Introduction to Tempo Blockchain

Stripe's Tempo blockchain, developed in partnership with Paradigm, has entered its public beta phase, commencing on December 9. This launch enables businesses to leverage stablecoin payments, with initial partners including major financial institutions like UBS and Deutsche Bank.

Tempo's introduction provides a low-cost stablecoin payment solution, significantly enhancing Stripe's on-chain payment capabilities. It aims to challenge traditional financial systems by offering a fixed, predictable transaction fee model.

Key Developments, Impact, and Reactions

The joint release of the Tempo blockchain into public beta by Stripe and Paradigm highlights a strong emphasis on zero-fee settlement for stablecoins and enhanced on-chain scalability. This initiative combines Stripe's extensive experience in financial payments with Paradigm's deep expertise in blockchain innovation.

Several prominent companies are joining the network as early adopters. Alongside established participants like Deutsche Bank and OpenAI, new entities such as UBS and Cross River Bank are utilizing the Tempo network. Matt Huang of Paradigm has stated that Tempo is specifically designed to address the growing demand for stablecoin-focused, real-world payment solutions.

The beta release of Tempo is poised to reshape the stablecoin landscape. By implementing a fixed transaction fee of just 0.1 cents, Tempo aims to mitigate the unpredictability and cost associated with volatile gas fees. This could lead to increased adoption for micro-transactions and remittances, and encourage other enterprises focused on minimizing processing costs to integrate stablecoin payments.

“Tempo is purpose-built for stablecoins and real-world payments, born from Stripe’s experience in global payments and Paradigm’s expertise in crypto tech.”

Market reactions suggest recognition of Tempo's potential to disrupt existing blockchain infrastructures. Matt Huang has specifically highlighted Tempo's orientation towards real-world payments and its synergistic capabilities with Paradigm's technology. While the input from early partners is expected to be crucial, community reactions are still developing, with broad industry support anticipated.

Tempo and USDC in the Evolving Stablecoin Ecosystem

Tempo represents Stripe's most comprehensive blockchain initiative to date. It signifies a strategic shift from previous stablecoin ventures towards integrated payment solutions, mirroring recent advancements in the blockchain space by companies like Circle and Tether.

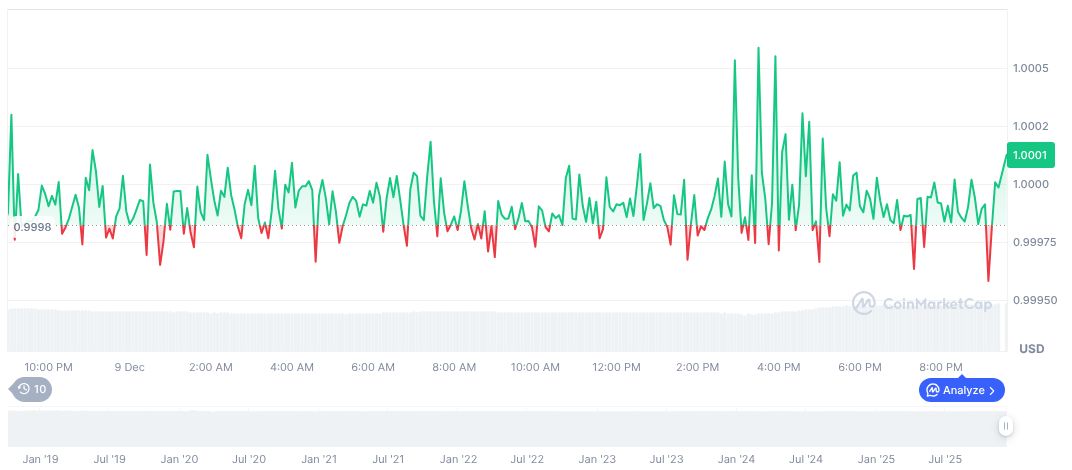

As of recent data, USDC holds a market capitalization of $78,493,478,469 and maintains a stable price of $1.00. Its 24-hour trading volume has seen a 10.66% increase, indicating consistent activity despite its stable pricing. Over the past 90 days, price variations have shown slight upward trends, with an increase of 2.83%.

Experts from Coincu observe that Tempo's architecture is designed to support fluid and regulated transaction channels, making it highly suitable for enterprise-level blockchain adoption. With Reth ensuring seamless EVM compatibility, businesses may find Tempo an attractive platform for sustainable, low-fee global transactions, thereby enhancing the efficiency of stablecoin asset transport.