Key Insights

- •Tom Lee suggested to CNBC that a technical glitch on an exchange might explain the crypto market crashes on November 20 and October 10.

- •Hours after Lee's CNBC interview, Ran Neuner of Crypto Banter revealed significant information regarding Tom Lee's BitMine, Strategy, and other Digital Asset Treasuries (DATs).

- •The technical glitch theory alone does not fully account for either crash. Neuner's analysis provides a strong reason to re-evaluate the risks associated with DATs.

Analysis of Recent Crypto Market Crashes

Following the stock market and crypto market crash on Thursday, Tom Lee discussed the events during an appearance on CNBC. The CNBC host inquired about the reasons behind the crypto market's decline from its peak on November 20 and its downtrend since October 6th.

Lee proposed that an erroneous trigger of an automated deleveraging (ADL) feature on a specific exchange on October 10th led to substantial liquidations, contributing to the market crash that day.

Despite this explanation, markets continue to express uncertainty regarding the definitive cause of crypto's significant downtrend since October 10th. A new analysis has emerged, potentially offering clarity on the events of October 10th.

The October 10 Market Crash: Unpacking the Events

Ran Neuner, from Crypto Banter, shared on X that on October 10, 2025, the MSCI announced its intention to review its classification of companies like MicroStrategy. The MSCI also proposed excluding companies from its indices if they hold 50% or more of their total assets in digital assets. MicroStrategy aligns precisely with this proposal.

Neuner highlighted that both mainstream and crypto media overlooked this MSCI update on that significant day. Morgan Stanley Capital International (MSCI) is a global provider of indices, financial, and analytics services for institutional investors. MicroStrategy (MSTR) was added to the MSCI World Index in May 2024.

Currently, MicroStrategy's Bitcoin holdings represent approximately 77% of the company's total assets. However, Founder-Chairman Michael Saylor has previously dismissed concerns about a potential delisting.

Neuner further stated that MSCI was conducting consultations regarding its proposal, with the consultation period extending until December 26th. The index provider is scheduled to announce its decision on January 15th, determining whether MicroStrategy will be classified as a fund or a company.

MSCI's indices are designed for operational companies, not investment funds. MicroStrategy initially operated as a software business. However, Michael Saylor later shifted the company's primary focus to function as a Bitcoin treasury.

Neuner claimed that on October 10th, while much of the market remained unaware, sophisticated investors recognized the implications of the MSCI proposal and adjusted their positions accordingly. He observed:

DAT’s like MSTR, BMNR, and others have been one of 2 big buyers that powered this cycle…Since DATs have been powering this cycle and have been most the buying pressure, the smart money saw this immediately after the 10TH of October announcement and positioned accordingly.

Binance Statement on the October 10 Crypto Market Crash

Tom Lee's explanation of a technical glitch causing the October 10 crypto market crash aligns with one of the prominent theories discussed. In his CNBC interview on Thursday evening, Lee did not specify the exchange involved.

However, in a statement released on October 12th, Binance acknowledged that a technical glitch had caused de-pegging issues for certain cryptocurrency pairs on its platform. The exchange subsequently reimbursed users of its earn products who experienced liquidations due to the de-pegging.

The glitch resulted in the price of some crypto pairs being displayed as $0 for numerous users on the exchange. Despite this, Binance clarified that the broader market crash was attributed to global macroeconomic shifts rather than the technical glitch.

The exchange also pointed out that the cascade of forced liquidations occurred prior to the de-pegging glitch, indicating distinct timestamps for these two separate events. Binance further stated that the forced liquidations constituted a minor portion of the total trading volume on that day.

Significance of MSCI's January 15 Decision for the Crypto Market

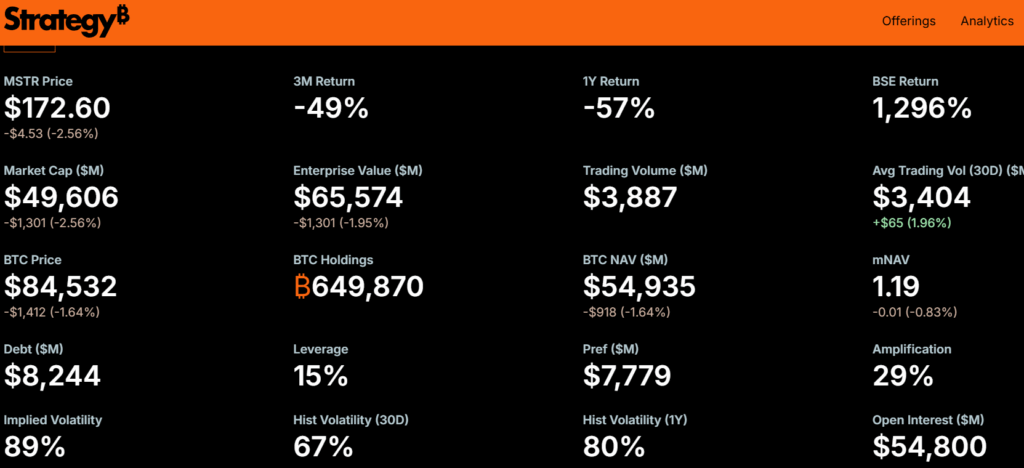

MSCI's determination regarding MicroStrategy's inclusion in its indices could substantially impact the crypto market's structure. MicroStrategy currently holds 649,870 BTC, valued at approximately $54.9 billion at a press time price of $84,532.

If MSCI removes MicroStrategy from its indices, it could trigger approximately $9 billion in forced selling. This is because numerous passive funds track these indices. These passive funds, which include pension funds, utilize algorithms to follow MSCI indices, meaning any sell-offs would be automatic.

Neuner indicated that an unfavorable decision for MicroStrategy on January 15th could lead to a more significant downturn in the crypto market. Ran added:

It would also mean that going forward they would never be included and as such , one of the big reasons why they actually exist would disappear.

Conversely, if MSCI decides against delisting the DAT, the crypto market might experience a resurgence into a bull market.

However, MicroStrategy's stock performance and its Bitcoin model metrics are not currently favorable. The stock has seen returns of -56% over the year and -48% over the last three months. The press time Bitcoin price of $84,532 is only about 10% above MicroStrategy's average purchase cost for its entire Bitcoin holdings. At press time, MSTR was trading around $170, approximately 70% below its all-time high.

Tom Lee's BitMine (BMNR) is an Ether (ETH) treasury company with a model similar to MicroStrategy, meaning the MSCI's decision will also impact BitMine. Nevertheless, both Lee and Saylor remain committed to their strategies for their respective treasury companies. Their statements clearly indicate no intention to sell their Bitcoin and Ether holdings.