The cryptocurrency landscape has reached a new milestone with the introduction of Solana ETFs by Bitwise and Grayscale. Within a mere four days of their launch, these innovative financial products garnered close to $200 million, signaling a burgeoning demand for SOL. This analysis delves into a phenomenon that has the potential to reshape the market.

In brief

- •Solana ETFs attracted nearly $200 million in just four days, setting a record for a cryptocurrency ETF launch.

- •Despite the significant inflow into Solana ETFs, the price of SOL has seen a 1.5% decrease over the past 24 hours.

- •The outlook for SOL is being closely watched; the question remains whether Solana ETFs will stimulate a future price increase for SOL.

Successful Launch of Solana ETFs Marks a Historic First

On October 28, 2025, Bitwise made history by launching the first ETF offering direct exposure to Solana. This event immediately captured the attention of the cryptocurrency community. Grayscale soon followed with its own ETF, underscoring the significant interest surrounding this digital asset.

This dual launch highlights a discernible trend: financial institutions are increasingly acknowledging the potential of SOL, which has long been viewed as a viable alternative to Ethereum. For investors, these ETFs provide a pathway to engage with Solana without the necessity of directly holding cryptocurrency, representing a substantial advancement in institutional adoption.

Solana ETF Sees Nearly $200 Million Inflow Within Four Days

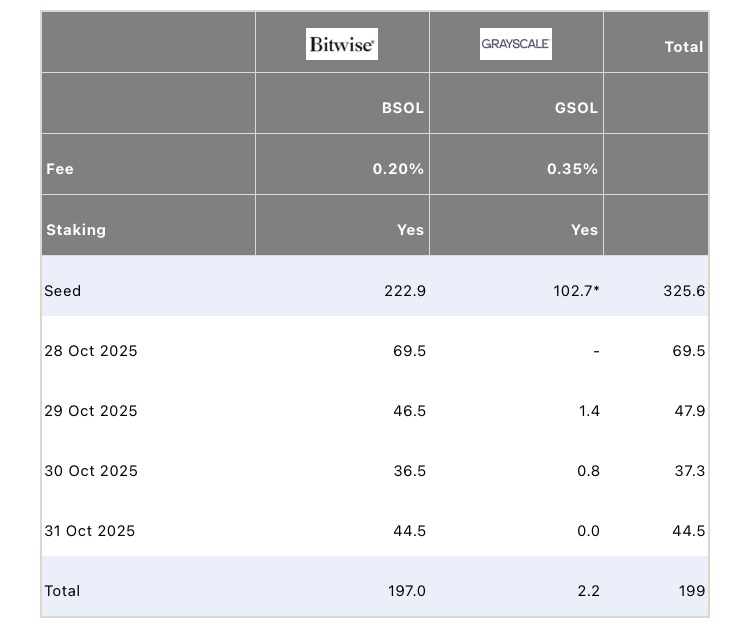

The financial data clearly illustrates the impact of the launches. The Bitwise Solana ETF (BSOL) recorded inflows of $69.5 million on its inaugural day. This was followed by subsequent daily inflows of $46.5 million, $36.5 million, and $44.6 million. Over the course of four days, BSOL accumulated a total of $197 million.

The Grayscale Solana ETF (GSOL) attracted $2.2 million during the same four-day period, with inflows of $1.4 million and $0.8 million recorded on October 29 and 30, respectively. Collectively, these two ETFs reached $199.2 million, establishing a new record for products linked to SOL. These figures demonstrate immediate and substantial investor confidence in the Solana ecosystem.

SOL Experiences Mixed Reaction Despite Massive ETF Inflow

Notwithstanding the significant enthusiasm surrounding the Solana ETFs and the $199.2 million in inflows recorded over just four days, SOL has experienced a slight decrease of 1.5% in the last 24 hours. Trading at $185.73, Solana appears to be reacting with caution, despite the prevailing optimism surrounding the financial products linked to this cryptocurrency.

This situation prompts several questions: why is SOL not immediately benefiting from this substantial inflow? Several factors may contribute to this trend:

- •Cryptocurrency markets are often characterized by high volatility, where short-term price movements can be influenced by investor expectations and profit-taking strategies.

- •Institutional investors might be adopting a phased approach, observing the performance of these ETFs before committing larger investments.

It remains to be determined whether this current price dip is a temporary fluctuation or an indicator of a more sustained market trend.

The launch of Solana ETFs represents a significant turning point, attracting hundreds of millions of dollars in a very short period. The question arises: could Solana (SOL) emerge as the next leading cryptocurrency? Regardless of the immediate price action, it is evident that the Solana ecosystem is experiencing unprecedented dynamism.