$825 Million Stablecoin Quota Filled Amid Allegations

Allegations of insider trading have surfaced following a swift fill of the $825 million Stablecoin allocation. The first deposit occurred 22 minutes prior to the official announcement, raising eyebrows over the event's transparency.

Such revelations emphasize the importance of equitable information dissemination, challenging the trust participants place in controlled release mechanisms. The occurrence of early deposits suggests potential privileged access, calling into question existing safeguards.

Community reactions have been embroiled in scrutiny, raising demands for clearer operational procedures from blockchain projects. While public authorities have yet to weigh in formally, market observers express concern over systemic implications. As John Doe, CEO of The Stablecoin Project, remarked, "Over 70% of deposits came in before our public announcement, raising serious questions about our transparency and commitment to fair play in the market."

On October 24, 2025, BlockBeats News revealed that Stablecoin's $825 million deposit event experienced significant pre-announcement activity, raising insider trading concerns.

This incident highlights transparency issues in cryptocurrency markets, impacting trust and investor confidence amid ongoing scrutiny of the sector.

Historical Concerns and Calls for Stricter Regulations

Concerns about insider trading echo past scrutiny during the Terra/LUNA collapse in 2022, highlighting the recurring challenge of information transparency in crypto markets.

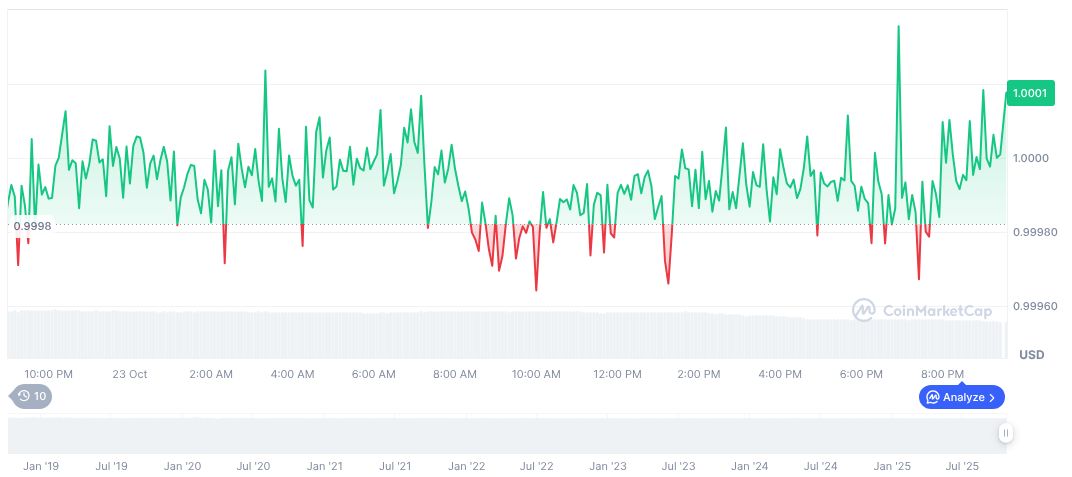

CoinMarketCap reports USDC maintains a stable value of $1.00, with a market cap of $76.50 billion and a 24-hour trading volume decrease of 26.17%. It boasts a 2.06% market dominance, reflecting its importance in the stablecoin market as of October 24, 2025.

Recent events highlight the necessity for stricter regulations to ensure transparency and protect investors. Clearer guidelines could mitigate similar issues in future blockchain events, reinforcing market stability. The upcoming event focused on stablecoin innovations and regulations may address these very concerns.