Key Insights

- •SUI has reclaimed the $1.45 resistance level and is now targeting a breakout above $1.60 for short-term momentum.

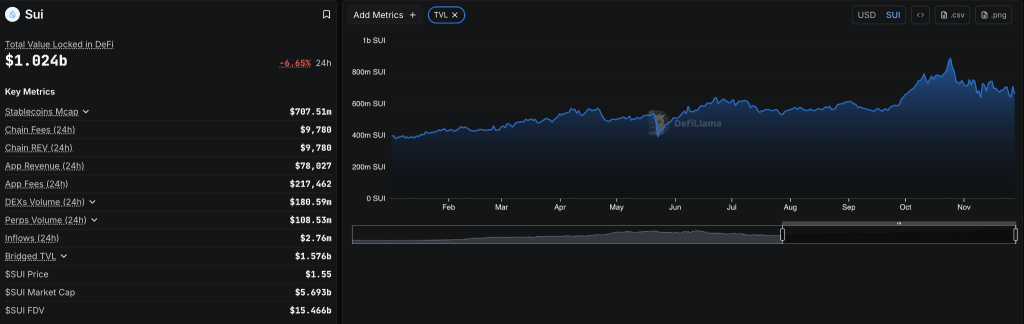

- •On-chain data reveals a 25% drop in Total Value Locked (TVL) since October, indicating reduced DeFi activity on the Sui network.

- •The Relative Strength Index (RSI) has signaled a buy after extreme oversold levels, though overall market sentiment remains cautious and bearish.

Sui (SUI) has successfully recovered a critical resistance level at $1.45, reigniting interest in the token. At the latest reporting, SUI was trading at $1.51, with a 24-hour trading volume of $622 million, indicating active market participation. Despite this recovery, the price experienced a slight intraday dip of 0.71% in the last day, suggesting some short-term weakness.

This price movement occurs against a backdrop of mixed market signals, where some bullish momentum is emerging, yet the overall market structure continues to exhibit caution.

Price Recovery and Technical Resistance

SUI has demonstrated a notable recovery from its recent lows, managing to reclaim the $1.45 level. This price point had previously acted as a significant resistance, and its successful retaking is interpreted as a potential short-term shift in momentum. According to analysis shared by DaanCrypto, the price is now closely watching the $1.60 mark, which could serve as a catalyst for a more rapid price movement.

The Relative Strength Index (RSI) has provided an early buy signal, having rebounded from an oversold position near 22. This upward movement above the 14-day average suggests a return of some momentum, although the broader market trend remains under pressure.

Analysts caution that if SUI fails to achieve a decisive break above $1.60 in the near future, a retest of lower support levels is likely. One analyst commented that "The market still leans bearish unless SUI can close above $1.80." The immediate objective for traders remains a confirmed break above the current resistance to validate any sustained reversal.

On-Chain Data Shows Weakness in Activity

While the price action indicates a degree of recovery, on-chain data continues to reflect underlying weakness in network activity. Sui's Total Value Locked (TVL) has seen a substantial decrease of 25% since late October. This decline is a direct consequence of reduced activity across various Decentralized Finance (DeFi) platforms operating on the network.

Data compiled by DeFi Llama reports a fall in TVL from 889 million SUI to 661 million SUI. Although daily active users have shown a slight increase, the trading volumes on Decentralized Exchanges (DEXs) are approaching five-month lows. This trend indicates a diminishing interest from traders, particularly following recent price depreciations.

Despite these metrics, some traders perceive potential for a recovery if liquidity conditions improve and the price successfully reclaims key resistance levels. However, until SUI achieves a significant upward move, bearish pressures are expected to persist.

Market Sentiment and Upcoming Events

In the broader cryptocurrency market, a prevailing sense of caution persists. Mark Roussin, CPA, shared an observation that markets are currently factoring in an estimated 85% probability of a Federal Reserve rate cut at the upcoming December 10 meeting. The anticipation of such a cut could potentially provide support for assets like SUI.

According to his analysis, if the Federal Reserve does not implement the anticipated rate cut, major U.S. stock indexes could experience significant declines. Market sentiment surrounding SUI, based on current indicators, still leans towards fear. Nevertheless, some analysts suggest that such negative sentiment might paradoxically support the formation of a local bottom.

Traders remain vigilant, closely monitoring macroeconomic developments and critical technical zones. A strong price movement above $1.60 could attract increased trading volume and potentially propel the token towards the $2.00 range.