Texas has made history by becoming the first US state to treat Bitcoin as a strategic treasury reserve asset, purchasing $10 million worth of the cryptocurrency via a spot ETF.

This adoption by a state-level entity strengthens Bitcoin's macro narrative, although it does not address the limitations of its base layer, such as low throughput, high fees during congestion, and the absence of native smart contracts or rich decentralized application (dApp) ecosystems.

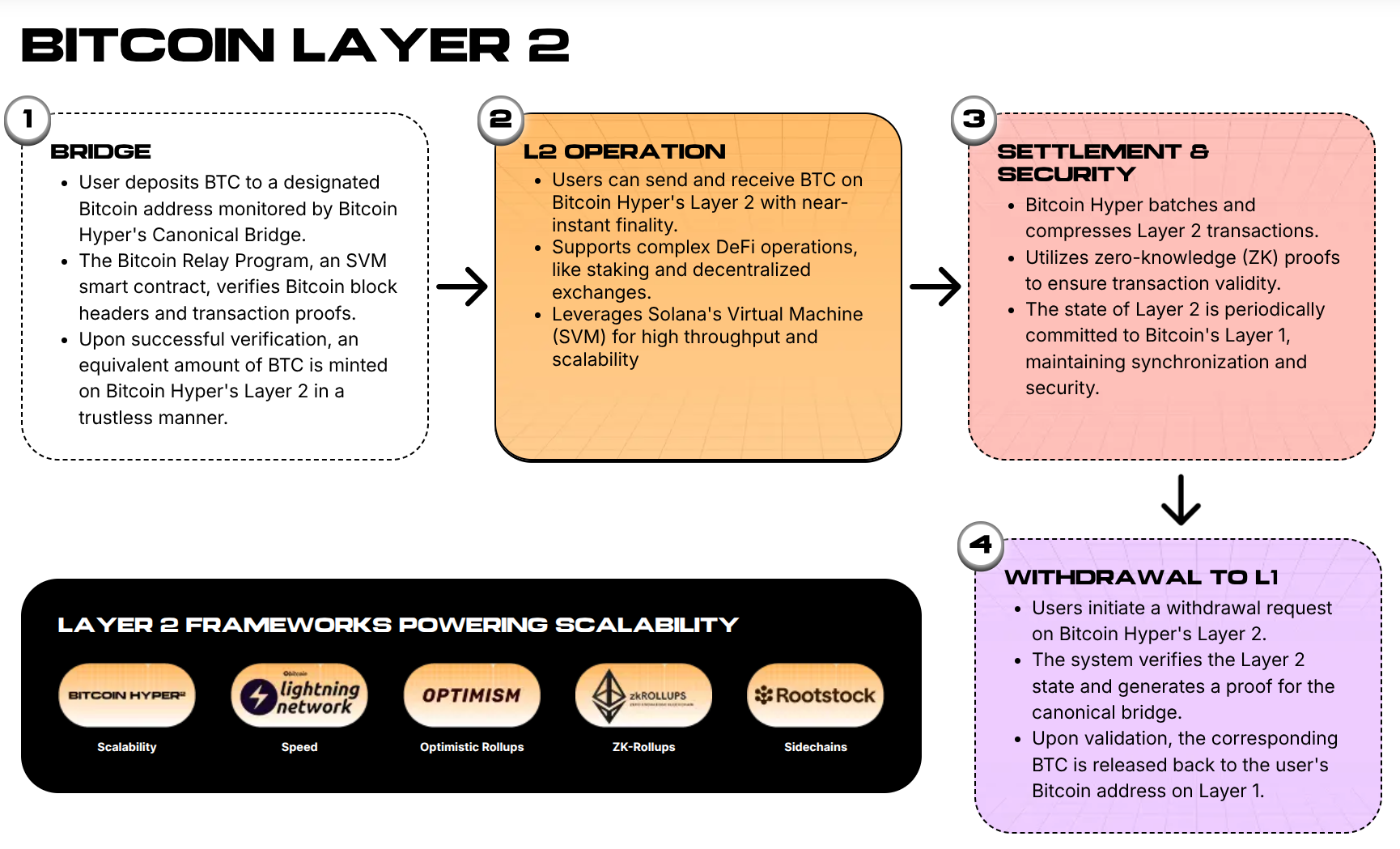

In response to these challenges, competition among Bitcoin Layer 2 solutions is intensifying. These solutions employ various approaches, ranging from EVM sidechains to rollups and execution layers anchored to Bitcoin's settlement and security.

One such project, Bitcoin Hyper, proposes a Bitcoin Layer 2 solution that integrates the Solana Virtual Machine (SVM). This integration aims to enable sub-second, low-fee smart contracts, thereby unlocking DeFi and dApps built around Bitcoin's store-of-value foundation.

Bitcoin Hyper: SVM Speed On A Bitcoin Security Backbone

Texas's Bitcoin purchase signifies a shift in market expectations. If states are now holding Bitcoin as a macro reserve, there will be increased demand for a more functional Bitcoin ecosystem built on top of the base layer.

Bitcoin Hyper ($HYPER) is positioning itself as a solution to this need. The project leverages the SVM paradigm, offering high throughput, parallel execution, and sub-second finality. Crucially, all transactions are settled to the Bitcoin Layer 1, inheriting its robust security.

The core of this architecture is the Canonical Bridge, which acts as the primary gateway for the Bitcoin Hyper ecosystem. This bridge operates on a secure lock-and-mint model, allowing users to deposit mainnet Bitcoin and receive a 1:1 wrapped asset on the Layer-2 network.

To ensure decentralization, the bridge utilizes Zero-Knowledge (ZK) proofs to verify state transitions against on-chain data. This eliminates the reliance on third-party custodians.

This design enables the use of Bitcoin within a high-velocity, SVM-powered DeFi environment without compromising the fundamental security of the Bitcoin base layer. The platform's promise of fast performance, extremely low latency execution, and fees targeting the sub-cent range opens the door for high-speed use cases such as swaps, lending, NFT mints, and gaming loops – applications that are currently not feasible on Bitcoin Layer 1, especially during periods of high network activity from meme coins or inscriptions.

$HYPER Whales, Massive Money and Social Success

The Bitcoin Hyper presale has demonstrated significant momentum, raising over $28.5 million. On-chain data indicates substantial accumulation by whale wallets, with recent large transactions including $500,000, $379,900, and $274,000. These transactions suggest that major investors recognize the value of $HYPER's proposition and are seeking early entry.

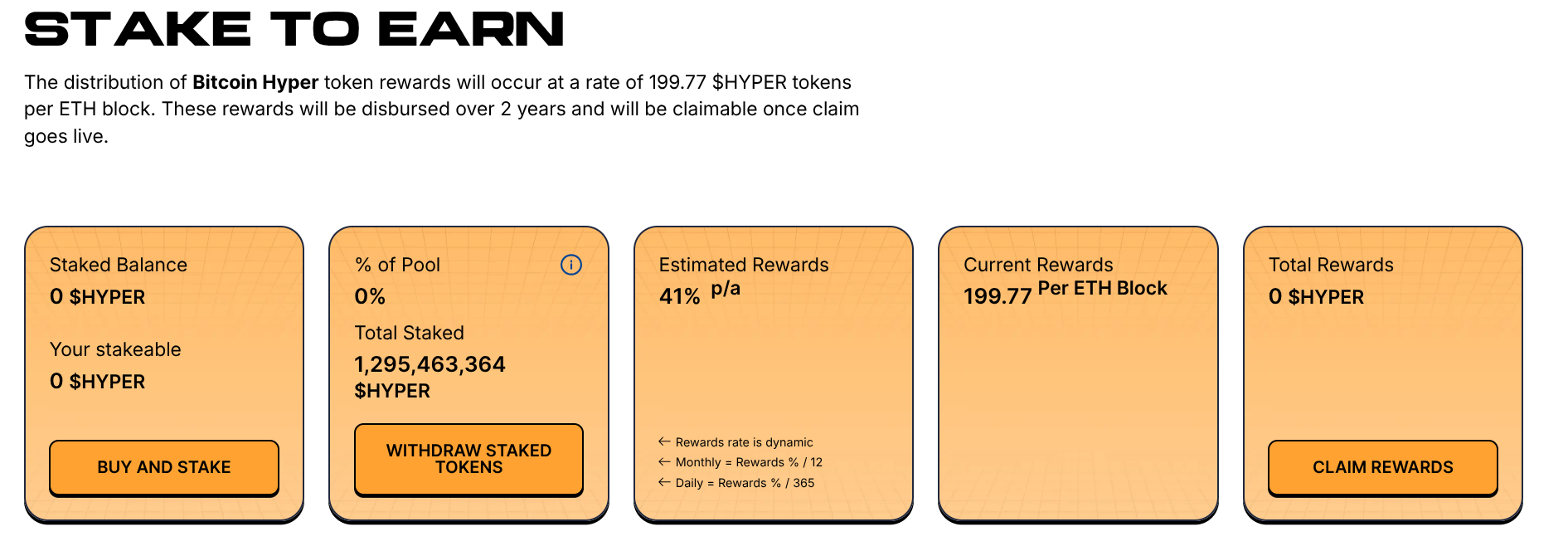

Additionally, the project offers dynamic staking rewards. Investing currently yields a 41% APY, with the potential for even greater returns by participating early, as these reward rates are subject to change.

$HYPER is building a strong foundation for success. Beyond its utility and potential future value, coupled with an impressive presale performance, the project also boasts a robust social media presence. With over 16,000 followers on X and more than 7,000 subscribers on Telegram, Bitcoin Hyper has cultivated a dedicated and active community that believes in the project's vision.

The project's legitimacy is further supported by smart contract audits conducted by Coinsult and Spywolf.

Interested participants can acquire $HYPER at a price of $0.013335.