Despite a market-wide downturn that has persisted for weeks, the Sei (SEI) price has maintained its ground in a notably resilient manner. Instead of experiencing a collapse similar to many other cryptocurrencies, SEI’s price remains within its long-term demand zone, a stability that is beginning to attract significant attention.

This resilience is further underscored by the network's performance data. Sei has surpassed 81 million unique EVM addresses, with over 230,000 new users joining in the past day alone. For context, this time last year, the network had barely 2.5 million users, indicating a period of extraordinary growth.

Market sentiment on X (formerly Twitter) reflects this positive shift. Analysts are observing that SEI is among the few digital assets still respecting a crucial support zone established in 2023.

Rather than breaking lower, the Relative Strength Index (RSI) is displaying a clear bullish divergence, a common precursor to a potential shift in momentum. With increasing adoption and the price chart defending its floor, the SEI price is emerging as one of the stronger performers in a generally weak market.

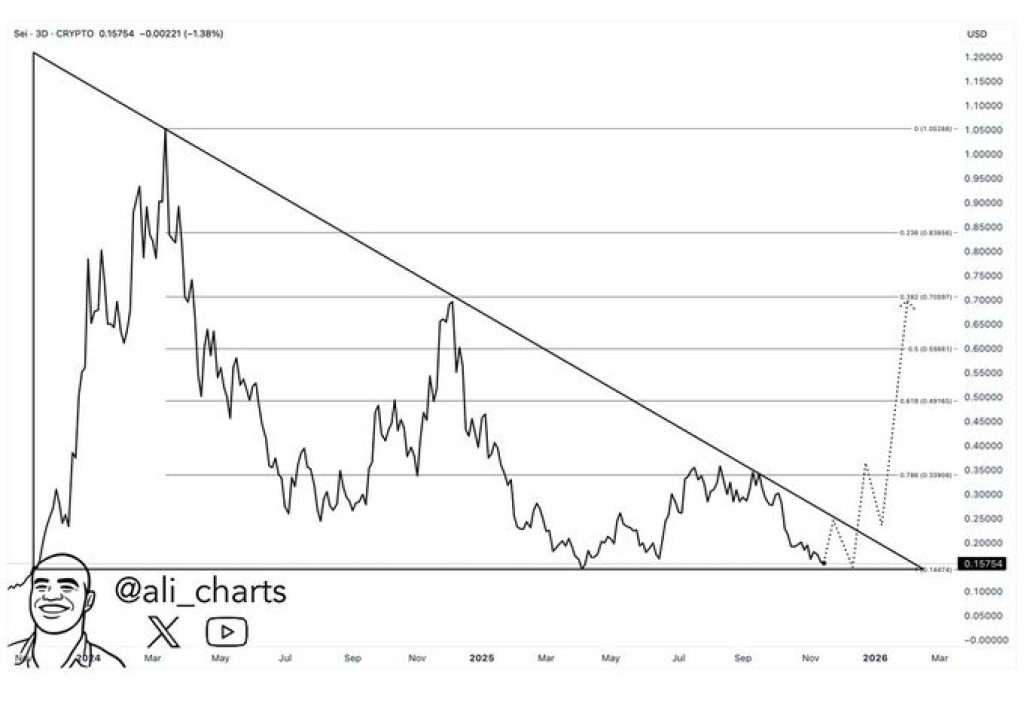

Chart Analysis for SEI

Analyst Ali identifies the $0.15–$0.13 range as an optimal accumulation zone. He suggests that this area could serve as a launchpad for a potential rally towards $0.70, representing a possible 400% increase.

The chart indicates that the SEI price is approaching the conclusion of a significant descending structure, a pattern often associated with major market reversals.

Analyst Sjuul has also pointed out a strong bullish divergence. While the price has been declining, the RSI has been trending upward, suggesting a potential loss of control by sellers.

The SEI price has historically bounced off this same support zone multiple times over the past two years, reinforcing the conviction that buyers remain actively engaged in defending this level.

Furthermore, the network's on-chain metrics represent arguably SEI's most significant strength. The addition of over 230,000 users in a single day, at a time when the broader market is experiencing a slowdown, is an exceptional development.

With a user base of 81.5 million and millions of daily transactions, the network is exhibiting growth patterns that often translate into price appreciation over time.

Wow, so if there are 560M crypto users, and the @SeiNetwork has 81.5M users, that’s an estimated 15% of the entire crypto population on Sei… 🤯

— Sjuul | AltCryptoGems (@AltCryptoGems) November 18, 2025

In the last 24 hours alone, as you can see on Seiscan, over 230,871 new users have been onboarded. Needless to mention, this time last… https://t.co/SzvYyio0dG pic.twitter.com/ipDV0La5bq

SEI Price Outlook: Potential for a 400% Rally

As long as SEI maintains its position above the current support zone, the chart suggests ample room for a stronger recovery. The initial resistance level is observed around $0.22–$0.25. A successful breach of this area could pave the way for a move towards the $0.32 region, which has previously acted as significant resistance.

If momentum continues to build and the broader market begins to recover, the $0.70 target could become a realistic objective, aligning with the projected 400% increase.

Should the SEI price fall below the identified support area, the current bullish setup would require more time to develop. However, at present, there are no indications on the chart of an impending breakdown, and buyers continue to actively defend this price level.

In summary, SEI stands out as one of the few altcoins demonstrating concurrent strength in its price structure, on-chain growth, and user demand. Support is holding firm, bullish divergence is accumulating, and adoption is expanding rapidly.

The realization of the full 400% potential move will be influenced by overall market conditions. Nevertheless, the SEI price is currently exhibiting greater resilience compared to most of the top-100 cryptocurrencies.