T3 FCU Achieves Significant Milestone in Combating Financial Crime

The T3 Financial Crime Unit (FCU), a collaborative initiative involving Tether, TRON, and TRM Labs, has announced a major achievement in its first year of operation: the freezing of over $3 billion in illicit cryptocurrency assets globally. This accomplishment has been acknowledged by global law enforcement agencies, highlighting the unit's critical role in enhancing compliance and accountability within the stablecoin sector.

The T3 FCU's efforts are instrumental in promoting stablecoin compliance across multiple continents. Its success underscores the significant collaborative efforts being made to bolster global financial security perceptions and tackle criminal activities effectively.

High-Profile Operations and Deterrence Against Illicit Activities

The T3 Financial Crime Unit's collaboration has resulted in the freezing of $3 billion in illicit cryptocurrency within its initial year. This success, recognized by global agencies, demonstrates the effectiveness of integrating public-private partnerships in the fight against financial crime.

Justin Sun, Founder of TRON, emphasized the initiative's efficacy in countering unlawful USDT activities. He stated that the swift freezing of criminal assets serves as a significant deterrent to illegal use, marking a turning point for stablecoin networks that are embracing enhanced compliance and security measures.

Criminals now have 100 million reasons to think twice before using TRON. T3 FCU's rapid success in freezing criminal assets sends an unmistakable message: if you're using USDT on TRON for crime, you will be caught. Justin Sun, Founder, TRON

The industry has responded positively to these developments. Paolo Ardoino, CEO of Tether, reiterated the importance of collaborating with legal authorities worldwide. Global enforcement bodies, including Brazil’s Federal Police, have formally commended T3’s role in a significant anti-money laundering case.

Setting New Compliance Benchmarks in Digital Finance

The T3 FCU's approach, which is modeled on past successful public-private partnerships, is notable as it is the first to be led by a stablecoin issuer like Tether. This pioneering effort sets new compliance benchmarks within the digital finance landscape.

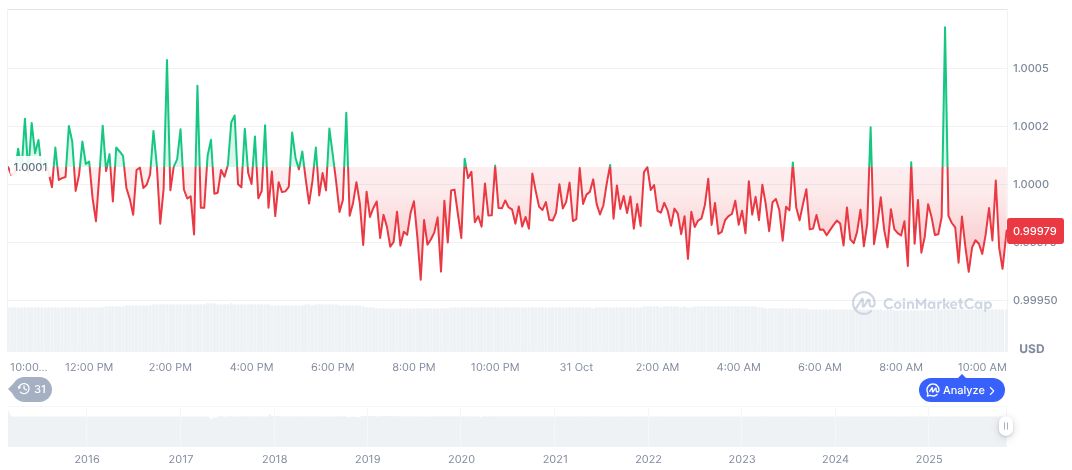

According to CoinMarketCap, Tether USDt (USDT) is trading at $1.00 with a market capitalization of $183.33 billion. Its 24-hour trading volume stands at $146.87 billion USD, reflecting a 5.16% decrease. The stablecoin's price has remained stable despite minor weekly and monthly declines.

Experts suggest that the achievements of the T3 FCU could lead to broader adoption of regulatory frameworks within the cryptocurrency industry, fostering a shift towards enhanced transparency. The initiative's success may also encourage similar enforcement models globally, contributing to a more secure cryptocurrency ecosystem.