Bitcoin’s sharp pullback below $90,000 may already be in the rearview mirror, according to Standard Chartered’s head of digital asset research, Geoffrey Kendrick. Despite the cryptocurrency plunging to its lowest level in seven months on November 18, 2025, Kendrick argues that the move aligns with past corrective patterns and shows signs of exhaustion, a setup he believes could precede a renewed rally into year-end.

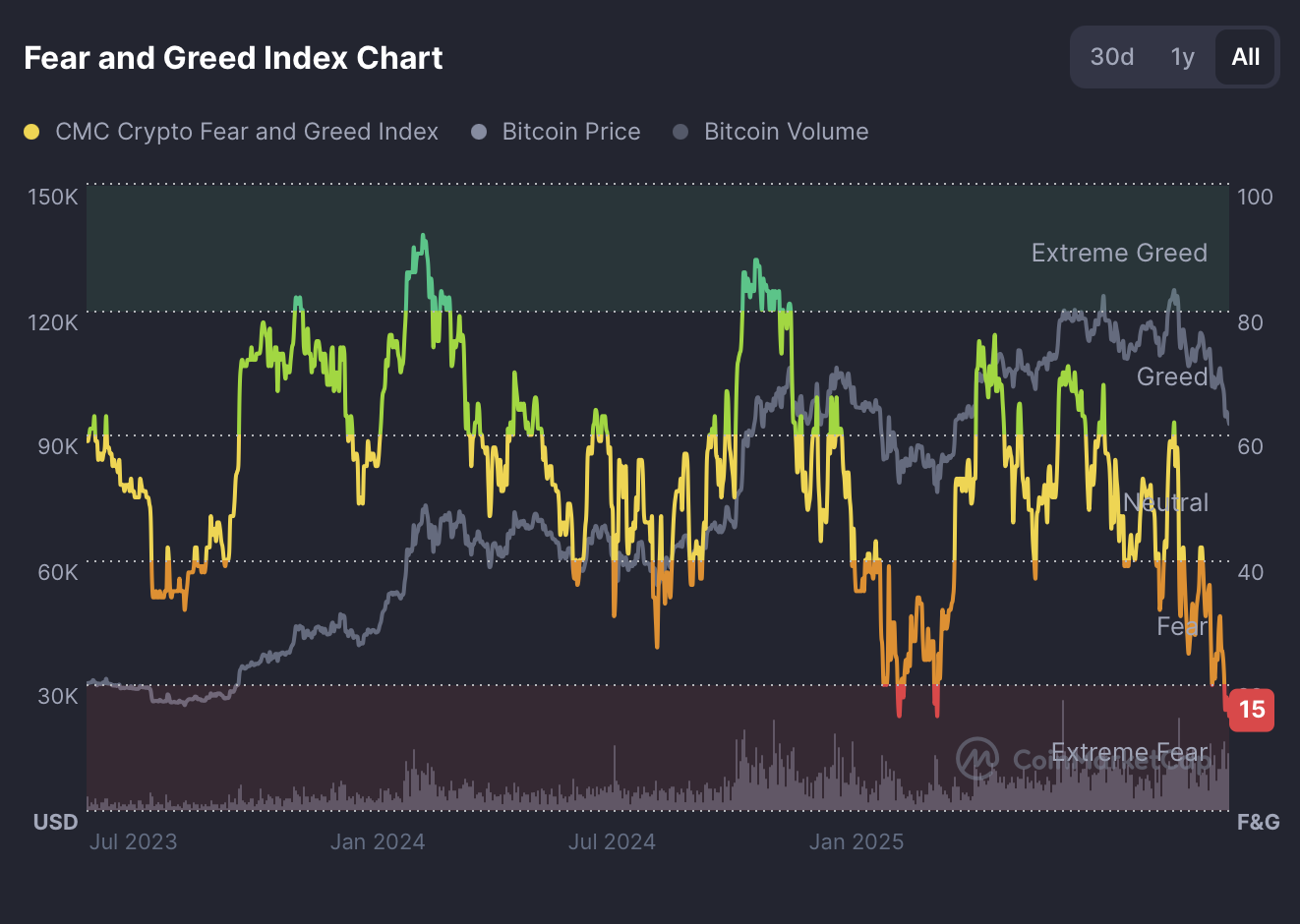

Bitcoin briefly traded under $90,000, erasing all gains for 2025 and sending market sentiment into panic territory. The Crypto Fear & Greed Index dropped to 15, one of its lowest readings of the year, as leveraged positions unwound and ETF flows cooled. Still, Kendrick maintains that the fundamental trend remains intact.

He describes the recent drawdown as a “fast, painful version” of previous post-ETF corrections. Since U.S. spot Bitcoin ETFs launched in 2024, Bitcoin has experienced three major retracements, each followed by a strong rebound once sellers were flushed out. Standard Chartered believes the latest decline mirrors that pattern, with several metrics now pointing to capitulation among short-term holders.

Kendrick has reiterated his ambitious year-end price target of $200,000, highlighting several factors that support the forecast. These include renewed ETF inflows, ongoing institutional accumulation, and corporate treasury interest that has continued even during market turbulence. He also notes that macro data, particularly around inflation and liquidity, remains supportive of risk-asset recovery heading into December.

Other analysts have also highlighted improving long-term signals despite the recent volatility. Bitcoin ETF investors now sit near breakeven, and accumulation from high-conviction buyers has quietly resumed. With retail panic selling at elevated levels, some market watchers view the current environment as a classic late-correction phase.

While the path higher may remain volatile, Standard Chartered maintains that the broader trajectory of the cycle is unchanged. If ETF flows stabilize and macro conditions remain supportive, Kendrick believes Bitcoin could still stage a powerful rally before the year closes.