Japan’s leading yen-pegged stablecoin issuer, JPYC Inc., is preparing to direct the majority of its reserves into Japanese government bonds (JGBs), a shift that could reshape the country’s financial landscape as digital currency adoption accelerates.

According to CEO Noritaka Okabe, JPYC plans to invest approximately 80% of its reserves in JGBs and the remaining 20% in traditional bank savings. Initially, the company aims to focus on short-term securities, though Okabe said longer-dated JGBs may be added later depending on market conditions and regulatory clarity.

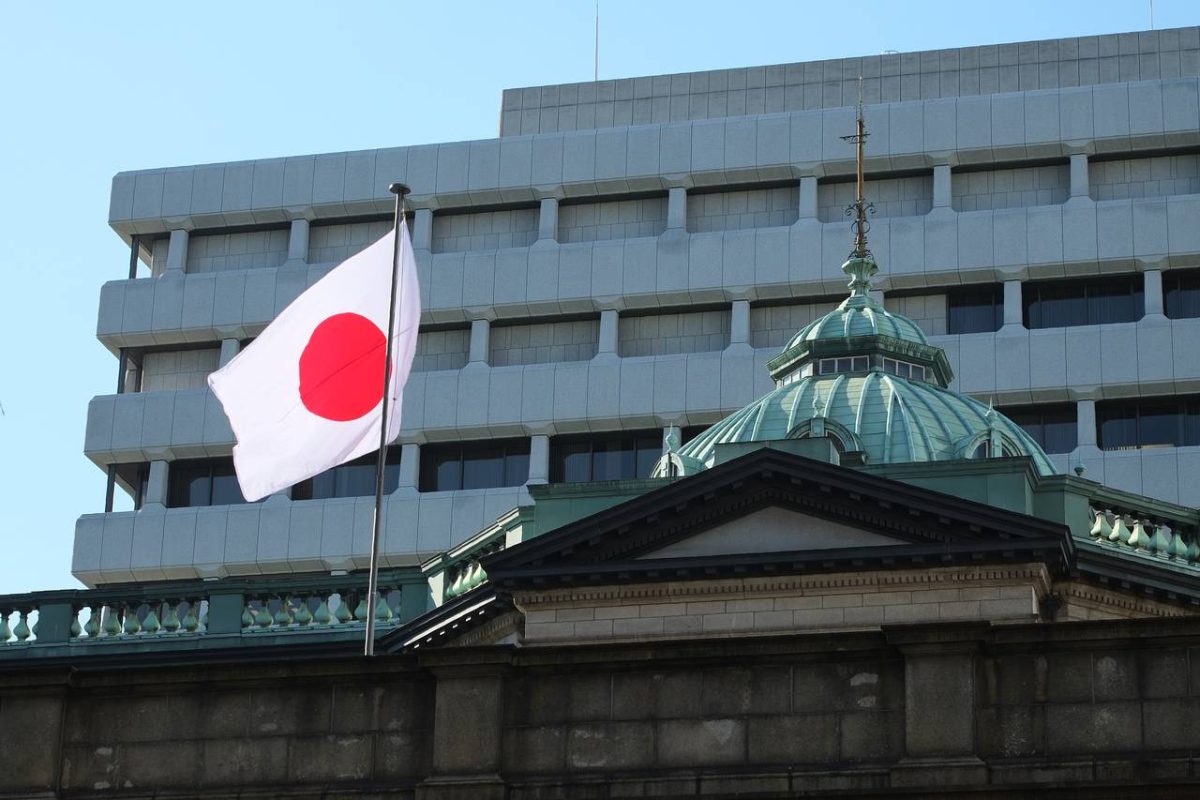

The move positions JPYC, issuer of the JPYC stablecoin, pegged 1:1 to the Japanese yen, as a potential large-scale participant in the domestic bond market, traditionally dominated by the BOJ and major financial institutions.

Stablecoin Issuers Could Fill BOJ’s Void

The development comes amid the Bank of Japan’s ongoing tapering of its historic bond-buying program. Since 2024, the BOJ has gradually reduced its JGB purchases, aiming to wind down its ultra-loose monetary policy while maintaining financial stability.

Despite this tapering, the BOJ still holds roughly 50% of the JGB market, underscoring how deeply intertwined its stimulus measures remain with Japan’s bond ecosystem. As the central bank scales back, stablecoin issuers like JPYC could step in to absorb market supply, using reserves generated from growing stablecoin circulation.

This dynamic may create a new feedback loop between digital currency markets and sovereign debt, where stablecoin demand indirectly determines bond purchases, subtly influencing yields and monetary conditions.

Policy Implications and Global Outlook

Regulators could, in theory, impose restrictions on the duration or maturity range of bonds stablecoin issuers hold. However, Okabe noted that controlling the total amount of JGBs purchased would be far more challenging, given that stablecoin supply is driven by market demand rather than central authority mandates.

Okabe added that Japan’s experience is likely to become a global model, predicting that stablecoin-backed bond investment strategies will emerge in other major economies as the tokenization of money-market assets and sovereign debt accelerates.

“This trend is not unique to Japan,” Okabe stated. “The integration of stablecoins and government bonds will unfold globally as digital finance becomes mainstream.”

A New Intersection Between Digital and Traditional Finance

JPYC’s strategy highlights a growing intersection between digital finance and traditional sovereign debt markets, signaling how stablecoins could evolve beyond payment tools into major fixed-income investors.

If this shift continues, stablecoin issuers could soon play a structural role in national financial systems, stabilizing liquidity, influencing interest rate dynamics, and complementing central banks as participants in sovereign bond markets.

For Japan, it represents not just another innovation in the digital asset sector, but a potential transformation in how liquidity flows between stablecoins, banking reserves, and public debt, reshaping the global conversation around the future of monetary systems.