StableChain Mainnet Launch and STABLE Token Introduction

Stable, a project backed by Bitfinex, has officially launched its mainnet, StableChain, alongside its native token, STABLE, on December 8. A key feature of this launch is the utilization of Tether's USDT as the gas token for transactions on the network. The total supply of STABLE is set at 100 billion tokens, with its primary functions designated for governance and ensuring network security.

The project has already garnered significant attention, attracting over 24,000 wallets that have engaged in pre-deposits, collectively exceeding $2.80 billion. The governance token model for STABLE specifically restricts it from any payment functions, thereby concentrating its utility on the Delegated Proof of Stake system to maintain network security. Notable institutional partners supporting this initiative include Anchorage Digital, PayPal, and Standard Chartered's Libeara.

The cryptocurrency community has expressed considerable interest in StableChain's debut. Industry observers are closely monitoring the potential implications for trading volumes and overall market liquidity. Official communications from the project indicate a continuous process of observing regulatory feedback and conducting market analysis to better understand the long-term impacts of this new blockchain network.

USDT Integration as Blockchain Fuel: A New Precedent

StableChain's decision to use USDT as its gas token establishes a pioneering precedent in the blockchain industry. This integration makes it a leading network to employ a fiat-pegged stablecoin as a core component for blockchain fuel, setting a new standard for how transactions can be facilitated.

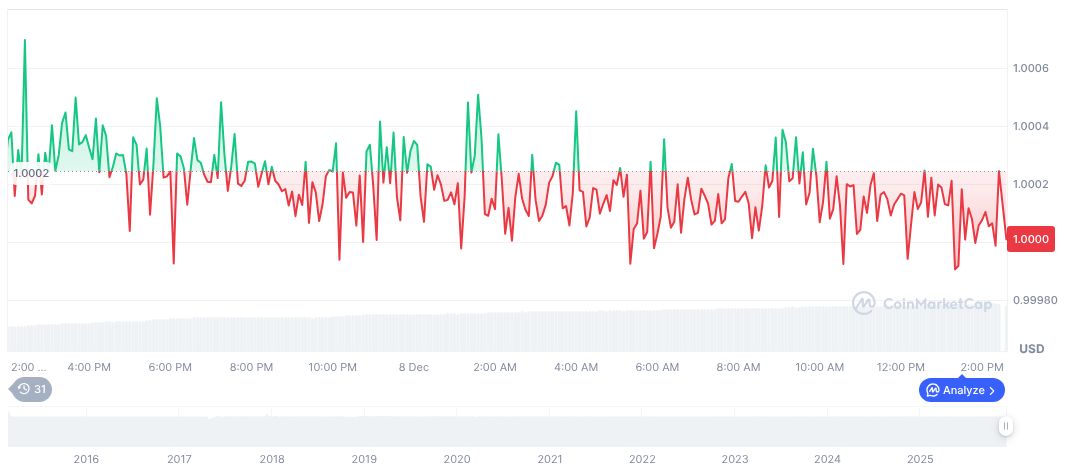

According to data from CoinMarketCap, Tether (USDT) currently holds a market dominance of 6.04%, with a market capitalization of $185.64 billion. Its 24-hour trading volume has experienced significant fluctuations, showing a 68.99% change, while its price has remained stable at $1.00.

Experts at Coincu suggest that the adoption of USDT for transaction fees on StableChain could potentially drive widespread user adoption and enhance market liquidity. While the network's governance structure and strong institutional backing may attract regulatory attention, these factors also offer the potential for robust ecosystem development.