Stablecoin Surge Amidst Market Reallocation

Since October 11, 2025, Tether and Circle have minted approximately $15 billion in stablecoins, responding to investor demand for dollar-backed assets following a significant market crash. This issuance reflects a shift towards stability, impacting cryptocurrency liquidity and market dynamics, while highlighting the ongoing preference for compliant digital currencies.

Stablecoin inflows have fueled DeFi and liquid market segments as trillions of dollars reallocated from riskier asset classes. This shift underscores investors' confidence in stablecoins and highlights the preference for regulated digital dollars, evident from the heightened supply. Jeremy Allaire, CEO, Circle, noted, "USDC’s growth is affirmation of trust in regulated digital dollars as foundational to a re-architected global financial system."

Regulatory Influence and Expansion Efforts

Experts emphasize the U.S.'s revised regulations on stablecoins, prompting Tether to launch a compliant U.S.-based stablecoin, USAT. Circle has similarly expanded efforts, posting over $1 billion in USDC minted on the Solana blockchain.

Did you know? During the March 2020 crash, stablecoin issuance spiked similarly, reflecting trust in USDT and USDC amidst market uncertainty.

Market Dynamics and Performance of Tether

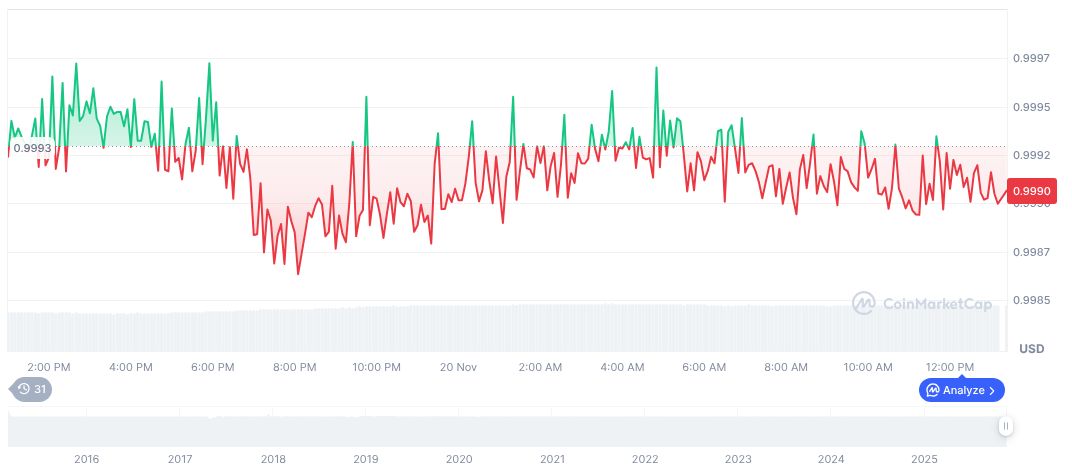

Tether USDt (USDT) currently trades at $0.99 with a market cap of $183.68 billion and dominates 6.19% of the market. In the past 24 hours, the trading volume was $145.85 billion, marking a 20.49% increase, despite a minor price dip of 0.07%. Over the past 90 days, USDT experienced a slight decrease of 0.11%, highlighting relatively stable performance amidst market turmoil.

Coincu analysts anticipate regulatory compliance will drive further stablecoin adoption, predicting significant impacts on liquidity flows and technological innovations within decentralized finance (DeFi ecosystems).