Strive has urged MSCI to reconsider a proposal that would remove Bitcoin treasury firms from its indexes, arguing that such a move would limit investors' access to a rapidly expanding sector of the global economy. The firm is responding to MSCI's consideration of excluding companies with more than 50% of their assets in crypto from benchmark eligibility, with a decision expected on January 15.

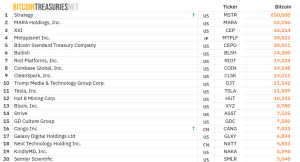

Strive, which is the 14th-largest listed BTC treasury firm, stated in a letter to MSCI CEO Henry Fernandez that the proposed 50% threshold is also "unworkable." The company explained that the inherent volatility of Bitcoin would frequently cause firms to fluctuate above and below this limit, making consistent compliance difficult. MSCI had previously indicated that many investors perceive digital-asset-treasury firms more as investment funds than operating businesses, which would disqualify them from inclusion in MSCI's equity indexes.

This letter comes amid warnings from analysts that the exclusion of companies like Strategy, Metaplanet, and others from stock indexes could significantly impact the crypto industry. JPMorgan has projected that the removal of Strategy could lead to up to $2.8 billion in outflows for the corporate Bitcoin buyer's stock, with a potential risk of $12 billion if other index providers follow MSCI's lead.

Bitcoin Companies' Role in the AI Boom

Strive CEO Matt Cole rejected MSCI's characterization of large crypto treasury firms as mere investment funds. He highlighted the crucial role Bitcoin miners play in facilitating the artificial intelligence (AI) boom by leveraging their surplus energy and infrastructure.

— Matt Cole (@ColeMacro) December 5, 2025

Cole stated that companies holding significant Bitcoin reserves, particularly miners, are increasingly becoming vital AI infrastructure providers. He elaborated that these miners are rapidly diversifying their data centers to offer power and infrastructure for AI computing. Even as AI-related revenue grows, their Bitcoin holdings will persist, and an exclusion from indexes would curtail client participation in this fast-growing economic sector.

Cole further noted that several Bitcoin miners have recently become preferred vendors for tech giants' computing needs, positioning them ideally to meet the escalating energy demands of AI firms.

Growth in BTC Structured Finance

Cole also contended that excluding crypto treasury firms would restrict companies that offer investors products similar to the structured notes linked to Bitcoin's returns provided by traditional finance leaders like JPMorgan, Morgan Stanley, and Goldman Sachs. He emphasized that Bitcoin structured finance is a legitimate business for these firms, just as it is for traditional financial institutions. Cole argued it would be an unfair disadvantage for crypto firms to compete against traditional financiers, who are already burdened by higher capital costs due to penalties from passive index providers on the very Bitcoin that enables their offerings.

The 'Unworkable' 50% Threshold

Cole elaborated on his assertion that MSCI's 50% threshold is impractical in its application. He explained that linking index inclusion to a numerical threshold for assets as volatile as Bitcoin could lead to more frequent turnover in funds benchmarked to MSCI's products.

This increased turnover, according to Cole, would raise management costs and heighten the risk of tracking errors, as companies would "flicker in and out of funds in proportion to their holdings' volatility."

Beyond the management and tracking error issues, Strive's CEO pointed out the difficulty in accurately measuring when a company's holdings reach the 50% mark. He noted the increasing variety of instruments through which companies gain exposure to Bitcoin, many of which are complex.

Cole raised questions about how such exposure would be measured, asking if companies holding Bitcoin structured products from firms like JPMorgan or Strategy would count towards the 50% threshold. He further questioned whether this would vary by product or if instruments beyond direct spot holdings could offer ways to circumvent MSCI's rule.