Key Developments in Financial Markets

On October 27, the spot gold price experienced a significant intraday decline of over $100, falling below $4010 per ounce, as reported by BlockBeats News. This notable drop in the commodities market occurred without any immediate or evident linkage to recent activities within the cryptocurrency space.

Gold Market Losses Exceed $100 per Ounce, Draws Scrutiny

The gold market experienced a substantial loss exceeding $100 per ounce, attracting considerable attention from various financial sectors. While this event prompted discussion, major institutions such as BlackRock have not indicated any direct correlation between this price movement and cryptocurrency maneuvers. Instead, BlackRock focused on significant crypto transactions, depositing over $220 million into Coinbase Prime. This routine activity raises questions about the valuation of traditional assets in comparison to newer digital alternatives.

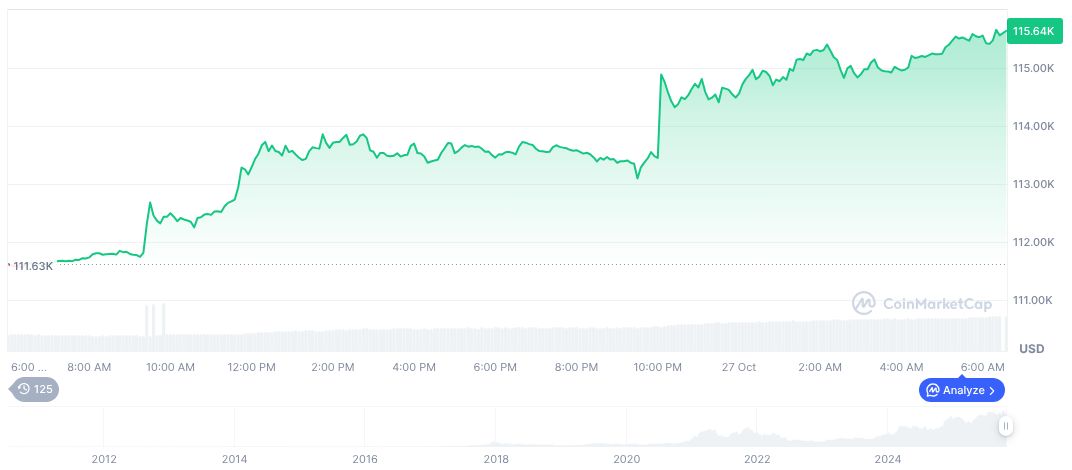

Following the sharp decline in spot gold prices, market dynamics have seen shifts in investor strategies. Notably, large institutional players have increased their cryptocurrency holdings, although they have not explicitly cited the gold price drop as a direct catalyst for these decisions. This approach to diversification suggests an effort to leverage opportunities amidst market volatility. During this period, Bitcoin's price surged to over $113,000, indicating robust investor confidence that remained unaffected by the fluctuations in the gold market.

Key opinion leaders within the cryptocurrency and broader financial sectors have not publicly connected the gold market's decline with current crypto activities. They maintain the perspective that ongoing crypto market developments are fundamentally distinct from trends in real-world commodities. However, substantial inflows into cryptocurrency ETF platforms and stable funding rates for BTC underscore continued mainstream trader interest in digital assets.

Bitcoin Price Surges Past $113,000 Amid Gold Market Decline

Historical instances of sudden gold price drops are frequently associated with adjustments in hedge fund and institutional asset allocations. However, comprehensive analyses seldom reveal direct repercussions stemming from the cryptocurrency market.

According to CoinMarketCap, Bitcoin (BTC) is currently trading at $115,643.32. It holds a market capitalization of $2.31 trillion, representing 59.02% of the total market dominance. The trading volume has surpassed $62.45 billion in the last 24 hours, marking an increase of 87.24%. Bitcoin's price has seen a rise of 4.81% over the past week, although it remains down by 1.81% over a 90-day period. Approximately 19.94 million tokens are currently in circulation, nearing its maximum supply of 21 million tokens.

Experts suggest that the current dip in the gold market is unlikely to prompt immediate regulatory changes within digital asset markets. Analytical patterns indicate the resilience of cryptocurrencies in the face of instability in traditional sectors. Investor sentiment may continue to favor digital assets, driven by institutional acceptance and prolonged weakness in equity markets.