Arthur Hayes Raises Alarm Over Tether's Financial Stability

BitMEX co-founder Arthur Hayes has voiced significant concerns regarding Tether's (USDT) financial stability, particularly in light of its current interest rate strategy and recent asset purchases. Hayes' commentary, shared on the X platform, follows the release of a recent audit report and highlights potential risks to Tether's solvency.

These remarks intensify existing worries about Tether's financial health, especially in the context of anticipated Federal Reserve rate adjustments. The situation prompts critical questions about the stablecoin issuer's asset management practices and the level of transparency surrounding its operations.

Hayes Warns of Significant Risk to Tether's Solvency

"The Tether team is in the early stages of large-scale interest rate trading. They believe the Federal Reserve will cut interest rates, which will significantly reduce interest income. To counter this, they are buying gold and Bitcoin, and theoretically, as currency prices fall, the prices of these assets should surge. If their gold and Bitcoin holdings drop by about 30%, their equity will vanish, and USDT will theoretically go bankrupt. I believe some large holders and exchanges will demand to see their balance sheets in real time to assess Tether's solvency risk." — Arthur Hayes, Co-founder, BitMEX

Hayes' assertion suggests that a substantial decline of approximately 30% in Tether's gold and Bitcoin holdings could lead to the complete erosion of its equity, potentially resulting in the bankruptcy of USDT. This scenario has amplified calls for immediate and ongoing transparency from Tether regarding its financial reserves.

Increased Demand for Real-Time Balance Sheet Transparency

In response to these pressing concerns, there is a growing demand from major holders and cryptocurrency exchanges for real-time transparency regarding Tether's balance sheets. This push for immediate insight is crucial for assessing Tether's solvency risk and directly impacts market confidence in the USDT stablecoin.

The call for enhanced transparency is seen as a vital step in mitigating solvency fears and protecting Tether's market standing. This situation, viewed alongside historical scrutiny of Tether's reserves, underscores the evolving landscape of regulatory considerations and potential technological advancements within the stablecoin sector.

Historical Reserve Scrutiny and Market Data

Tether has previously faced significant scrutiny over its reserve transparency. In 2021, the company was fined $41 million by the Commodity Futures Trading Commission (CFTC) amid concerns that its reserves were not adequately backed as represented.

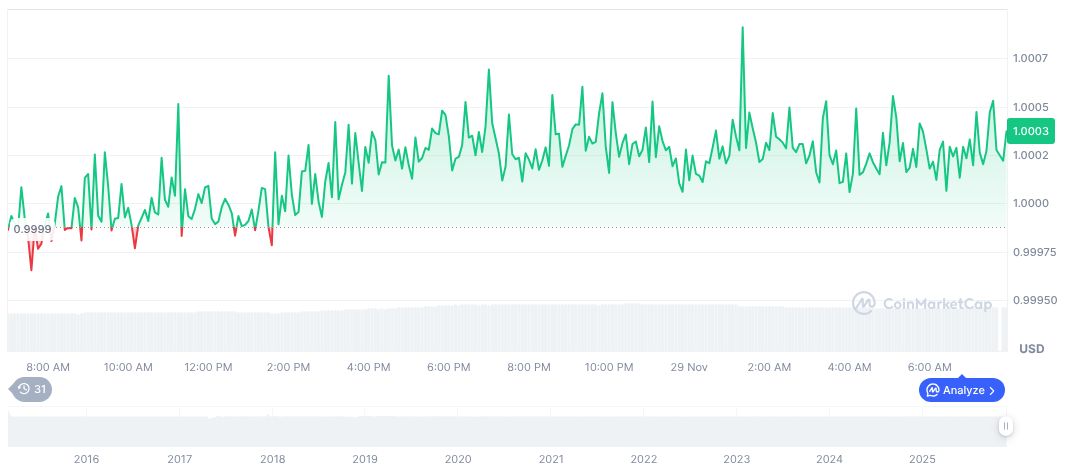

Currently, Tether (USDT) maintains its peg at $1.00. The stablecoin boasts a market capitalization of $184.68 billion and recorded a trading volume of $56.04 billion in the last 24 hours. Its market dominance stands at 5.98%, with minimal price fluctuations reported recently, according to available market data.

Further analysis suggests that greater transparency could significantly protect Tether by proactively mitigating solvency fears. This ongoing situation, coupled with the history of reserve scrutiny, highlights the critical importance of evolving regulatory considerations and potential technological advancements in the stablecoin market.