S&P Global has assigned a speculative-grade rating to Michael Saylor's Strategy firm, citing its substantial reliance on the volatile Bitcoin and limited dollar liquidity. The credit rating agency initiated coverage of the Bitcoin treasury firm with a B- rating, six notches below investment grade, stating it possesses "speculative credit quality with increased default risk."

Key weaknesses identified by S&P include the firm's concentrated Bitcoin holdings, a narrow business focus, and weak risk-adjusted capitalization. The agency also cautioned about an "inherent currency mismatch," as Strategy's debt is entirely denominated in US dollars, while its assets are predominantly held in Bitcoin. A significant decline in Bitcoin's price could compel the company to sell assets at a loss to meet its obligations, potentially leading to liquidity stress.

Saylor Lauds 'First-Ever' Rating For A Crypto Treasury Firm

Michael Saylor expressed his enthusiasm for the development on X, referring to it as the "first-ever" rating for a Bitcoin treasury firm from a "major credit rating agency."

S&P Global Ratings has assigned Strategy Inc a 'B-' Issuer Credit Rating (Outlook Stable) — the first-ever rating of a Bitcoin Treasury Company by a major credit rating agency. https://t.co/WLMkFqkkCb

— Michael Saylor (@saylor) October 27, 2025

Industry peers shared Saylor's sentiment. David Bailey, CEO of KindlyMD, predicted that "market demand for treasury companies is about to explode" following the rating. Ratings are often a prerequisite for pension funds and other institutional investors to engage in corporate paper investments.

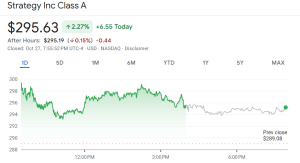

Strategy Shares Climb

Strategy shares saw an increase of over 2% yesterday. However, they have experienced a 9% decline over the past month and a more than 19% drop in the last six months, according to Google Finance data.

Strategy Continues Bitcoin Acquisitions

Strategy, formerly an enterprise software company, dedicates nearly all its excess cash to acquiring Bitcoin and expanding its reserves. The company also raises capital for Bitcoin purchases through the issuance of convertible debt, preferred stock, and equity.

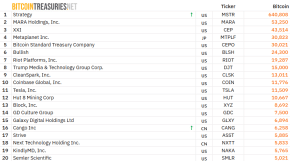

Since beginning its Bitcoin purchases in 2020, Strategy has become the largest BTC treasury firm globally. Bitcoin Treasuries data indicates that Strategy has amassed 640,808 BTC, valued at approximately $72.97 billion at current prices. The company holds an unrealized gain exceeding 52%, which translates to over $25.53 billion.

Recently, Strategy and other digital asset treasury firms have faced challenges due to declining stock prices, which has impacted their ability to raise capital for further acquisitions. Nevertheless, Strategy has persisted in buying Bitcoin while other crypto treasury firms have paused their purchases.

Strategy's most recent Bitcoin purchase occurred on October 27, when the firm acquired an additional 390 BTC for approximately $42.4 million, at an average price of $111,117 per coin.

Strategy has acquired 390 BTC for ~$43.4 million at ~$111,053 per bitcoin and has achieved BTC Yield of 26.0% YTD 2025. As of 10/26/2025, we hodl 640,808 $BTC acquired for ~$47.44 billion at ~$74,032 per bitcoin. $MSTR$STRC$STRK$STRF$STRDhttps://t.co/1d4Pmv8ub2

— Michael Saylor (@saylor) October 27, 2025