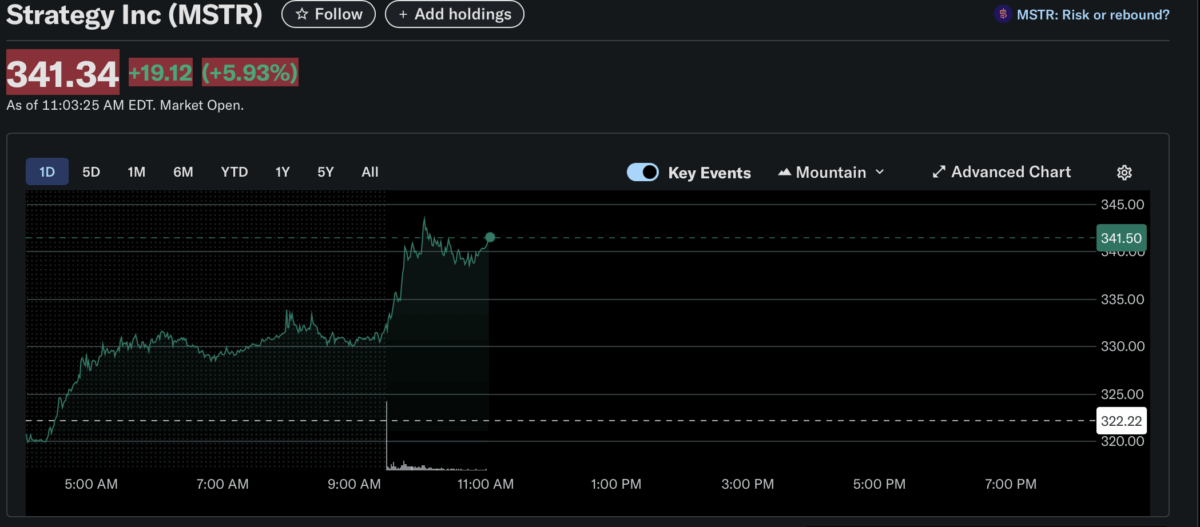

Michael Strategy’s software company, Strategy Inc. (MSTR), witnessed its price surge 5.93% on Wednesday after the Bitcoin-focused company revealed it will no longer be affected by the U.S. corporate alternative minimum tax.

This came shortly after investors received new guidance from the Treasury Department and the Internal Revenue Service, which changes how digital assets are treated under the rule.

The company was previously expected to face the 15% corporate minimum tax starting in 2026. This applies to corporations with average annual profits of more than $1 billion over a three‑year period. Strategy’s earnings and digital asset holdings made it a likely candidate for the tax.

What Changed in the Tax Rules

The rules changed on Tuesday after the U.S. Department of the Treasury and the Internal Revenue Service released new interim guidance, which explained that first, they can ignore unrealized gains and losses from digital assets when checking if they cross the $1 billion line. Unrealized gains are profits on paper, which a company has not actually received because it has not sold the asset.

In a filing following the update, Strategy said it now expects exemption from the corporate minimum tax, which was introduced under the Inflation Reduction Act to ensure profitable firms contribute a baseline amount to the federal government. Shortly after the news, the share surged to $341, up from its daily low of $320.

Strategy’s Bitcoin Holdings and Accounting Change

Strategy has been central to corporate Bitcoin adoption. It adopted new accounting standards that require the company to report its Bitcoin holdings at fair value. This means it must show the current market price of Bitcoin, even if it does not sell the coins.

For the six months ending June 30, Strategy reported an $8.1 billion unrealized gain on its Bitcoin holdings. The company currently holds about $74.6 billion in the cryptocurrency, which makes it the largest public company holder of Bitcoin worldwide.