Key Observations

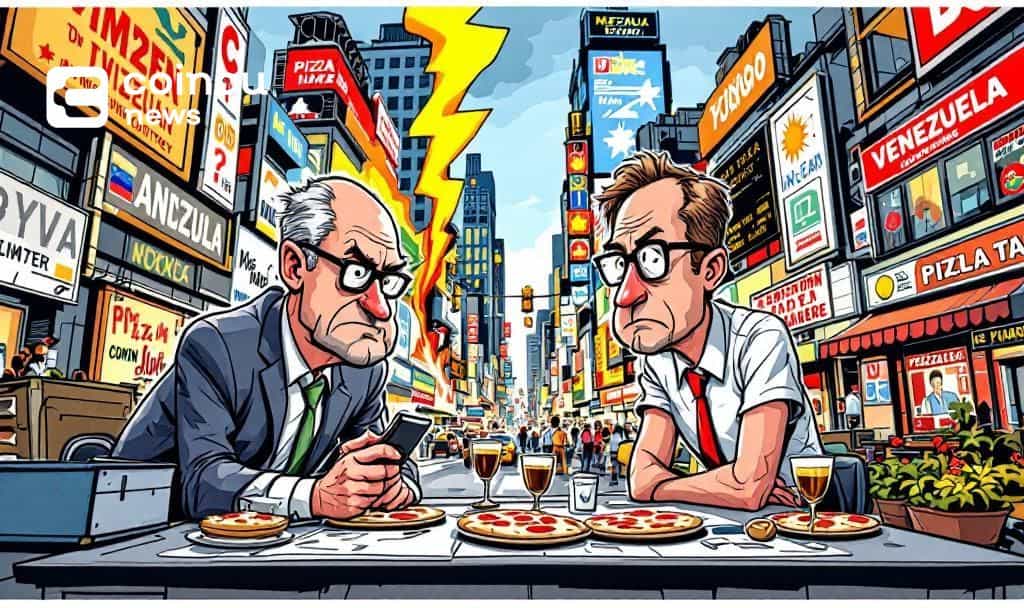

- •Investors are monitoring Pentagon activity through the Pizza Index amidst rising tensions with Venezuela.

- •Suspicious manipulation has been observed in prediction markets focused on Venezuela.

- •Research indicates skepticism regarding the reliability of the Pizza Index as a predictive tool.

Two traders, identified as methebestss and smaugvision, have made substantial bets on the possibility of a U.S. military engagement with Venezuela, coinciding with the activation of the Pentagon Pizza Index indicator.

The concentrated trading activity within Venezuela-focused prediction markets suggests a rise in geopolitical concerns, prompting questions about the potential for insider information and its implications for international relations.

Heightened Pentagon Activity and Venezuela Market Movements

On December 6th, analysts observed an increase in pizza orders around the Pentagon, which could signify heightened military readiness. This pattern aligned with significant activity in prediction markets related to Venezuela. Traders methebestss and smaugvision placed concentrated bets on potential U.S. military interventions. Their substantial financial commitments drew the attention of the crypto community due to their unusual trading patterns and significant investments.

These transactions, executed using non-typical on-chain methods, remained under scrutiny. Market participants speculated about the importance of these trades, particularly concerning their timing and the focus on military-related bets. No official exchange has confirmed these moves, leaving their motivations and potential consequences largely speculative but closely observed by those following the situation.

A Pentagon spokesperson denied the validity of using pizza orders as an indicator of military actions, highlighting the availability of internal food services. The spokesperson stated, "The Pentagon has numerous internal food vendors...so external pizza orders are not a meaningful operational indicator." Despite the doubts raised by military officials, the Pentagon Pizza Index continues to attract media and public interest, especially given its perceived correlation with past geopolitical events.

Historical Context and Current Market Reactions

During the Cold War, there are accounts of Soviet operatives allegedly tracking fast-food orders around Washington to anticipate U.S. military actions, which is believed to have contributed to the informal concept of the Pentagon Pizza Index.

As of December 9, 2025, Ethereum (ETH) is trading at $3,107.83, marking a slight decrease of 0.62% over the preceding 24 hours. The asset's market capitalization is $375.10 billion, with a 24-hour trading volume of $24.12 billion, indicating a 10.79% increase over the past week.

Analysts from Coincu suggest that while unconventional indicators like the Pentagon Pizza Index generate curiosity, decisions based on verifiable government or official announcements are more precise. A prudent trading strategy involves balancing geopolitical open-source intelligence (OSINT) with data-driven insights.