Key Developments in the DeFi Sector

Stream Finance's xUSD stablecoin has collapsed following a significant loss of $93 million, an event that has triggered substantial stablecoin outflows totaling $1 billion across various decentralized finance platforms. This week's outflows represent the largest such event since the collapse of UST in 2022, highlighting persistent vulnerabilities within the DeFi ecosystem.

The liquidity crisis has had a ripple effect, impacting several prominent protocols and raising renewed concerns about the stability of stablecoins in the cryptocurrency market.

Stream Finance's Loss and Market Contagion

The collapse of Stream Finance's xUSD was precipitated by a $93 million loss, reportedly incurred due to a high-risk strategy employed by an external fund manager during a period of market volatility. Stream Finance has appointed Keith Miller and Joseph Cutler to conduct a thorough investigation into the incident. Following the event, attention quickly shifted to other protocols such as Coinshift and Elixir, whose stablecoin assets were interconnected with Stream. These protocols experienced severe liquidity shortages, echoing the financial distress observed during the 2022 market turmoil.

The immediate consequence of these events has been a sharp decline in the total value locked (TVL) for several key DeFi protocols. Coinshift's csUSDL saw its TVL plummet by 95%, leaving only $1.92 million. Elixir encountered significant liquidity challenges, leading to a critical drop in its stablecoins, deUSD and sdeUSD. Additionally, Euler experienced a substantial hit, accumulating $137 million in bad debt.

"...just one conversation with them and five minutes of browsing their Debank account is enough to realize that this is going to end badly."

Calls for Transparency and Regulatory Scrutiny

The significant outflows observed this week, totaling $1 billion, underscore the ongoing risks associated with decentralized finance and mark the most substantial stablecoin crisis since the collapse of UST in 2022. This situation is prompting increased discussion about the need for enhanced transparency and potentially new regulatory frameworks within the DeFi space.

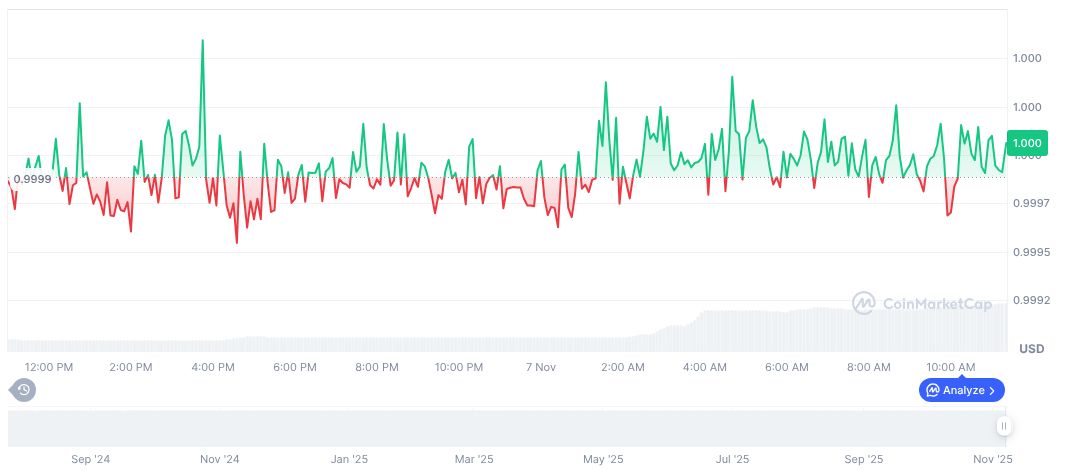

In contrast, StraitsX USD (XUSD) has maintained its peg, holding steady at $1.00 according to CoinMarketCap data from November 7, 2025. The cryptocurrency exhibited minimal price volatility, with a 0.01% increase over a 24-hour period. Its trading volume saw a notable surge of 287.76% to $88.46 million, although its overall market dominance remained at 0.00%.

Research indicates that such events may accelerate the evolution of regulatory frameworks, with a potential focus on improving the transparency of asset backing mechanisms for stablecoins. Historical data consistently demonstrates that systemic risks, particularly those stemming from synthetic assets and the interconnectedness of protocols, can amplify financial shocks. This reinforces the argument for enhanced oversight and risk management strategies within the decentralized finance sector.