Expanded Regulations Target Transparency and Money Laundering

On November 28th, South Korea's Financial Services Commission Chairman Lee Eok-won announced expanded cryptocurrency regulations under the "travel rule" at the Anti-Money Laundering Day ceremony. This move heightens compliance, curtails money laundering risks, and impacts global crypto interactions, affirming South Korea's regulatory rigor in virtual asset oversight.

Crypto Market Braces for Liquidity Shifts

Lee Eok-won announced the extension of the travel rule, also known as the "cryptocurrency real-name system," during the Anti-Money Laundering Day ceremony. The expanded scope aims to scrutinize transactions below 1 million won, approximately US$680, signaling intensified efforts against financial crimes in crypto. The crackdown includes bans on transactions with high-risk overseas exchanges and a comprehensive review of crypto business stakeholders' financial and criminal profiles. These measures will likely discourage illicit activities and foster a more transparent crypto trading environment.

"The 'travel rule' or 'cryptocurrency real-name system' will be expanded to cover cryptocurrency transactions below 1 million won." - Lee Eok-won, Chairman, Financial Services Commission (FSC) of South Korea

Market observers note that stricter reviews and prohibitions could decrease cross-border liquidity. While no comments from global figures have emerged, local regulators see this as aligning with international standards.

Historical Context and Market Data

South Korea's expansion of the travel rule aligns with previous efforts like the real-name system, reflecting a consistent history of comprehensive measures against crypto-related financial crimes.

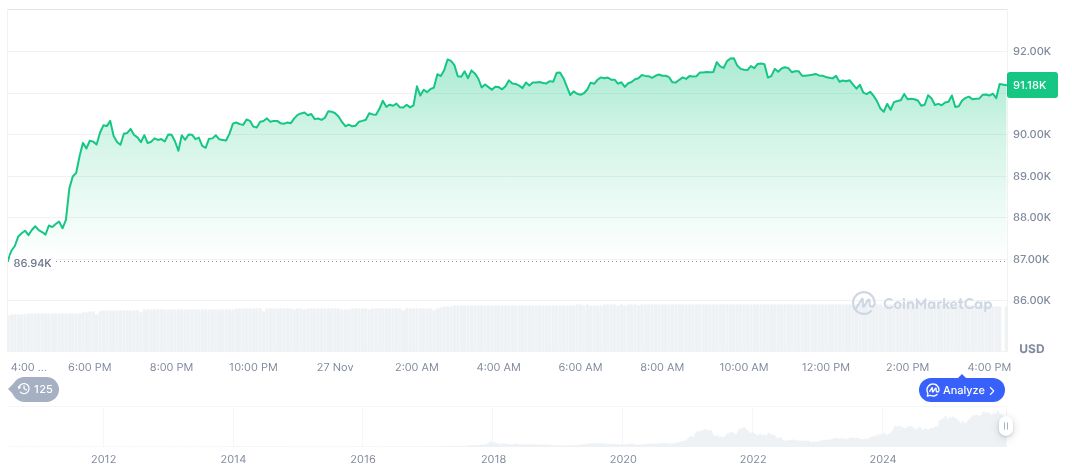

Bitcoin (BTC) holds a market cap of $1.82 trillion with a current price of $91,395.97. It experienced a 24-hour shift of 5.81% and a 7-day increase of 7.32%. The circulating supply is 19,954,762 against a maximum of 21 million BTC.

Coincu's research team suggests that these regulatory changes might propel South Korea into a significant role in international crypto compliance, encouraging other countries to adopt similar measures to increase transaction transparency and market fairness.