Solana Labs co-founder and CEO Anatoly Yakovenko is entering the decentralized exchange (DEX) arena with a new project called Percolator. This announcement comes as decentralized perpetual trading platforms gain strong momentum across the crypto markets, led by the recent successes of Hyperliquid and Aster. The new Solana-based protocol aims to push the boundaries of decentralized finance (DeFi) by improving speed, scalability, and liquidity management on-chain.

On Monday, Yakovenko shared plans for Percolator, a sharded perpetual exchange protocol built on the Solana blockchain. The system introduces a decentralized framework for trading perpetual futures contracts, enabling users to speculate on cryptocurrency prices without expiry dates.

Percolator will rely on two primary on-chain components: the Router program, which manages collateral, portfolio margins, and cross-slab routing, and the Slab program, a self-contained perpetual engine operated by liquidity providers responsible for matching and settlement. These details were revealed in Yakovenko’s recent GitHub proposal.

The Rise of Decentralized Perpetual Exchanges

The initiative follows Hyperliquid’s major upgrade that allowed third-party builders to deploy their own perpetual swap contracts. The platform introduced permissionless, builder-deployed perpetual contracts with independent parameters for users staking at least 500,000 HYPE tokens, valued at around $18 million.

Hyperliquid's Impact on the Market

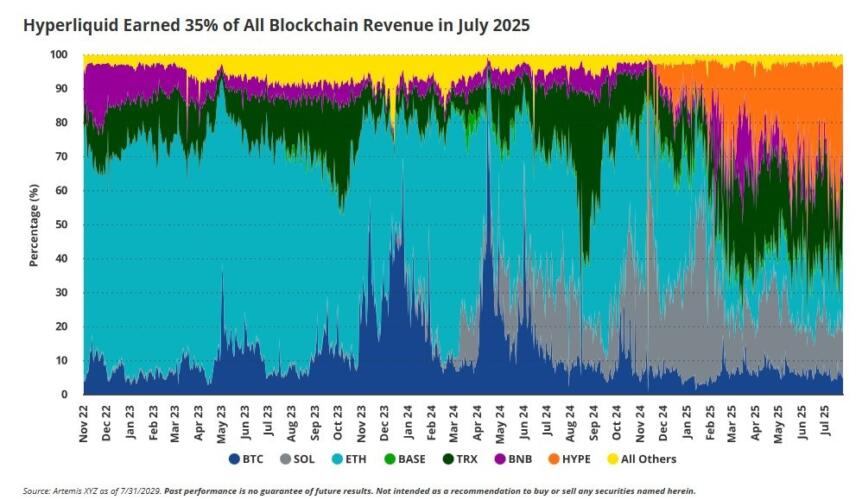

Yakovenko’s proposal comes just two months after a VanEck report suggested that Hyperliquid has been drawing users away from Solana. In July, Hyperliquid accounted for 35% of all blockchain-generated revenue, largely at the expense of Solana, Ethereum, and BNB Chain, the report stated.

VanEck’s analysts highlighted that Hyperliquid successfully attracted “high-value users from Solana” by delivering a streamlined and effective trading experience.

Hyperliquid’s trading volume reached a record $319 billion in July, marking a clear shift toward decentralized finance solutions over centralized exchanges. Its rapid rise began in early 2024, following the launch of its spot trading markets and aggressive listing strategy.

Intensifying Competition in the DEX Arena

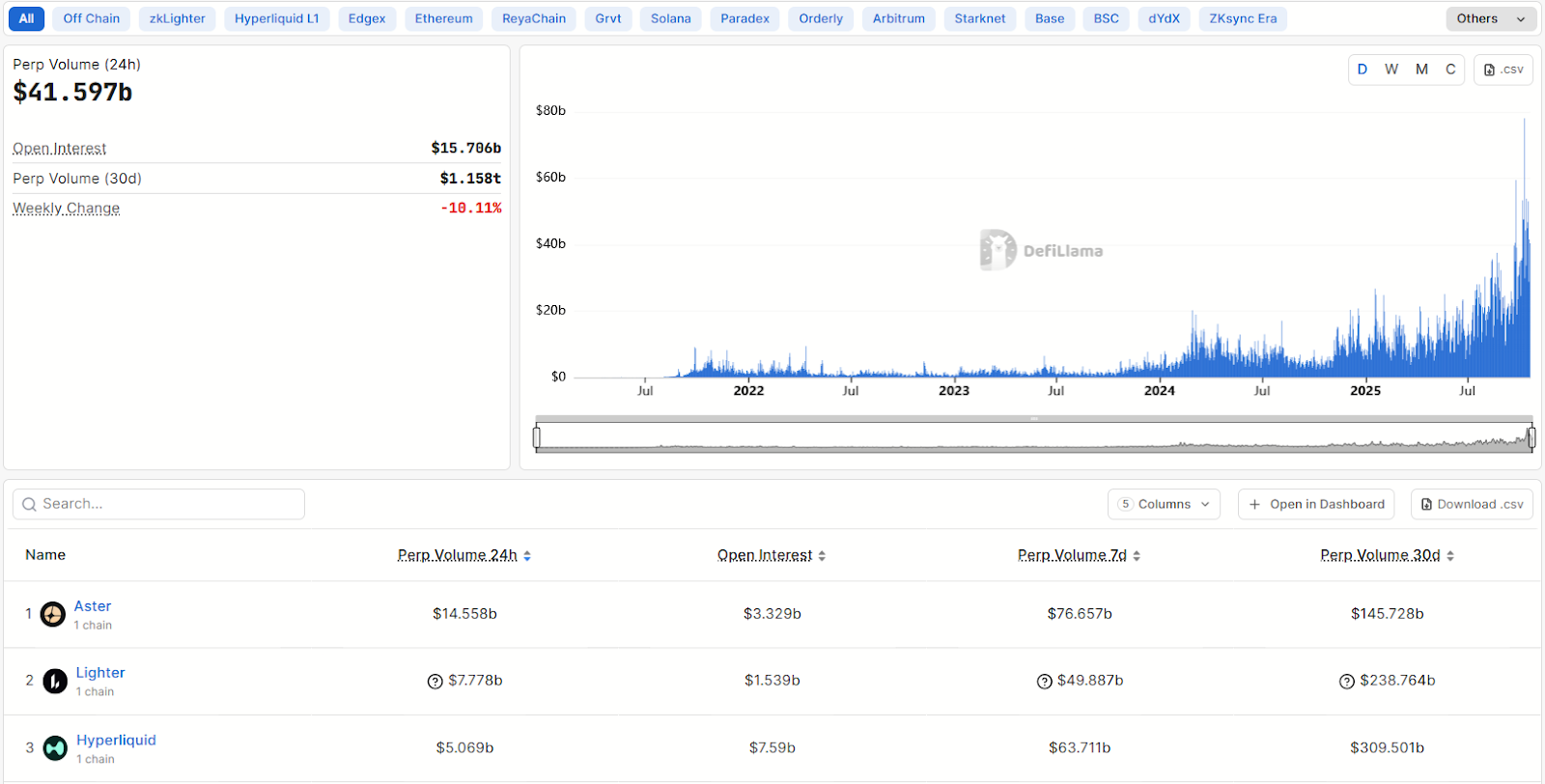

Meanwhile, Aster, another major DEX built on Binance’s BNB Chain, recently overtook Hyperliquid in daily volume, hitting $14.5 billion — nearly three times higher than Hyperliquid’s 24-hour activity. However, blockchain data from DefiLlama shows Hyperliquid’s 30-day volume still doubles Aster’s, highlighting fierce competition within the DeFi sector.