TAO moves toward a major trendline as the market signals reduced sell pressure on the 2-hour chart. Open Interest (OI)-weighted funding shows muted leverage, keeping TAO in a controlled phase ahead of a key test. Price steadies inside the $290 zone, forming higher lows after a $300 rejection within the 24-hour window.

TAO trades within a narrow intraday band as a shift in short-term structure emerges. The market sits near a major technical trigger, with buyers attempting to stabilize conditions after a period of controlled downward pressure.

Trendline Pressure Builds

TAO price action on the 2-hour chart shows a long phase of declining structure. The descending trendline has capped every recovery attempt. This line has acted as resistance and shaped the controlled series of lower highs across recent sessions.

Captain Faibik’s update indicates renewed attention around this boundary. Price now approaches the same diagonal that rejected attempts for weeks. TAO printed a higher low after the latest downswing, reducing downside momentum and forming early stabilization.

A wide green projection zone on the chart outlines the potential reaction if price clears the trendline. This area shows available rooms above current levels. The market remains positioned directly under resistance, increasing focus on the coming test.

Funding Levels Show Reduced Leverage

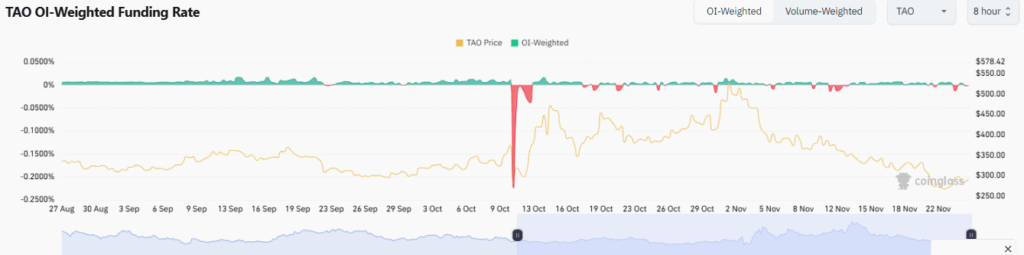

The OI-weighted funding chart shows nearly flat behavior over several months. Funding stays near zero, despite a broad downward path from late September to November. This reflects a market where no strong long or short bias dominates.

Negative readings appeared through mid-September to late October. Traders maintained a steady short bias, though levels never extended into extreme territory. This kept pressure contained while avoiding an over-leveraged setup.

A sharp negative spike occurred around October 12–14. This came with a brief price rise before a decline. After this event, funding returned to balanced levels. By mid-November, both trading sides remained muted, suggesting compression before a broader move.

Short-Term Price Stability Forms

The 24-hour chart shows TAO trading near $293.58, as of writing up 1.9% for the day. The range between $278.66 and $300.36 defines intraday volatility. Early trading dipped toward the $280 area before forming a stable base.

A strong recovery followed as the price climbed toward $300–$305. Volume reached $200.3M, supporting the advance. After touching above $300, a controlled pullback formed, bringing TAO toward the mid-$290 region.

TAO now trades inside a steady band. Circulating supply remains 9.59M out of 21M, keeping liquidity tight. If the higher-low structure holds, TAO may reattempt the upper range. Failure would keep trading within the current consolidation band.