USDT issuer Tether has been awarded a key regulatory status in Abu Dhabi, opening the door for licensed institutions to use its stablecoin in regulated services across multiple blockchain networks.

In a recent announcement, Tether stated that its USDT token has been formally recognized as an “accepted fiat-referenced token.”

The company explained that this milestone signifies that regulated firms within the Abu Dhabi Global Market (ADGM) are now permitted to offer trading, custody, and other services involving USDT on several blockchains. These include Aptos, Celo, Cosmos, Kaia, Near, Polkadot, Tezos, TON, and TRON.

Tether’s USD₮ Recognised as Accepted Fiat-Referenced Token in Abu Dhabi’s ADGM for Use on Several Major Blockchains

Learn more: https://t.co/PKmF7w5aUx— Tether (@Tether_to) December 8, 2025

The ADGM operates as a special economic zone and international financial center within the UAE capital, functioning under its own distinct regulatory and legal framework.

This recent approval builds upon the ADGM’s prior recognition of USDT on the Ethereum, Solana, and Avalanche blockchains.

Tether indicated in its statement that this expanded recognition is expected to generate “fresh opportunities for collaboration and growth throughout the Middle East.”

ADGM Approval Reinforces Role of Stablecoins in Modern Financial System, Tether CEO Says

Stablecoins are digital assets designed to maintain a stable value by being pegged to an underlying asset, most commonly fiat currencies like the US dollar.

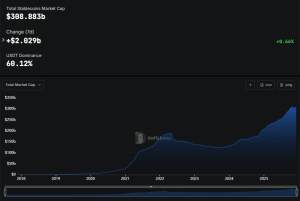

The year 2025 has witnessed substantial growth in the stablecoin market, with the sector's combined capitalization surpassing $300 billion for the first time in history during this year.

This market expansion has been significantly influenced by a more favorable regulatory environment in the United States and the enactment of the GENIUS Act into law by President Donald Trump in July.

The clarity in regulation provided by the signing of the GENIUS Act has spurred considerable activity in the stablecoin space, leading numerous companies to announce intentions to launch or explore stablecoin offerings.

Tether's USDT continues to hold a dominant market position. With a capitalization exceeding $185.737 billion, the token represents approximately 60.12% of the total stablecoin market share.

Commenting on the recent ADGM approval, Tether’s CEO Paolo Ardoino stated that “introducing USDT within ADGM’s regulated digital asset framework reinforces the role of stablecoins as essential components of today’s financial landscape.”

He further added, “By extending recognition to USDT on several major blockchains, ADGM further strengthens Abu Dhabi’s position as a global hub for compliant digital finance.”

Abu Dhabi Aims to Become DeFi Hub, Targets Stablecoins

Tether’s USDT is not the only stablecoin experiencing increased adoption in Abu Dhabi.

Recently, local regulators also approved Ripple’s RLUSD dollar-pegged stablecoin as an accepted fiat-referenced token, paving the way for its institutional utilization.

These recent approvals coincide with rising expectations surrounding a separate initiative supported by some of Abu Dhabi's major financial entities.

A consortium comprising the emirate’s sovereign wealth fund ADQ, International Holding Company, and First Abu Dhabi Bank has announced plans to introduce a dirham-pegged stablecoin, contingent on approval from the UAE Central Bank.

Abu Dhabi has also initiated a broader strategy to establish itself as a global cryptocurrency hub. Just recently, Binance, the cryptocurrency exchange with the largest 24-hour trading volumes, announced it has received full authorization to operate its global platform within the ADGM framework.

Binance Co-CEO Richard Teng remarked, “ADGM is one of the most respected financial regulators globally, and holding an FSRA license under their gold standard framework shows that Binance meets the highest international standards for compliance, governance, risk management, and consumer protection.”