The crypto market is moving toward 2026 after a period of significant swings, reduced willingness to take risks, and a clearer distinction between assets with strong use cases and those driven primarily by speculation. Most tokens still trade 40% to 50% below their recent highs, but the next cycle is forming around infrastructure, payments, and actual utility.

Three look positioned to reclaim or exceed those peaks by 2026: Solana (SOL), XRP, and WeFi (WFI). Each represents a different thesis — speed, settlement, and everyday banking — but all share a common thread: fundamentals that have continued building even as prices retreated.

Solana’s Foundation Points to Higher Ground

Currently, Solana trades around $125, down from its January $293 high. Short-term weakness has pushed the asset below $130, but buyers are holding the $120 zone while the rest of the market remains cautious.

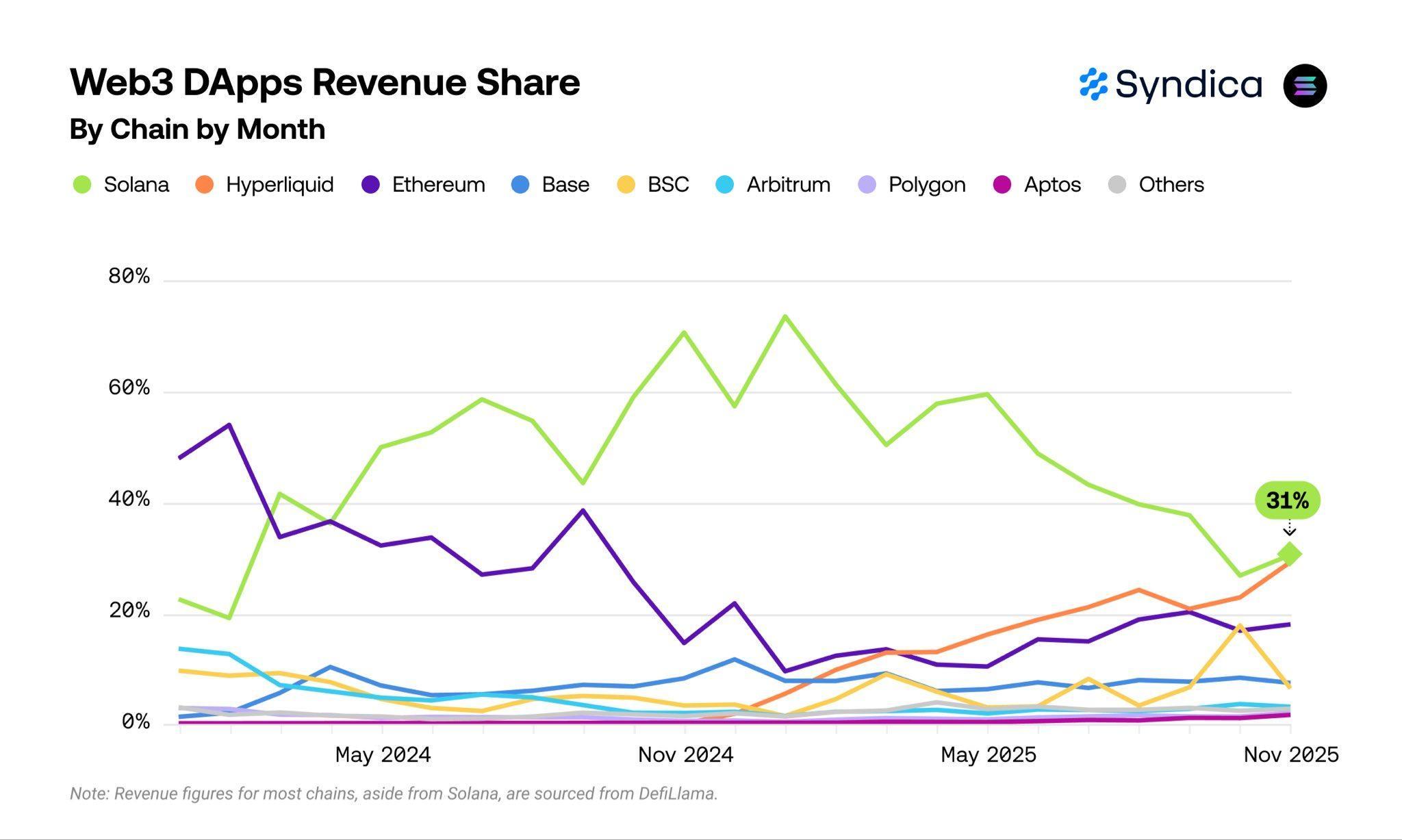

That price action contrasts sharply with what’s happening on-chain.

🚨BREAKING: @Solana continues to lead all L1 and L2 chains in DApp revenue for the 19th consecutive month. pic.twitter.com/2DFpiROXGm

— SolanaFloor (@SolanaFloor) December 17, 2025

Institutional interest remains strong: spot Solana ETFs recently saw about $11 million in net inflows in just one day, with the Bitwise BSOL fund

🚨 JUST IN: $SOL ETF BY @BitwiseInvest HAS HAD 33 STRAIGHT DAYS OF POSITIVE INFLOWS SINCE LAUNCH— NOW AT $608,900,000 IN $SOL INFLOW!

INSTITUTIONS ARE ACCUMULATING SOLANA #SOLANA ⚡️ pic.twitter.com/1xUcxBR5j2

— curb.sol (@CryptoCurb) December 15, 2025

🚨 JUST IN: $SOL ETF BY @BitwiseInvest HAS HAD 33 STRAIGHT DAYS OF POSITIVE INFLOWS SINCE LAUNCH— NOW AT $608,900,000 IN $SOL INFLOW!

INSTITUTIONS ARE ACCUMULATING SOLANA #SOLANA ⚡️ pic.twitter.com/1xUcxBR5j2

— curb.sol (@CryptoCurb) December 15, 2025

Network upgrades are strengthening the long-term outlook as well. Firedancer — a new validator client designed to boost transaction speed and reduce costs — is now live on the mainnet, and analysts expect it to widen Solana’s edge over competitors.

Analyst MiA wrote on X that while the token was down year-to-date, “progress isn’t.”

From a price standpoint, a recovery back above $150 would mark a clear shift in momentum. In a stronger liquidity cycle, a return toward $300 by 2026 would simply place SOL back at levels already seen during its last expansion phase.

XRP’s Institutional Runway Is Just Beginning

XRP was changing hands at just under $2. Similar to Solana, XRP has struggled in recent months, with its current price representing a 48% drop from its all-time high of $3.65 in July, as well as a nearly 9% dip in the last 30 days.

XRP’s case is more about its role within payment infrastructure than short-term charts.

The resolution of its long-running legal dispute with the SEC has given the market much-needed clarity and opened discussions about institutional use and ETF products. XRP isn’t meant to be a store of value like Bitcoin. Instead, it’s meant to be a bridge asset — a tool for settling transactions quickly and cheaply across jurisdictions.

Analysts view the current price as a pause rather than a final verdict. Xaif Crypto called the weakness temporary, pointing out that steady institutional interest should hold it in good stead going into 2026.

🇩🇪 Said the quiet part out loud:

➡️ XRP price weakness is temporary

➡️ Institutional demand is strong (ETFs inflowing)

➡️ Ripple’s infrastructure is being built for the long termHe said what Ripple is building for crypto could become as essential as Amazon is for traditional… pic.twitter.com/rwMcQJCJQH

— Xaif Crypto🇮🇳|🇺🇸 (@Xaif_Crypto) December 23, 2025

24HRSCRYPTO offered a counterintuitive take: once XRP gains wider adoption for settlement, huge price swings will become impractical. Payment rails used to clear large volumes need stability, not speculation.

When you least expect it…

XRP will print a legendary candle that sets a structural foundation… and never look back.

The move coming won’t be retail hype. It will be REAL economic activity on the ledger.

Once XRP is used as a settlement asset, volatility becomes a…

— 𝟸𝟺𝙷𝚁𝚂𝙲𝚁𝚈𝙿𝚃𝙾 (@24hrscrypto1) December 23, 2025

XRP still follows the general mood of the crypto market and Bitcoin. But its next leg up will depend on real usage, not retail fervor. Should banks and payment providers accelerate adoption, prices could climb to $4 to $5 by 2026 — a new all-time high achieved without the retail frenzy seen in earlier cycles.

WeFi’s Banking Bet Could Unlock Triple-Digit Returns

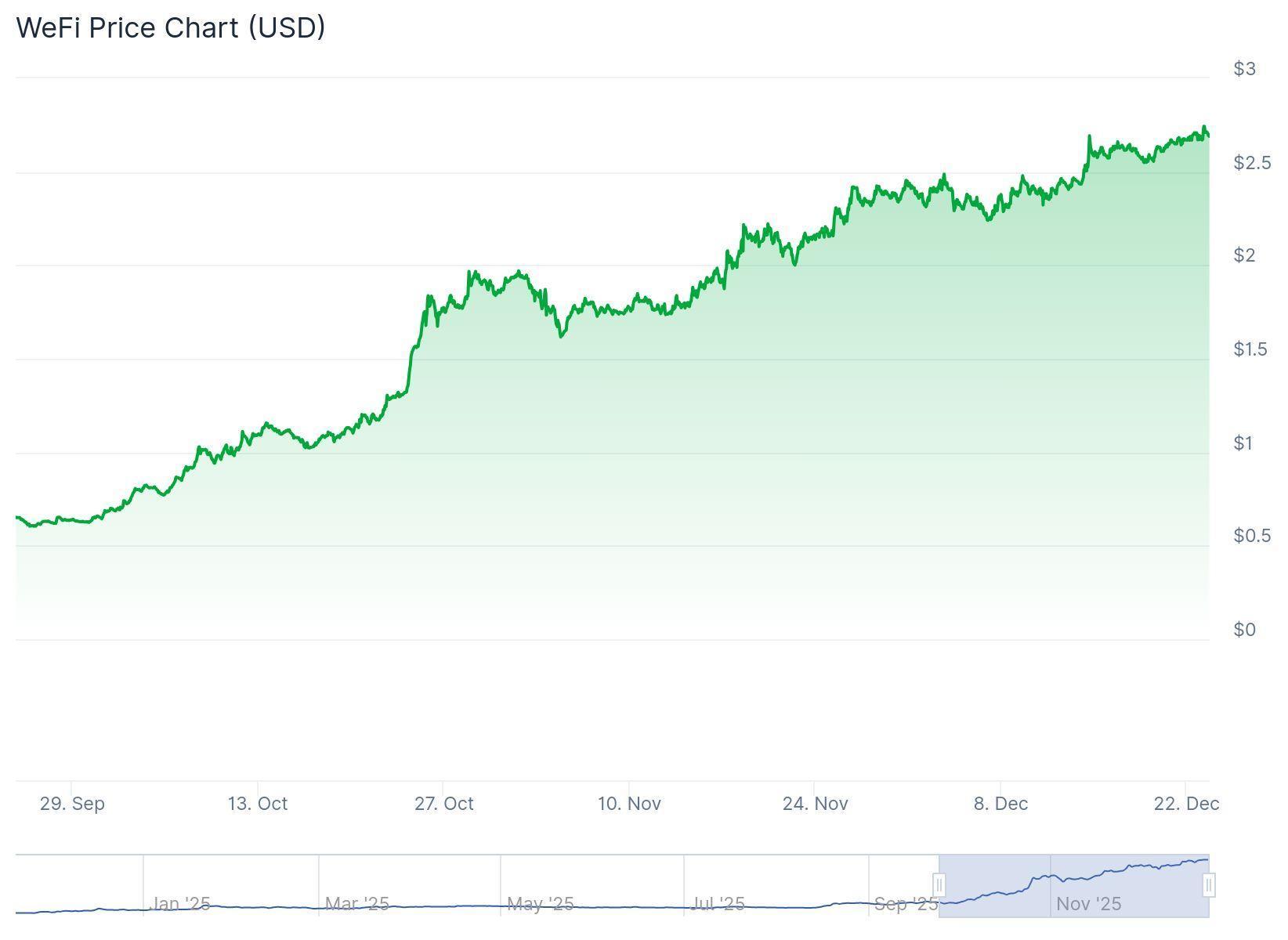

WFI sits at a different point in its life cycle. The token was trading at about $2.40 in late November, having just achieved a new all-time high of $2.75 on Dec. 23. Since January WFI is up more than 800%, outpacing 94% of mid-cap DeFi tokens over the same period, according to CryptoHopper data.

The cryptocurrency powers the WeFi ecosystem, which combines on-chain accounts with everyday banking features like card spending linked to on-chain balances. The roadmap includes moving from BNB Smart Chain to its own WeChain network, where WFI will be used for fees, staking, liquidity, and decentralized apps. That transition would position WFI similarly to how ETH functions within Ethereum — as native fuel for an ecosystem.

Adoption has accelerated sharply. In less than a year, WeFi attracted more than 150,000 users across 80 countries. Its cloud-based mining — a node-based distribution model that rewards early participants for supporting network infrastructure — has already minted more than 76 million WFI.

In December, WeFi won ‘Most Innovative Web3 Project’ at The Cryptonomist Awards 2025.

🏆 WeFi Named “Most Innovative Web3 Project” at The Cryptonomist Awards 2025 @wefi

Finance is entering a new era — and WeFi is leading the shift.

Recognized by The Cryptonomist, WeFi is pioneering deobanking: a fully compliant, on-chain banking model powered by stablecoins,…

— The Cryptonomist (@Cryptonomist_en) December 18, 2025

From a valuation standpoint, WFI’s circulating supply remains only a small fraction of its fixed maximum of 1 billion, and its market cap sits just over $205 million.

Analysts modeling WeFi’s trajectory point to several milestones: a move into double digits ($10-$25) would likely accompany WeChain’s mainnet launch and expanded card availability. If WeFi captures even a modest share of the on-chain banking and stablecoin payments market — projected to exceed $500 billion in volume by 2027 — the math starts supporting higher valuations.

A price of $100 or more by 2026 would require strong execution, favorable market conditions, and continued user growth. It’s a bull case, not a baseline — but it reflects the scale that early-stage infrastructure tokens have achieved when product-market fit clicks. As one DeFi analyst noted on X: “WFI is priced like a speculative bet but building like an infrastructure play. If the banking thesis lands, current prices will look like a rounding error.”

The Case for Fresh Highs in 2026

Solana, XRP, and WFI each have a case for new highs, but the reasoning differs.

Solana’s argument is straightforward: volume and active addresses are elevated, but price hasn’t followed. The gap between usage and valuation is the trade.

XRP depends on whether institutional settlement actually moves through Ripple’s rails. Cross-border payments are a massive market, but the timeline is slower and the outcome is binary. Banks either adopt the infrastructure or they don’t.

WFi is earlier-stage and priced accordingly. The bet is that DeFi expands past trading and yield farming into ordinary banking: transfers, bill pay, basic accounts. If that shift happens, current prices leave room above.

None of these paths are guaranteed — they depend on macro conditions, liquidity, and execution. But if crypto’s integration with traditional finance continues, these three tokens show how infrastructure, payments, and on-chain banking could each reach new highs on fundamentals, not hype.