Key Insights

- •Solana is entering Wave 3, with Elliott Wave analysis projecting targets of $295 and $380.

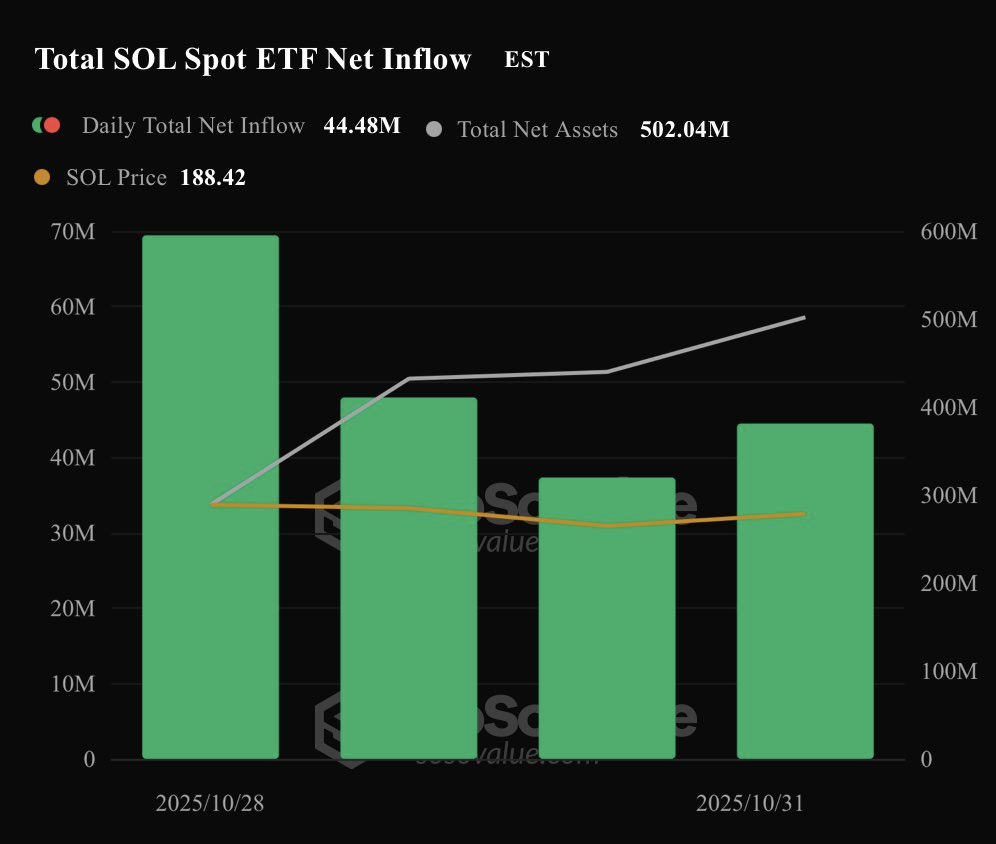

- •Solana ETFs experienced $200 million in inflows within a single week, bringing total fund assets to over $500 million.

- •Solana applications generated $3.82 million in revenue in a 24-hour period, surpassing the combined revenue of Ethereum and Hyperliquid.

Solana's market activity has captured significant attention following new technical chart data and increasing institutional interest, suggesting a potential for a strong rally. Analysts and community members are highlighting a new Elliott Wave count that indicates a possible price increase toward $295, followed by a subsequent push to $380.

Elliott Wave Analysis Suggests New Uptrend for SOL

According to NekoZ, Solana has successfully completed its Wave 2 correction and has now entered Wave 3, a phase that is often characterized by robust price movement. This trader has indicated that the initial target is $295, with a subsequent move towards $380 anticipated in Wave 5. These projections are based on the widely recognized Elliott Wave Theory, a methodology employed by some traders to study price cycles within financial markets. While this approach is not universally adopted, the pattern is currently drawing considerable attention due to recent market developments.

Despite the compelling technical patterns, uncertainties surrounding the timing of these movements and short-term volatility persist. These perspectives suggest that even with established technical indicators, many investors are awaiting further confirmation before making investment decisions. As of the latest reporting, Solana is trading at $177.91, with its 24-hour trading volume exceeding $4.6 billion.

Institutional Investment Grows Despite Price Dip

Despite a recent price dip of 4.83% in the last 24 hours, bringing Solana's price to $177.91, data reveals a growing interest from significant investors. Solana ETFs have attracted nearly $200 million in inflows within their inaugural week, with the majority of this investment originating from Bitwise's BSOL fund. With both Bitwise and Grayscale staking their Solana holdings, the total assets managed within these funds have now surpassed $500 million. This substantial level of interest is noteworthy, especially considering that SOL's price has remained relatively stable, which could indicate continued accumulation by institutional players.

Margex has observed that even with the flat price of $SOL, institutions are clearly continuing their purchasing activities. This behavior lends support to the belief that large-scale buyers perceive long-term value in the Solana ecosystem.

Solana Network Activity Remains High

Furthermore, the Solana network is demonstrating robust usage across its various applications. Over the past day, Solana-based applications have generated $3.82 million in revenue, a figure that exceeds the combined revenue generated by Ethereum and Hyperledger during the same period. The decentralized exchange (DEX) volume on Solana reached $3.35 billion within the same 24-hour timeframe, indicating sustained trading interest. Proponents of Solana are utilizing these metrics to argue that the network continues to experience growth and widespread adoption, notwithstanding short-term price fluctuations.

“All roads lead back to Solana.”

Solana Sensei

The observation from Solana Sensei, stating "All roads lead back to Solana," in reference to the escalating on-chain activity, highlights the growing momentum. While the statement is assertive, the consistent volume and revenue figures continue to draw significant attention to the network's practical utility and user engagement.