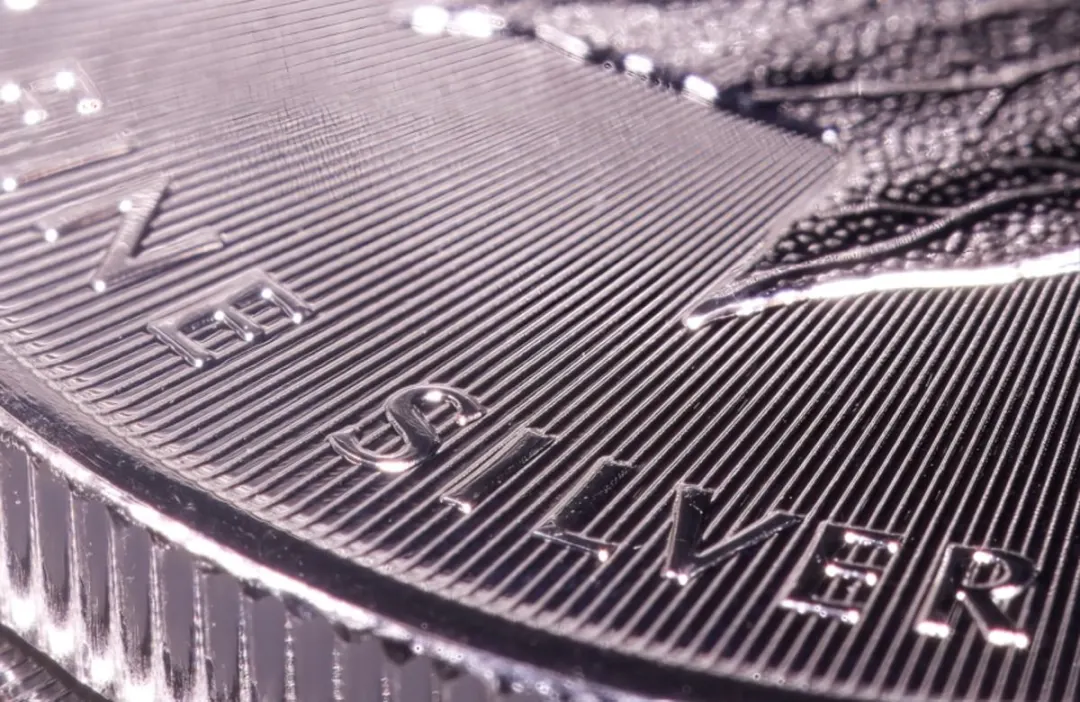

Silver is currently trading at $90.05, showing gains of 8% over both the past seven and 30 days. Earlier in the week, the metal briefly climbed above record highs, reaching $93 before experiencing a pullback. This significant move marked a historic breakout, pushing silver into a phase of price discovery.

Market participants are now closely observing whether the $90 level can serve as a support zone. The key question is whether this price range can hold firm under potential pressure.

Pullback Follows Shift in Risk Sentiment

Silver prices have eased in the last 24 hours as investors appear to be rotating back towards riskier assets. This shift was influenced by comments from U.S. President Donald Trump, who signaled a de-escalation of potential military action following assurances of reduced violence abroad. These remarks helped to calm geopolitical concerns, consequently softening demand for safe-haven assets across the market.

Market confidence also received a boost after President Trump confirmed he has no plans to remove Federal Reserve Chair Jerome Powell. This stance alleviated concerns regarding central bank independence, which had previously supported precious metals during periods of recent uncertainty.

Furthermore, the absence of immediate new tariff actions on strategic products contributed to a cooling of trade tensions. Collectively, these developments have exerted short-term pressure on the silver price.

Macro Forces Still Shape Price Action

Despite the recent pullback, broader macroeconomic conditions continue to exert a significant influence on silver trading. Expectations for U.S. interest rates to remain higher for longer are weighing on non-yielding assets like silver. Recent employment data has indicated resilience in the U.S. labor market, reinforcing the case for the continuation of restrictive monetary policies. Consequently, elevated bond yields are presenting a competitive alternative for capital allocation compared to precious metals.

Nevertheless, investors remain vigilant. Communications from the Federal Reserve and ongoing geopolitical developments still possess the capacity to rapidly shift market sentiment. Much of the current price movement is attributed to short-term profit-taking rather than a fundamental alteration in demand dynamics. Volatility continues to be a prominent feature of the silver market.

Investor Demand and Search Interest Surge

Silver prices have already appreciated by approximately 25% in early 2026, following a substantial gain of nearly 150% in 2025. This upward momentum has attracted widespread attention to the commodity. Online search interest for "silver" reportedly doubled following the breakout above the $90 mark, indicating a growing engagement from both retail and institutional investors.

This surge in interest is significant as attention often correlates with capital flows, and recent data points to robust participation in the silver market.

Vanda Research data revealed that retail investors allocated $921.8 million to silver-linked ETFs over the past month. Notably, the iShares Silver Trust has experienced a remarkable streak of 169 consecutive days of positive inflows, setting a new record.

Researchers at Vanda have characterized this trend as structural accumulation rather than mere speculative chasing. They observe that investors are increasingly treating silver as a core macro asset, moving away from viewing it solely as a short-term trading instrument.

Physical Markets Add Another Layer

Physical demand for silver is also contributing to market dynamics. Significant buying activity throughout 2025 led to an increase in stockpiles within U.S. warehouses, which in turn disrupted traditional global silver flows. London, historically a central hub for silver trading, experienced tighter availability as a direct consequence of these shifts.

These changes in inventory patterns were partly driven by concerns over potential U.S. tariffs on precious metals, prompting buyers to secure supply proactively. Although the immediate threat of tariffs has diminished this week, existing inventory patterns continue to influence pricing behavior.

Technical Signals Point to Ongoing Correction

From a technical analysis perspective, silver is exhibiting signs of a corrective phase rather than an outright trend reversal. Prices are approaching a descending trendline on shorter timeframes, with resistance identified in the vicinity of the $91.00 to $90.80 zone.

Analysts are closely monitoring support levels around $88.50, with deeper demand zones identified near $86.00, where prior buying interest emerged. The short-term price structure remains bearish; however, broader momentum indicators still suggest underlying strength.

CoinCodex forecasts indicate a potential price continuation towards $122 by mid-February 2026, following the current short-term corrective phase. Over the last 30 days, silver has recorded positive trading sessions on 83% of days, coupled with elevated volatility. This combination of factors highlights an active and highly engaged market.

As silver consolidates after its significant breakout above $90, investors remain focused on sentiment shifts, macroeconomic signals, and key technical levels. The recent rally has captured global attention, and the upcoming phase will serve as a crucial test of market conviction.