Asset Seizure in the UK

Su Binghai, a figure implicated in Singapore's significant money laundering case, has had assets valued at approximately 260 million yuan confiscated in the United Kingdom. This action involves a substantial collection of properties and unique items, highlighting the international reach of financial crime and the efforts to recover illicitly gained funds.

The broader case, which encompasses a total of 16 billion yuan, is connected to a cryptocurrency scam originating in Hong Kong. This development is prompting a re-evaluation of regulatory approaches to money laundering and asset recovery within the global financial landscape.

Confiscation of Over $15 Million in UK Assets

Su Binghai, identified as a key individual in Singapore's $3 billion money laundering investigation, has seen his UK-based assets seized, amounting to roughly 260 million yuan. Among the confiscated items are nine apartments located in London and several dinosaur fossils. These seizures represent a significant move against criminal financial networks operating across international borders and demonstrate the effectiveness of global legal cooperation in asset recovery. This action further emphasizes Singapore's commitment to financial crime prevention. Observers of the market have noted the absence of public statements from prominent cryptocurrency figures regarding these developments. Regulatory bodies have responded by focusing on the critical aspect of asset recovery.

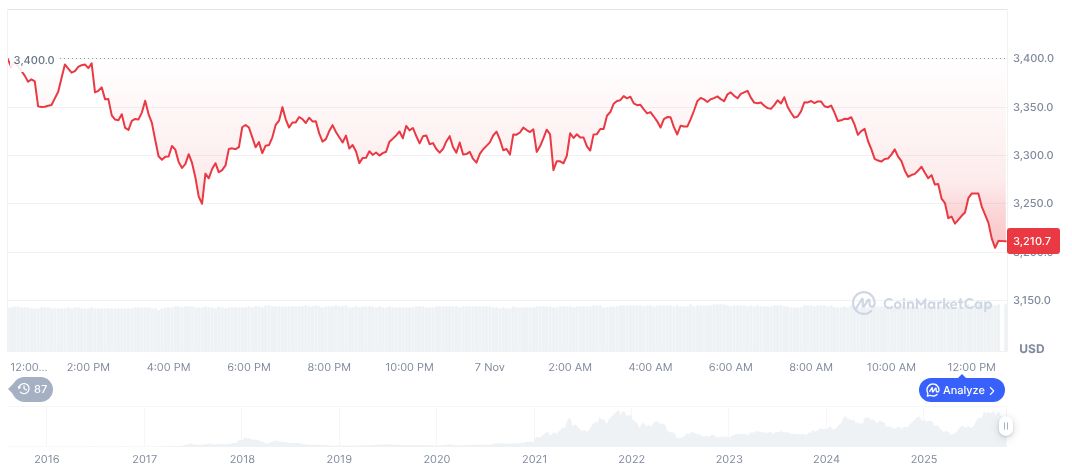

As of November 8, 2025, Ethereum (ETH) is trading at $3,440.01, according to data from CoinMarketCap. The cryptocurrency has a market capitalization of $415.2 billion and a 24-hour trading volume of $41.88 billion, reflecting a 2.44% increase over the last day. The circulating supply of ETH stands at 120.7 million.

Currently, there are no direct quotes from individuals involved in the 2023 Singapore money laundering case, including key players like Su Binghai, Wang Shuiming, or Su Weiyi, as they have not made any official statements via social media or public platforms. All references to these individuals are found in legal documents or government reports.

Comparative Analysis: Su Binghai Case and 1MDB Scandal

The scale of assets confiscated from Su Binghai is comparable to the funds involved in the 1MDB scandal. This comparison underscores the persistent global challenge of combating fraud and money laundering, which often involve intricate international networks.

For context on the legal framework governing such asset seizures, reference the UK legislation overview for the 2002 Act 29, which outlines the procedures for asset confiscation in cases of this nature.

The Coincu research team suggests that the primary financial and regulatory repercussions of this case are likely to be confined to fiat transactions. No direct disruptions to the cryptocurrency market have been identified, reinforcing the focus on non-digital assets within this particular investigation.