Strategy's Persistent Bitcoin Accumulation

Michael Saylor's company continues its strategy of acquiring Bitcoin daily this week, actively countering sale rumors through frequent updates shared via Saylor's Twitter account and confirmed in official interviews. This persistent acquisition amidst volatility highlights a strategic investment approach, despite potential market fluctuations that could affect both Bitcoin prices and the company's stock performance.

Daily Bitcoin Purchases Defy Market Trends

Michael Saylor's declaration on the X platform, stating Strategy’s intention to purchase Bitcoin daily, reaffirms their unwavering commitment. His explicit denial of sales rumors emphasizes a continued acquisition path, signaling to stakeholders that Bitcoin remains an integral asset in Strategy’s portfolio. Besides negating rumors, Saylor maintained that the current volatility does not alter their acquisition plan. The announcement fuels market speculation over price stability, potentially influencing investor positioning.

These daily purchases reflect an ongoing faith in Bitcoin's potential while dismissing destabilizing rumors. Market participants are observing behavioral economics signals, anticipating their possible influence on Bitcoin valuation. The immediate implications resonate, as Strategy’s actions might set an industry precedent amid cryptomarket turbulence. Continued purchases underscore Strategy’s steadfast approach, independent of current price trends. Investors are tracking such activity, anticipating wider market repercussions as Strategy declares its sustained enthusiasm for this cryptocurrency asset.

Market participants have reacted variably, with mixed opinions across forums and financial analysts expressing skepticism over the sustainability of such a strategy. Key figures like Saylor assert clear investment perspectives, counseling patience and endurance, reflecting Strategy’s faith in future Bitcoin market appreciation. These strategic moves align with historical accumulation patterns, mirroring past behavior in similar market conditions.

Bitcoin Market Dynamics During Strategy's Accumulation

Did you know? Strategy’s continued purchasing pattern contrasts common market hesitation, reflecting historic precedence from 2021 acquisitions which paused similar price declines before.

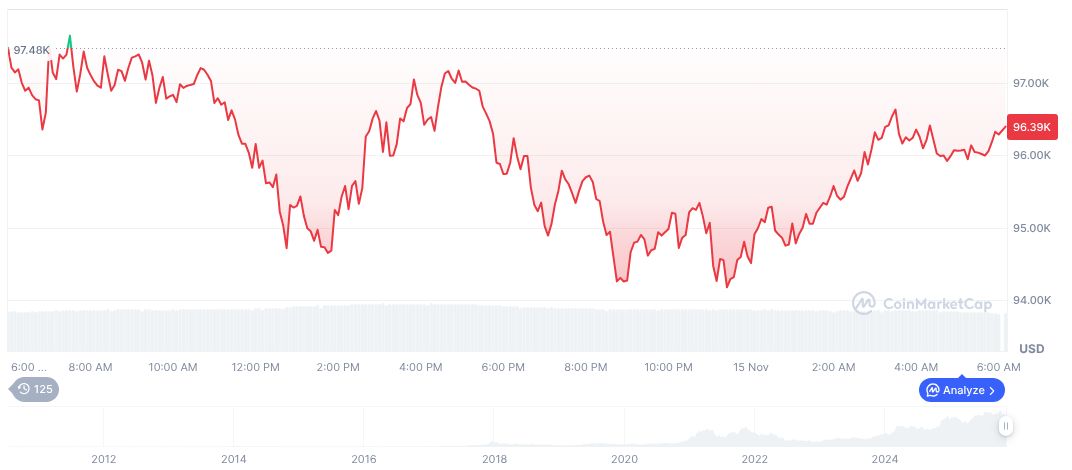

Bitcoin (BTC) is currently priced at $95,907.00, exhibiting a market cap of $1.91 trillion with a 24-hour trading volume reaching $97.30 billion as per CoinMarketCap metrics. Despite facing an increasing market cap, BTC has experienced a decline, with negligible movements contributing to a market dominance of 58.86%. Short-term changes reflect a mixed performance, with a 1.05% price reduction in the past 24 hours and a broader 18.96% dip over 90 days. The circulating supply stands at 19.95 million against a max supply of 21 million. Comprehensive market landscape data is captured by CoinMarketCap.

Insights suggest Strategy’s purchasing behaviors may buffer further price dips and contribute to extended BTC stabilizing periods. Historical trends indicate recurrent purchasing cycles often result in market inclines, even amidst prevailing downturns. These acquisition strategies might preempt other institutional investors to sustain or affirm BTC's market stature.