Solana is approaching a key support level, with its price nearing $124. After falling from the mid-$140s, the SOL price has experienced a steady decline, and the breach below the $136–$138 range indicates that sellers are currently dominant.

Technical analysis suggests that the SOL price might drift down to $124, a level that has previously acted as support and is now back on traders' radar as the price sits in the low $130s.

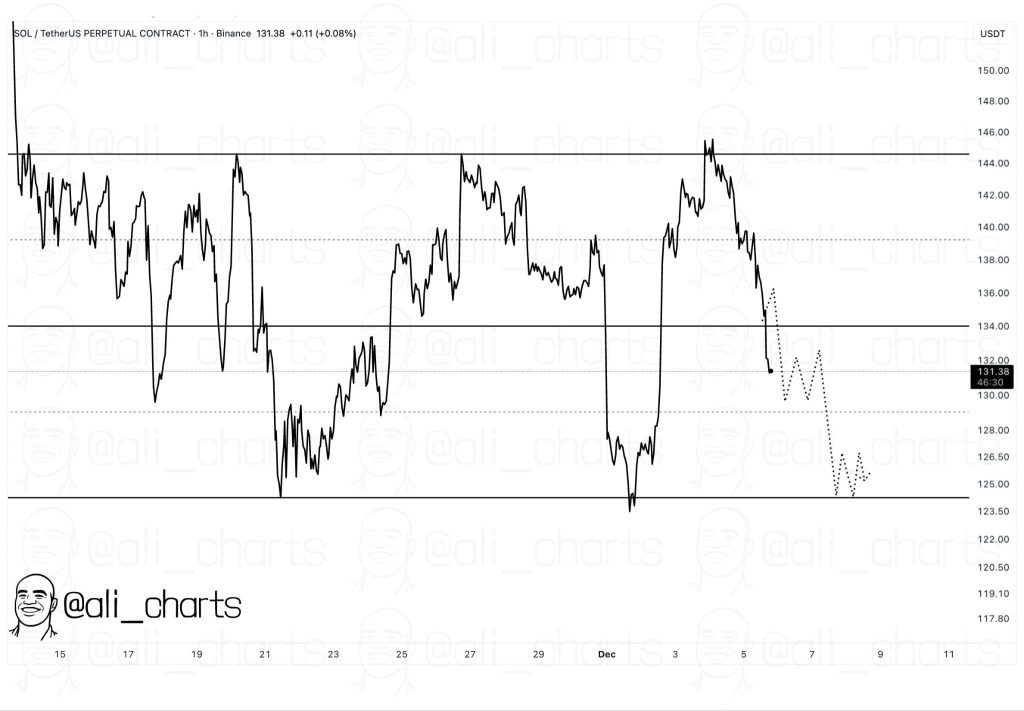

The SOL Chart Shows a Clear Breakdown Structure

The current trend for Solana is clearly illustrated on a one-hour chart. The price drop from the $144 area highlights the rapid fading of bullish momentum, with each subsequent bounce forming a lower high, a classic indicator of ongoing seller control.

A significant development was the break below the $136–$138 zone, which had previously served as support multiple times. Its failure opened up room for SOL to move lower with limited resistance.

The projected path on the chart suggests a scenario where the price could continue to slide towards $124. Around this level, the price might consolidate before the market determines its next direction. Historically, the $124 zone has acted as a pivot point during corrections, leading many traders to anticipate renewed buyer interest there.

The broader implication from the chart structure is that Solana's price is undergoing a controlled downtrend rather than a sharp crash. If the $124 support holds, the trend could be reset. However, failure to hold this level might necessitate probing lower prices to establish a stronger base.

A Whale Makes a Big Move Behind the Scenes

Amidst the market pullback, on-chain activity has become noteworthy. A whale was observed creating a new wallet, identified as "8TGzUb," and subsequently withdrawing 499 SOL, valued at approximately $69.8K, from Bybit.

Instead of holding the SOL, the whale converted almost the entire amount into 74.3 million TBY tokens in a single transaction.

A whale just created a new wallet, 8TGzUb, withdrew 499 $SOL($69.8K) from #Bybit to buy 74.3M $TBY in a single transaction.https://t.co/WSNkIkmqqB pic.twitter.com/Pc3qDmTOT2

— Lookonchain (@lookonchain) December 5, 2025

Transaction data shows SOL being transferred to the new wallet, followed by an immediate swap for TBY. While such moves do not directly impact Solana's chart, they demonstrate significant activity from large players during the current market downturn.

Whales typically adjust their positions when anticipating volatility or identifying emerging opportunities, which often occurs near critical technical levels.

What to Expect Next for SOL

The primary question is whether Solana can maintain the $124 support level as its price approaches it.

If buyers step in as they have during previous dips, this area could serve as a robust bounce point, offering SOL an opportunity to reset its trend. Conversely, a failure to attract buyers might lead to further price declines before stabilization.

Currently, traders are focused on two key factors: the speed at which the SOL price reaches $124, and whether on-chain indicators, such as this whale activity, begin to intensify.

The actions of whales—buying, selling, or reallocating assets during a pullback—often signal the development of a larger underlying market move.

Solana is not yet in a precarious position, but the upcoming reaction around the $124 mark will likely set the trajectory for future price action. Buyers have defended this level in the past, and current analysis suggests they may attempt to do so again soon.