the exact narrative structure that previously drove recoveries like:

- •XRP after the SEC case

- •Solana after FTX

- •BNB after regulatory turbulence

Comebacks are not anomalies in crypto. They are part of its culture.

Market Levels Traders Are Watching

Based on current structure, volume profile, and momentum alignment, traders are focusing on:

- •Short-term: 0.00005

- •Mid-term: 0.00007

- •High-momentum extension: 0.00009+

None of these levels require unrealistic assumptions — only continued volume, burn pressure, and narrative continuation.

But Risks Still Exist

Despite the strength of the rally, Terra remains a high-volatility ecosystem.

Key risks include:

- •Exchange delistings still limiting access in parts of Europe

- •Sentencing volatility potentially triggering short-term shakeouts

- •Aggressive whale profit-taking

- •Macro instability in broader markets

- •The long-term complexity of rebuilding USTC utility

High reward exists precisely because high risk still exists.

The Community Is Now Fueling the Market

Across X, Telegram, Reddit, Discord, and CoinMarketCap:

- •Burn trackers run daily

- •Whale wallets are actively monitored

- •Legal countdowns dominate discussion

- •New validator proposals circulate

- •Influencers have returned to covering LUNC

The emotional shift is significant.

In 2023, the Terra community was surviving. In 2025, it is shaping narrative momentum.

Why This Rally Matters More Than the Price

Price is just the surface layer.

The deeper shift is psychological:

Terra is no longer treated as a “dead chain.” It is now being viewed as a high-volatility comeback ecosystem.

Confidence — once completely destroyed — is returning. And confidence is the rarest asset in crypto.

Final Catalyst: The Power of Closure

Do Kwon’s sentencing does more than close a legal case.

It closes:

- •The leadership vacuum

- •The uncertainty loop

- •The emotional trauma of 2022

For the first time since the collapse: The past can finally be buried.

The Terra ecosystem moves forward as a fully community-driven network — no longer defined by unresolved scandal.

Closure creates clarity. Clarity invites capital.

Full Data, Charts & Deep-Dive Analysis

This article provides the narrative framework behind Terra’s revival.

The full deep-dive on my CoinMarketCap profile includes:

- •Detailed burn statistics

- •Liquidation maps

- •Whale tracking

- •Exchange flow analysis

- •Sentencing outcome scenarios

- •On-chain rebuild roadmap

- •Historical comparison with major crypto recoveries

This move is not just technical. It is structural, psychological, and narrative-driven.