Key Insights

- •Solana (SOL) price has closed in the green for three consecutive weeks.

- •Solana’s weekly network activity shows positive growth, with transaction counts surging to levels not seen since August 2025.

- •Solana’s Real World Assets (RWA) ecosystem has surpassed the $1 billion milestone.

The price of Solana (SOL) has just concluded its third consecutive bullish week, indicating a recovery following its bearish performance in Q4 2025. The cryptocurrency is currently retesting its short-term resistance near the $146 price level, and a breakout above this zone could further reinforce its recovery.

At press time, Solana (SOL) was trading at $143, having experienced a slight retracement from its weekly high of $148. Despite this minor pullback, the cryptocurrency has gained over 20% from its recent local low in December.

On the weekly timeframe, Solana’s price has been on an upward trend for the third consecutive week. This suggests that the cryptocurrency may be poised for further recovery, especially considering it was still trading at a discount due to its steady downtrend since September.

A broader view of the price action reveals that SOL has experienced significant swings over the past few months. Its current position suggests that an upward trend may be developing, potentially extending its bullish momentum into the coming weeks.

Robust Network Activity Supports Solana Price Action

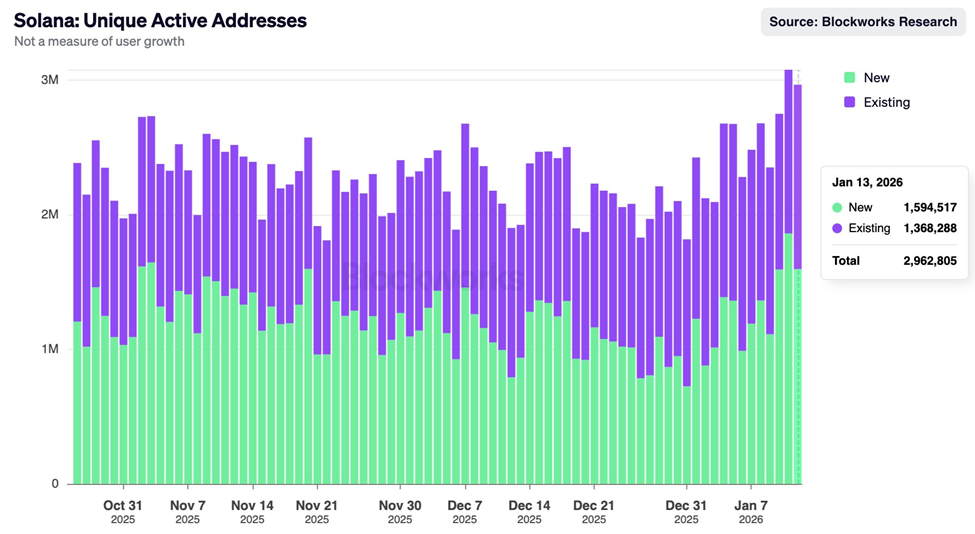

A portion of the demand driving Solana's recent price increase appears to be organic, fueled by a surge in network activity. The number of active addresses on the Solana network has seen a substantial rise since late December.

The data also indicates a noteworthy spike in unique active addresses. For context, the highest number of active addresses was recorded on Tuesday of the past week.

New addresses on the network approached 1.6 million, while existing addresses accounted for 1.36 million.

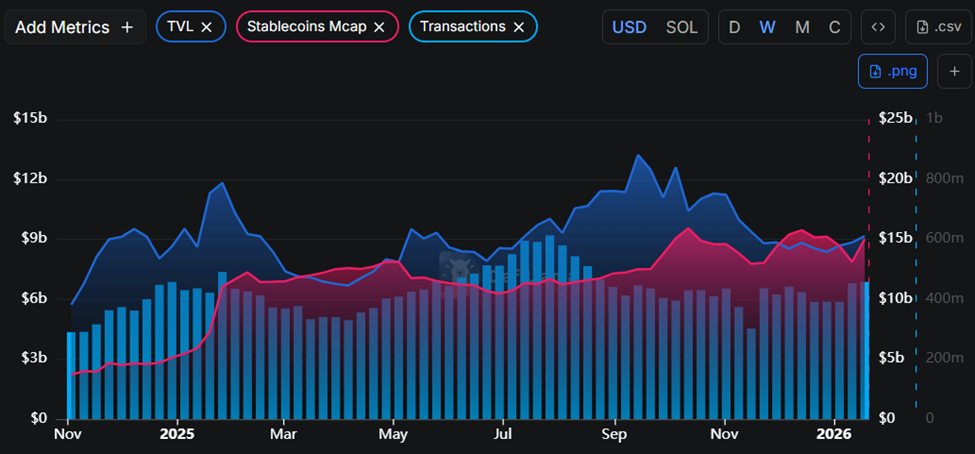

On a weekly basis, the Solana network processed over $457 million in transactions this week. This represents the highest weekly transaction volume the network has achieved since mid-August 2025.

Solana has also demonstrated significant growth in other key metrics. For instance, its stablecoin market capitalization increased from $13.1 billion on January 11 to $15 billion at the time of this report.

Its Total Value Locked (TVL) has also followed an upward trend, rising from a low of $8.36 billion in late December last year to $9.16 billion at the time of observation.

Solana Achieves Major Real World Asset Milestone

In addition to the increasing network activity, the Solana network celebrated a significant milestone in the Real World Assets (RWA) sector this week. In 2025, Solana strengthened its position as a leading blockchain for supporting the RWA narrative.

This development occurred as meme coin activity substantially cooled down during the year, despite having been a primary growth driver for Solana previously.

According to recent reports, the total value of real-world assets on the Solana blockchain surpassed $1 billion earlier this week.

The data further indicates that RWAs on Solana have been experiencing exponential growth.

Meanwhile, Solana Exchange Traded Funds (ETFs) recorded approximately $47 million in positive net flows during the week. On a daily basis, Solana ETFs experienced their first instance of daily outflows since their launch.

Solana ETFs made history on Friday by recording their first-ever sale since their inception. They experienced $2.2 million worth of outflows on Friday, despite the positive net flows for the week.

It remains to be seen if this outcome is indicative of future trends, given that ETFs currently represent a limited portion of demand and may not significantly impact price.