The Starknet (STRK) price has emerged as a notable performer in a volatile market, defying the downward trend observed in most altcoins. Over the past week, STRK has experienced a significant rally.

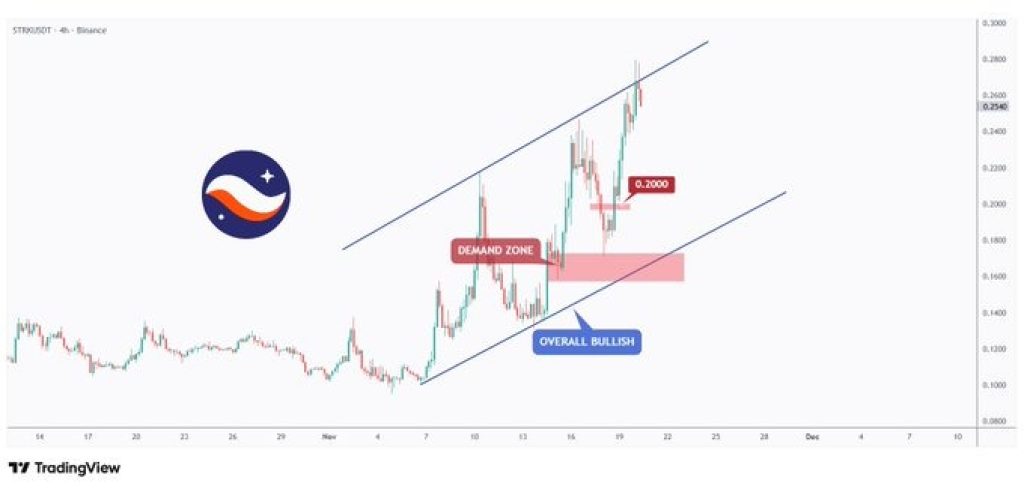

Technical analysis of the Starknet chart reveals a distinct rising channel pattern. The recent surge, triggered by a bounce from the channel's lower trendline, has resulted in an increase of over 50%. This price action is attracting considerable attention, as the observed pattern suggests that the upward momentum may persist.

The price movements observed over the last two weeks have clearly established an upward channel, characterized by successively higher highs and higher lows.

Earlier in the week, the STRK price tested the bottom of this channel, which it successfully held, leading to a sharp upward movement accompanied by strong trading volume. This indicates that buyers remain in a dominant position, even amidst broader market weakness.

The underlying structure suggests a straightforward scenario: as long as STRK maintains its position within the channel, the bullish trend is likely to continue. Each instance of the price retesting the lower boundary has resulted in a renewed upward push, a behavior that is currently evident on the chart.

Additionally, a significant demand zone has been identified between the price levels of 0.1600 and 0.1800. This area has served as the starting point for the most recent price increase.

Each time the STRK price has entered this zone, buying pressure has intensified. The rapid rebound from this region indicates a high level of confidence among traders who perceive these dips as opportunities for profit rather than as significant risks.

This demand zone is now established as a crucial support level. If STRK can sustain its price above this level, the ongoing uptrend is expected to continue without substantial impediments.

Potential Future Movements for STRK Based on Chart Patterns

If the Starknet price continues to adhere to the established rising channel, the next anticipated target would be near the upper boundary of the channel, approximately within the range of 0.2600 to 0.2800.

Current momentum indicators are already pointing towards this direction, and the recent successful defense of the lower trendline demonstrates that buyers are not losing steam.

A decisive breakout above the channel's upper limit would pave the way for even higher price levels. However, even without such a breakout, the existing chart structure remains fundamentally bullish.

The primary factor that could potentially disrupt this upward trajectory would be if the STRK price were to fall back into the aforementioned demand zone and fail to initiate a subsequent bounce. However, based on the strength of the recent rally, this risk currently appears to be minimal.

Should this observed pattern persist, STRK may be positioning itself for another significant upward movement in the coming days.