Tether's Financial Strength and Market Confidence

Tether CEO Paolo Ardoino disclosed on December 1 that the company holds $135 billion in U.S. Treasury bonds, a revelation that has prompted discussion and scrutiny, particularly from Arthur Hayes.

This significant disclosure underscores Tether's financial robustness and its substantial profits generated from these holdings. However, it also brings to the forefront questions regarding asset liquidity and its potential impact on market confidence, especially in the context of volatile investments.

Scrutiny Over $135 Billion U.S. Treasury Holdings

Tether, under the leadership of CEO Paolo Ardoino, has revealed its substantial investment in U.S. Treasury bonds, amounting to $135 billion. These holdings are reported to generate approximately $500 million in monthly profits, highlighting both the company's financial strength and its dominant position as a stablecoin issuer.

Arthur Hayes has voiced criticisms regarding Tether's lack of a formal dividend policy and explicit overcollateralization benchmarks. His concerns specifically target asset liquidity, raising the possibility that Tether's reserves might include illiquid investments beyond U.S. Treasuries.

"If Tether’s liability is in USD and its assets are U.S. Treasury bonds, then there is basically no major issue; however, if Tether’s assets are illiquid private investments, once an accident occurs, the market will have doubts about Tether’s overcollateralization."

Arthur Hayes, BitMEX Co-founder

The community's response to these disclosures has been varied. While a segment of users express confidence in Tether's strong backing by U.S. Treasuries, others share Hayes' reservations about transparency concerning non-Treasury assets. These differing perspectives underscore the ongoing scrutiny of Tether's financial practices.

Transparency Concerns and Potential Regulatory Impact

Tether's extensive holdings of U.S. Treasury assets position it as one of the largest holders globally. This unique standing among stablecoins is particularly noteworthy during periods of market fluctuation.

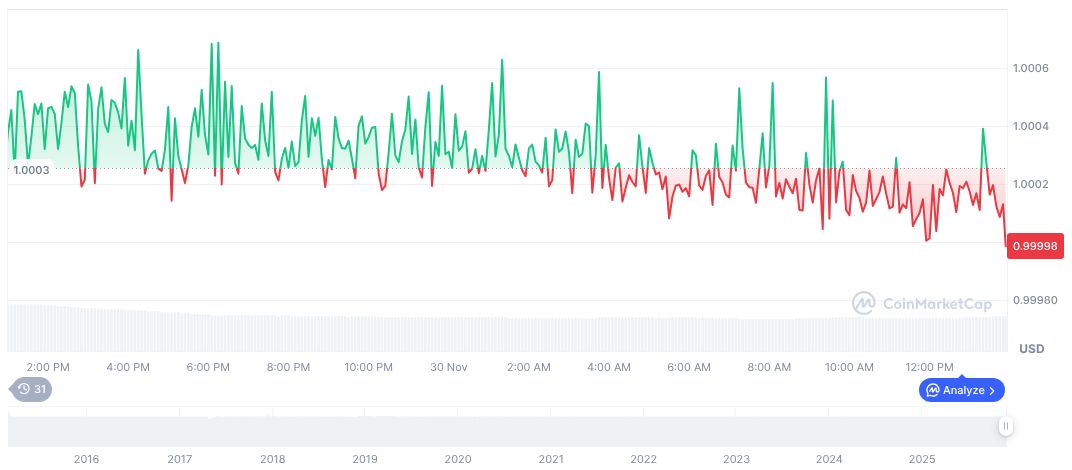

As of December 1, 2025, Tether (USDT) has maintained its $1.00 peg, according to data. Its market capitalization stood at $184.60 billion, with a trading volume of $92.38 billion, reflecting a significant 69.18% change. These figures, along with minor price shifts across different periods, reinforce its status as a stablecoin.

While Tether's substantial Treasury assets contribute to its stability, concerns regarding the transparency of its non-U.S. Treasury assets could attract regulatory attention. Such regulatory focus might intensify discussions around stablecoin reserve requirements and the need for enhanced transparency.