Hourglass Phase 2 Closes with $1.6 Billion Deposited

Hourglass reported that the Stablecoin Reserve Phase 2 garnered deposits exceeding $1.6 billion, involving over 25,000 unique wallets. The deposit channel closed at 1:25 AM UTC. An abnormally high volume of traffic led to the full utilization of Hourglass's frontend RPC capacity.

Hourglass conveyed that high demand led to a temporary pause in new deposit operations due to RPC capacity limits. They assured participants that all user funds remain secure and promised further updates soon.

"After the start of Phase 2 of the Stable Deposit Event, the platform experienced an abnormally high volume of traffic, causing Hourglass's frontend RPC capacity to be fully utilized. Due to overwhelming demand, Hourglass's institutional liquidity pool has temporarily paused new deposit operations. All user funds remain secure. Further updates will be announced shortly."

Institutional Finance Eyes Stablecoins Amid Liquidity Shifts

The Stablecoin Reserve Phase 2 saw one of the fastest growths in deposit volumes within hours, showcasing unprecedented market engagement since similar events like the USDT expansion five years ago.

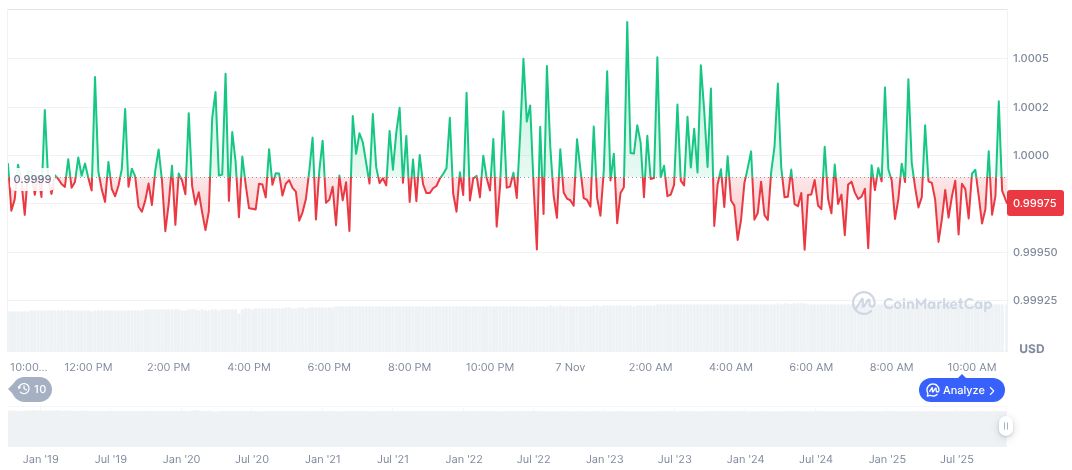

According to CoinMarketCap, USDC remains steady at $1.00 per token with a market cap of $75.74 billion. The stablecoin's trading volume reached $20.03 billion over the past 24 hours, ensuring its market dominance near 2.20%.

These deposit phases indicate a potential liquidity power shift towards stablecoins in institutional finance. Regulatory scrutiny may increase as authorities monitor these transactions, emphasizing security and transparency in the evolving market landscape.