Key Developments in Bitcoin Holdings

SpaceX has recently transferred 2,395 BTC, valued at approximately $268 million, across two distinct addresses within a 24-hour period. This significant movement follows a similar pattern observed three months prior, prompting discussions about SpaceX's internal fund management strategies and potential shifts in their Bitcoin holdings.

Blockchain data indicates that 1,187 BTC were moved to the address bc1qq...4sduw, while an additional 1,208 BTC were sent to bc1qj7...6kqef. Both of these receiving addresses have remained inactive since the transfer, with no outgoing transactions recorded thus far.

While the receiving wallets are not explicitly labeled, Arkham Intelligence previously identified a similar transaction in July as being related to Coinbase Prime Custody. This context leads analysts to believe that these recent movements may represent an internal reorganization of assets rather than an indication of a sell-off or liquidation event.

Long-Term Holders Reduce Bitcoin Positions Amidst Price Declines

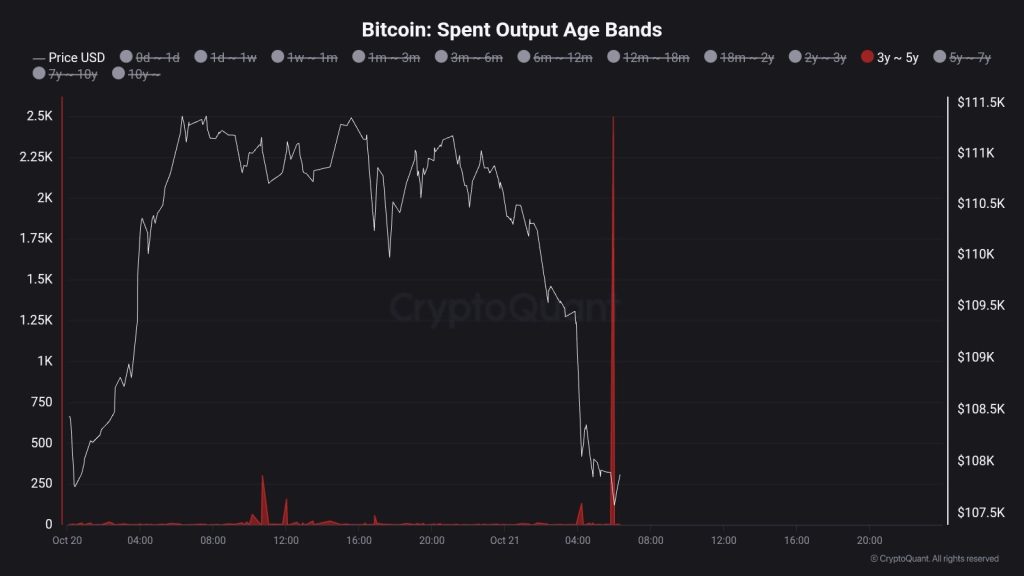

Concurrently, analysis from CryptoQuant highlights a notable trend among long-term Bitcoin holders. The 3–5 year spent output age band has seen a surge, with 2,496 BTC moved recently. This data suggests that older Bitcoin wallets have become active, potentially signaling a change in sentiment among long-term investors.

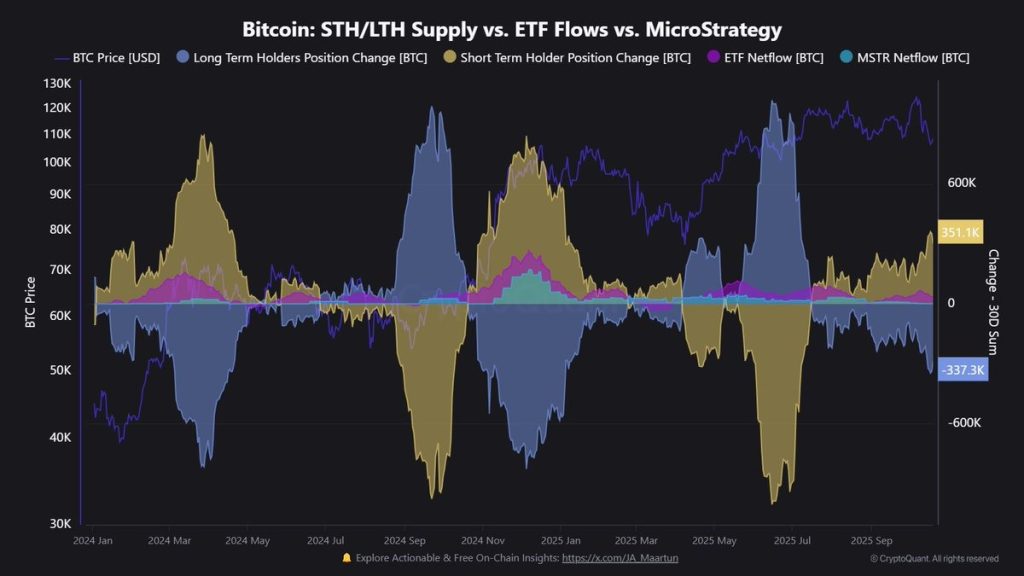

Further data from CryptoQuant's latest release on October 21 reveals that over the past 30 days, long-term holders have reduced their Bitcoin positions by a substantial 337,300 BTC. In contrast, short-term holders have increased their holdings by 351,100 BTC during the same period, indicating a significant reshuffling of Bitcoin ownership across different investor cohorts.

Bitcoin's price has experienced a decline of 2.86% in the last 24 hours, currently trading at $108,141.70. Over the preceding week, the price has fallen by 3.44%, though a minor hourly increase of 0.10% was noted.

While institutional investments from entities like MicroStrategy and Bitcoin ETFs have remained steady, analysts suggest that long-term holders may be taking profits on previous gains. This behavior appears to be consistent with the observed shifts in wallet activity and the recent large-scale transfers, such as those initiated by SpaceX.