Bipartisan Senate Draft Aims for Clearer Digital Asset Regulation

The cryptocurrency market has received a significant policy boost from Washington with the introduction of a bipartisan plan by the US Senate Agriculture, Nutrition, and Forestry Committee. This plan aims to establish clear rules for the digital-asset market by defining the distinctions between commodities and securities, and assigning regulatory oversight accordingly.

The proposed framework designates the Commodity Futures Trading Commission (CFTC) to oversee spot digital-commodity markets, such as Bitcoin. Simultaneously, the Securities and Exchange Commission (SEC) would be responsible for regulating investment-contract tokens, which are classified as securities.

This level of regulatory clarity is anticipated to significantly reduce compliance costs and mitigate headline risk, factors that are highly beneficial for altcoins and presale projects.

The proposal, spearheaded by Committee Chair John Boozman and Senator Cory Booker, also explicitly upholds self-custody rights, acknowledging a fundamental aspect of how cryptocurrency is utilized. While this proposal is not yet law, market participants typically price in the direction of policy shifts, and this indicates a move towards reduced ambiguity, which could lead to a faster return of liquidity to the market.

This Senate initiative complements other legislative efforts, including actions in the House of Representatives on crypto bills like the CLARITY Act. The convergence of these legislative efforts suggests a strategic shift from an improvisational approach to establishing comprehensive regulatory frameworks, thereby lowering the threshold for risk-taking in the digital asset space.

Bitcoin Hyper ($HYPER) – Bridging Bitcoin Security with Solana-Grade Speed

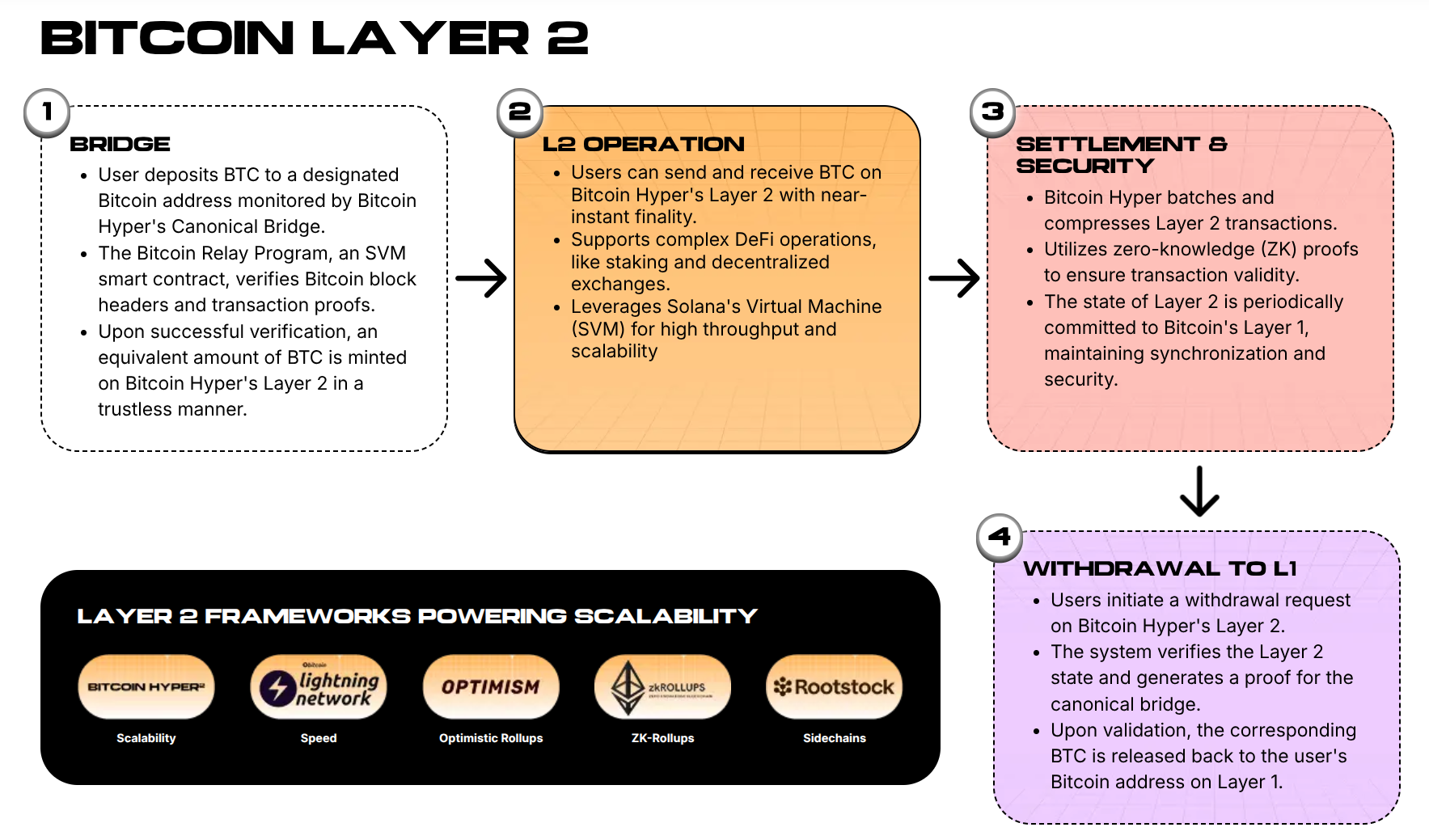

Bitcoin Hyper ($HYPER) is emerging as a Layer-2 (L2) network designed to be compatible with Bitcoin, offering Solana-like transaction speeds. The project aims to combine the robust settlement security of Bitcoin with a high-throughput execution environment, enabling Bitcoin to power payments, derivatives, and decentralized finance (DeFi) at a significantly larger scale.

Key Features of Bitcoin Hyper:

- •Speed: The network plans to integrate the Solana Virtual Machine (SVM) to achieve sub-second transaction finality and minimal fees. This is a substantial improvement over the slower speeds of the base Bitcoin blockchain.

- •Security: Transactions on the L2 will be batched and anchored to the Bitcoin Layer-1. This ensures that while the execution speed is comparable to Solana, the ultimate security and finality are derived from Bitcoin's established blockchain.

- •Developer Adoption: The use of the SVM is a strategic move to facilitate easier porting of existing Solana projects to the Bitcoin Hyper network with fewer code modifications, thereby enhancing the user experience for Bitcoin.

A crucial component of this infrastructure is the Canonical Bridge. This bridge enables the secure wrapping of original Bitcoin (BTC) and the creation of a 1:1 token for use on the Hyper L2 network.

The advancement of the US Senate's regulatory framework, which aims to reduce jurisdictional uncertainties, is expected to benefit venues building on credible L2 solutions like Bitcoin Hyper.

The $HYPER Presale: Attracting Investment and Offering Yield

The Bitcoin Hyper ($HYPER) presale has already garnered significant attention and momentum, raising over $26.8 million. The project has also built a substantial community presence, with 15.6K followers on X and 6.6K members on Telegram.

During its bootstrapping phase, Bitcoin Hyper is offering a staking Annual Percentage Yield (APY) of 43%. This high APY serves as an attractive incentive for early participants and is designed to decrease over time. Investors are encouraged to participate early to benefit from the higher reward rates. The current price for $HYPER is $0.013255, with a price increase anticipated soon.

The core investment thesis for $HYPER extends beyond the staking yield. It centers on the potential for a Bitcoin-anchored execution layer to capture significant on-chain activity as Bitcoin's narrative evolves from a "store of value" to a "spendable, programmable collateral." Projects positioned at this intersection of high performance and regulatory readiness are likely to attract early adoption from developers and large wallet holders.