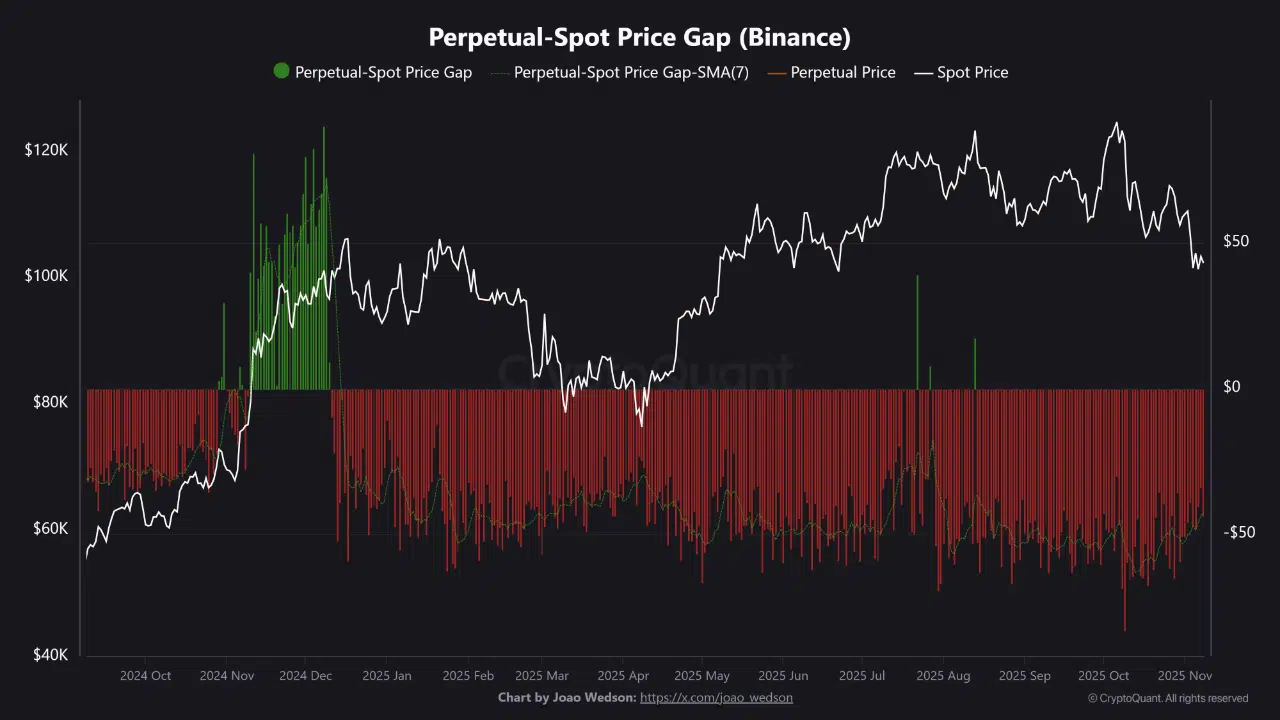

According to a new CryptoQuant report shared by analyst BorisD, Binance’s spot market has maintained a structural premium over its perpetual futures for an extended period. This indicates that spot-side demand remains dominant even amid lower retail speculation.

The data shows an average price gap of roughly $50, with the spot price consistently staying above the perpetual price. While such divergences are often temporary in fast-moving markets, this persistent negative spread suggests something deeper: steady, organic spot demand being absorbed by institutional liquidity providers rather than aggressive speculative buying.

A Market Quietly Balancing Demand and Liquidity

Typically, when the perpetual market becomes long-heavy, its price moves higher than spot, reflecting leverage-driven optimism that often precedes a correction. However, CryptoQuant’s data indicates the opposite; the perpetual side has stayed balanced, while spot prices continue to lead.

This pattern implies that Binance’s spot order flow is not driven by leveraged retail enthusiasm, but by consistent, measured accumulation met by institutional selling or hedging activity. In essence, the market has quietly transformed spot demand into liquidity, creating a stable equilibrium where demand and sell pressure coexist without triggering major volatility.

Structural, Not Short-Term

BorisD emphasizes that this is not a one-off anomaly but a long-term structural feature of Binance’s trading environment. The sustained nature of the gap suggests that institutions have been systematically converting incoming spot demand into liquidity, effectively maintaining price balance while providing market depth.

Such silent equilibrium is often a precursor to broader shifts in market behavior, as the accumulation of liquidity on one side can eventually set the stage for sharp directional moves when institutional strategies change.