Santiment's latest data reveals a trend contrary to what many expect during a volatile crypto market week. Bitcoin, Ethereum, and XRP have all experienced a significant wave of retail selling during price dips. Historically, such behavior has often coincided with local market bottoms rather than peaks, leading Santiment to view the current trend as a constructive indicator for a potential rebound.

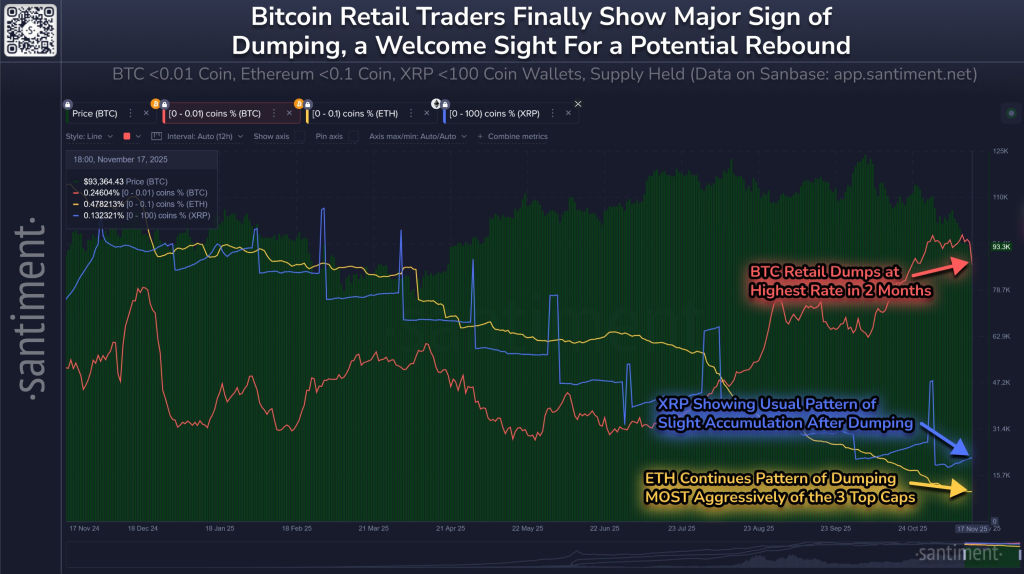

The analysis focuses on wallets holding minimal amounts of each asset. Bitcoin wallets with less than 0.01 BTC have divested 0.36% of their holdings in a mere five days. Ethereum wallets possessing less than 0.1 ETH have offloaded 0.90% of their assets over the past month. XRP wallets holding fewer than 100 tokens have sold 1.38% of their supply since early November. These represent some of the most substantial retail outflows observed in recent months, with Bitcoin's retail selling now at its highest level in two months.

When small traders engage in aggressive selling, it often signifies a peak in fear. Retail investors tend to sell at the least opportune moments, while larger participants may accumulate assets quietly. Santiment's chart effectively illustrates this dynamic. As the quantity of coins held by retail investors decreases, the price typically moves in the opposite direction. The observed pattern indicates that Bitcoin retail wallets consistently reach a high point before significant corrections and then decline sharply near levels where prices subsequently stabilize and begin to recover.

Ethereum's trend shows an even more pronounced decline, suggesting that retail capitulation is occurring at a faster pace compared to the other two assets. XRP's trend, conversely, exhibits its characteristic cycle of selling followed by gradual, steady accumulation.

The chart also reveals that while the prices of all three assets have been declining, the intensity of retail outflows has been increasing. This divergence, where small wallets panic while prices attempt to stabilize, is often an early indicator of market tightening preceding a shift. It reflects a typical phase where inexperienced traders sell out of fear, while institutions and larger wallets quietly position themselves for the next market movement.

Santiment's interpretation is straightforward: retail panic, while not a guarantee of immediate reversal, is typically a healthy component for one. Markets often require aggressive sellers to be flushed out before sustainable recovery can commence. With funding rates stabilizing, liquidity normalizing, and fear dominating market sentiment, the conditions for a relief bounce are being established.

There is currently no definitive confirmation that the market has reached its bottom, particularly with Bitcoin still trading near significant macroeconomic support levels around $90,000. However, the behavior of small wallets suggests that the final stage of capitulation might be in progress. If retail investors continue to sell into weakness, the likelihood of a market rebound increases.

For now, the key takeaway is clear: panic selling by small traders often signals an opportunity rather than imminent danger. Santiment's data suggests that the market may be closer to a turning point than many currently believe.

Market Insights and Analysis

The current market conditions, characterized by significant retail capitulation in Bitcoin, Ethereum, and XRP, present a potentially constructive scenario for a future rebound. Santiment's data highlights that small traders are actively selling during price dips, a behavior historically associated with market bottoms.

The decline in holdings by wallets with small balances across these major cryptocurrencies indicates a peak in retail fear. This often precedes a period of price stabilization and recovery, as less experienced investors are forced out of their positions.

While confirmation of a bottom is still pending, the increasing intensity of retail outflows, coupled with stabilizing funding rates and normalizing liquidity, suggests that the market may be preparing for a shift. The divergence between retail panic and price attempts at stabilization is a notable signal for potential upcoming upward movement.