Tether has reported substantial financial success, with net profits exceeding $10 billion in the third quarter of 2025. This achievement solidifies its prominent position within the cryptocurrency market, particularly due to its significant investments in U.S. Treasury bonds and its substantial digital asset reserves. The company's robust financial performance underscores its growing influence, establishing it as a major global player, especially within the stablecoin and broader digital currency ecosystem.

Tether's Financial Performance and Market Position

Tether's third-quarter financial report highlights an impressive net profit of over $10 billion. This significant achievement positions Tether as one of the largest holders of U.S. Treasury bonds, even surpassing the national holdings of South Korea. The company's record levels of U.S. Treasury holdings and the issuance of $17 billion USDT demonstrate its continued expansion and capacity to adapt within the market. This growth has a tangible impact across cryptocurrency markets, contributing to enhanced liquidity and the availability of USDT.

Market sentiment towards Tether's performance shows a divergence. While retail investors express skepticism, there is notable institutional interest. Tether's CEO, Paolo Ardoino, has projected profits to reach $15 billion by the end of the year, indicating strong investor confidence, despite prevailing bearish sentiments among retail participants.

Strategic Growth, Market Data, and Regulatory Considerations

Did you know? Tether has emerged as the 17th largest holder of U.S. government debt, outranking the national treasuries of several countries. This reflects its significant influence in global financial markets.

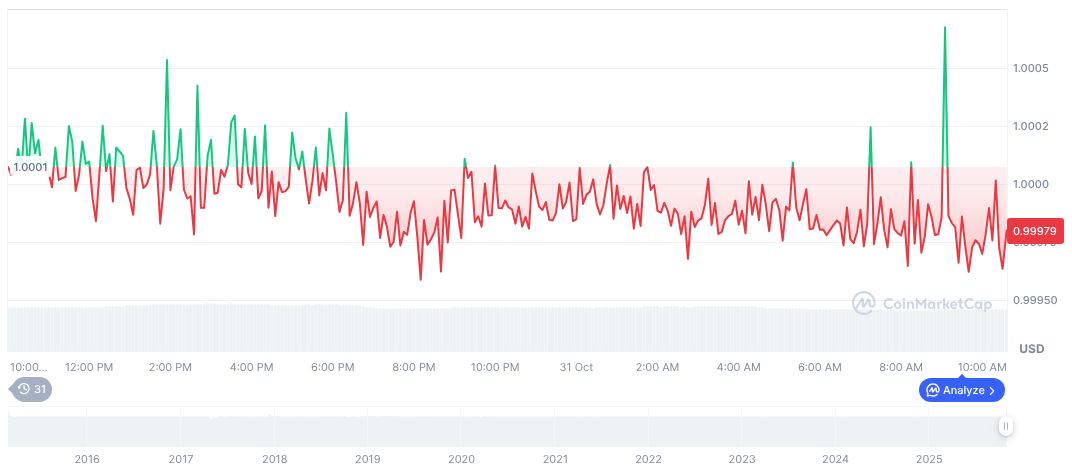

According to market data, Tether USDt (USDT) boasts a market capitalization of $183.34 billion and holds a dominance of 4.96% as of October 31, 2025. Daily trading volumes are substantial, reaching $139.04 billion, which underscores Tether's crucial role in maintaining market liquidity. While prices have experienced a slight decline over the past 90 days, the overall trend indicates stability.

Analysis suggests that Tether's financial strategies, particularly its increased reliance on U.S. debt markets, could potentially attract regulatory scrutiny. However, the company's ongoing technological initiatives in areas such as AI and P2P communication may lead to significant transformations in the financial landscape, potentially offering long-term benefits to Tether's ecosystem. Paolo Ardoino, CEO of Tether, commented on the company's financial trajectory, stating, "This year we’re going to approach another $15 billion profit. That’s very rare. There is no other company in the world that has that."