Solana offers investors "two ways to win," giving it "explosive" growth potential as it expands in the stablecoin and tokenization markets, said Bitwise CIO Matt Hougan.

Hougan stated in a post on X that Solana can benefit from the expected growth of the stablecoin and tokenization sectors, as well as from capturing a larger market share within those sectors.

He highlighted Solana’s advantages in its fast, user-friendly technology and its expanding ecosystem. As an example, he cited Western Union's recent decision to launch its stablecoin, USDPT, on Solana, indicating growing momentum in the network's stablecoin infrastructure.

"I think people dramatically underestimate how much and how quickly these technologies will remake markets," Hougan commented. "It’s easy for me to imagine this market growing by 10x or more."

Ethereum Leads the Market, But Solana Is Gaining Ground

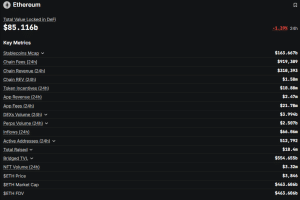

Ethereum currently holds a significant lead in the stablecoin and tokenization infrastructure market, as evidenced by metrics such as Total Value Locked (TVL) and stablecoin market share.

Data from DefiLlama indicates that Ethereum's TVL is approximately $85.116 billion, and the chain hosts $163.667 billion worth of the stablecoin supply currently in circulation.

In comparison, Solana's TVL stands at $11.386 billion, and it hosts $16.945 billion of the stablecoin markets.

Hougan views Solana as a strong contender and is optimistic about its prospects for "winning a larger share" of the stablecoin and tokenization infrastructure market.

"It offers fast, user-friendly technology, backed by a great community with a ship-fast attitude," he stated. "It’s a newer asset and is playing catch-up against its peers in winning institutional mandates, but it’s gaining ground."

First Spot SOL ETFs Trade In The US This Week

Hougan's assessment follows the recent launch of the first US spot SOL ETF (exchange-traded fund) by Bitwise this week.

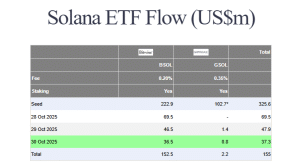

On its initial trading day, the Bitwise Solana Staking ETF (BSOL) saw inflows of $69.5 million and $56 million in trading activity. According to Bloomberg ETF analyst Eric Balchunas, this marked the highest debut trading activity among all 850 ETFs launched this year.

$BSOL's $56m is the MOST of any launch this year.. More than $XRPR, $SSK, Ives and $BMNU. And what's amazing is it seeded with $220m. It could have invested seed on Day One, which would have resulted in $280m-ish, would be even more than $ETHA's debut. Strong start either way.

— Eric Balchunas (@EricBalchunas) October 28, 2025

Prior to its launch, investors had already committed $220 million to the ETF. Balchunas noted that if this seed capital had been invested on the first day, the fund would have posted trading volumes of approximately $280 million, surpassing the debut trading volumes of BlackRock’s US spot Ethereum ETF (ETHA).

Inflows for the BSOL ETF continued in the subsequent days. Following its first trading day, BSOL recorded $46.5 million in inflows on October 29 and $36.5 million on October 30, according to data from Farside Investors.

The BSOL ETF also outperformed the Grayscale Solana Trust (GSOL) product, which began trading the day after BSOL.

The US spot SOL ETF market is expected to become more competitive as additional funds enter the space.

According to Grayscale executive Zach Pandl, spot SOL products could achieve similar success to investment products for Bitcoin and Ethereum. Pandl believes that spot Solana ETFs might absorb at least 5% of SOL’s total supply within the next one to two years.

At current prices, this would represent more than $5 billion worth of SOL tokens.

Despite the recent launch of US spot SOL ETFs, the price of Solana has not seen the anticipated impact and has retraced amid a broader crypto market correction. Data from CoinMarketCap indicates that SOL had fallen by more than 2% in the past 24 hours, trading at $186.56 as of 7:22 a.m. EST.