Solana (SOL) is currently trading near the $191.95 mark, having briefly touched $195 earlier in the day. The token has demonstrated resilience amidst evolving market dynamics, with traders closely observing its ability to establish the $192–$195 range as a new support zone.

Key Developments and Analyst Insights

Throughout the week, Solana has seen a combination of technical and fundamental advancements that have influenced market sentiment around its native token. Analysts have identified crucial support levels, while institutional engagement has been bolstered by new offerings from Fidelity and Gemini.

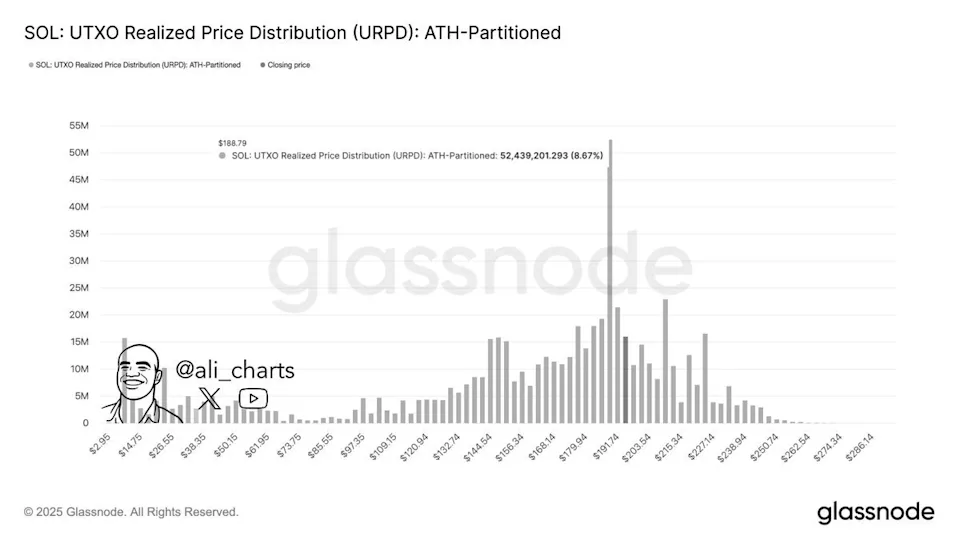

Market analyst Ali Martinez recently pointed out that $188 represents Solana's most significant support level. This assessment is based on Glassnode's "realized price distribution" data, which highlights areas where substantial volumes of SOL have previously traded. A high concentration of transactions near $188 suggests this could act as a price floor. Such zones typically help to ease selling pressure when prices remain above them. Conversely, a break below these levels could introduce additional selling pressure into the market. This area is therefore a critical point for traders monitoring Solana's ongoing uptrend.

Institutional adoption has continued to expand. Fidelity recently added support for Solana on its U.S. brokerage platform, broadening client access beyond Bitcoin (BTC), Ether (ETH), and Litecoin (LTC). While such listings may not immediately impact daily price fluctuations, they are instrumental in increasing visibility and expanding Solana's potential investor base.

Gemini's Solana Credit Card and Enhanced Staking Features

Earlier in the week, Gemini unveiled a Solana-branded edition of its Gemini Credit Card, which was initially launched in 2023. This new card design enables cardholders to earn rewards in SOL. Specifically, users can receive up to 4% back on gas, EV charging, and rideshare purchases; 3% on dining; 2% on groceries; and 1% on all other transactions. Some select merchants offer rewards as high as 10%. The card features no annual fee or foreign transaction fees, and there are no charges for receiving crypto rewards. Gemini has also introduced an option for users to automatically stake their Solana rewards, although staking yields are subject to variability and are not guaranteed.

Technical Analysis: Buyers Defend Key Levels

As of the latest data, Solana is trading around $195, holding a market dominance of 2.79%. In the preceding 24 hours, SOL saw a gain of approximately 1.9%. Market data indicates that Solana has appreciated by about $5.24, with buyers actively defending the $189.25 level while sellers are present near $195. Key support levels are established at $189.25 and $186, with the primary resistance noted around $195.49. The intraday pivot point is situated near $192.50.

Solana continues to trade above its 200-day simple moving average, which is a positive indicator of sustained strength. Over the last 30 days, SOL has experienced 16 green days, representing a 53% positive streak. Trading volume saw a significant peak at 09:00 UTC, rising 47% above the average to 786,000. A brief dip from $193.73 to $192.53 confirmed $195 as a short-term ceiling.

Analysts suggest that a sustained close above $195 could potentially lead to prices targeting the $200–$208 range. Conversely, a decline below $192.50 might trigger a retest of the $189.25 level, or even $186. Furthermore, a breakdown below the $189–$188 support zone could shift market focus towards $183 as the next potential downside target.