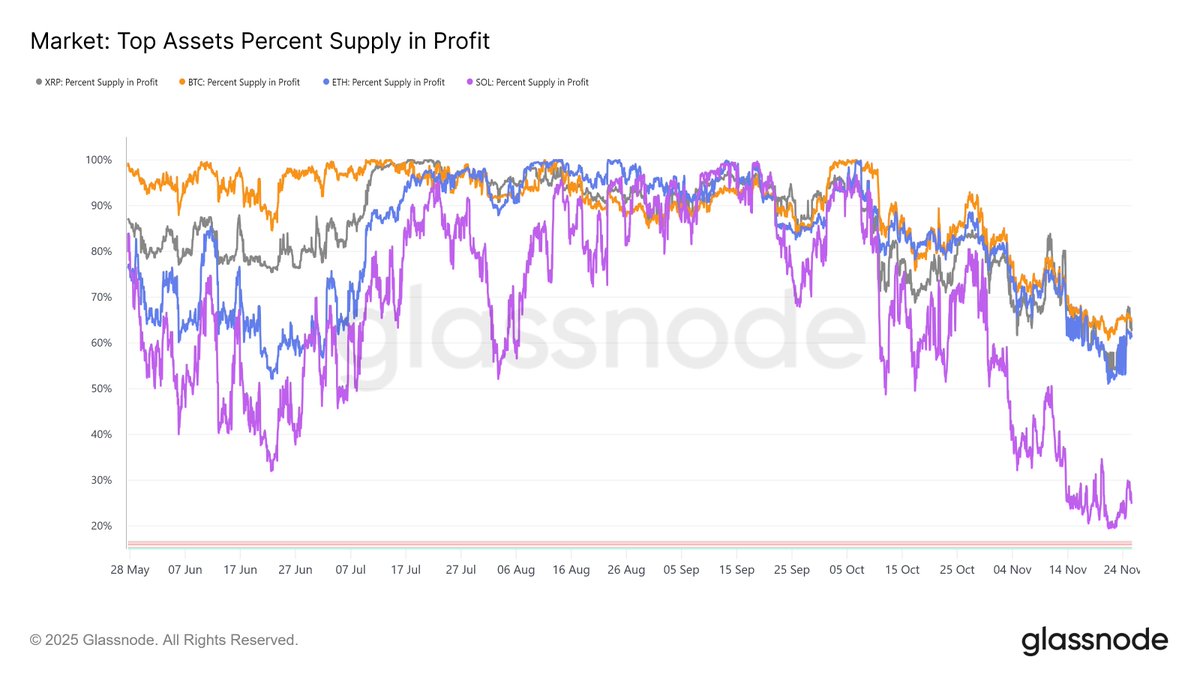

New Glassnode data reveals how deep the current market correction has cut across major cryptocurrencies, and the divergence is stark. As of November 25, the percentage of each asset’s supply sitting in loss shows Bitcoin, Ethereum, and XRP holding relatively steady, while Solana faces a far steeper drawdown.

BTC, ETH, and XRP Hold Up – Solana Takes the Biggest Hit

According to Glassnode’s latest on-chain metrics:

- •BTC: 34.91% of supply in loss

- •XRP: 36.70%

- •ETH: 38.37%

- •SOL: 74.84%

The chart shows that while Bitcoin, ETH, and XRP have moved mostly in tandem through months of consolidation, Solana experienced repeated, deeper profit-to-loss swings — especially during November’s drop.

What the Chart Shows

The lower band for Solana (in purple) tracks far below the other assets throughout the recent correction. As November selling intensified, SOL’s percent supply in profit collapsed toward the 20–30% range, meaning nearly three-quarters of all Solana coins are currently underwater. That stands in contrast to Bitcoin, where roughly two-thirds of supply remains in profit, even after a 20% monthly pullback.

Ethereum and XRP show similar mid-range patterns, with their supply-in-loss percentages rising gradually but staying far above Solana’s extreme levels.

Why This Matters

Percent supply in loss is a key indicator of investor pressure:

- •High loss levels can increase the likelihood of forced selling or panic-driven exits.

- •Lower loss levels suggest stronger long-term holder positioning and better market resilience.

In this cycle, Solana’s sharper corrections reflect its higher volatility and sensitivity to risk-off sentiment, while Bitcoin continues to show relative strength despite ETF outflows and macro uncertainty.

Early Signs of Stabilization

Late-November price action shows modest recovery attempts across all four assets. If those rebounds hold, supply-in-loss metrics may begin to reverse, a sign that sentiment is stabilizing after one of the month’s most aggressive drawdowns.

For now, Glassnode’s chart makes one thing clear: investors are feeling the pain across the market, but Solana holders are facing the heaviest losses by far.