Market Overview and Technicals

Sei ($SEI) is currently exhibiting a falling wedge pattern on its hourly chart, with its price consolidating around the $0.188 mark. This pattern is defined by resistance levels between $0.195 and $0.20, and support near $0.178, indicating a period of consolidation. This consolidation phase suggests a potential breakout, with immediate upside targets identified at $0.207 and $0.223, aligning with Fibonacci retracement levels. A confirmed breach above the falling wedge pattern could validate a short-term bullish reversal and propel SEI towards the $0.22 level.

Momentum indicators on lower timeframes currently support the possibility of a breakout, as buying interest has been observed near the support zones. As of the latest update, SEI is trading at $0.1947, marking a 2.70% increase over the past 24 hours, despite a slight hourly pullback.

Furthermore, the weekly chart reveals a macro bull flag pattern with two potential breakout points identified at approximately $0.67 and $1.40. This broader bullish structure suggests a potential for sustained continuation, which could drive SEI towards the $2.93–$3.00 range during an extended market rally.

On-Chain Metrics and Ecosystem Growth Bolster Momentum

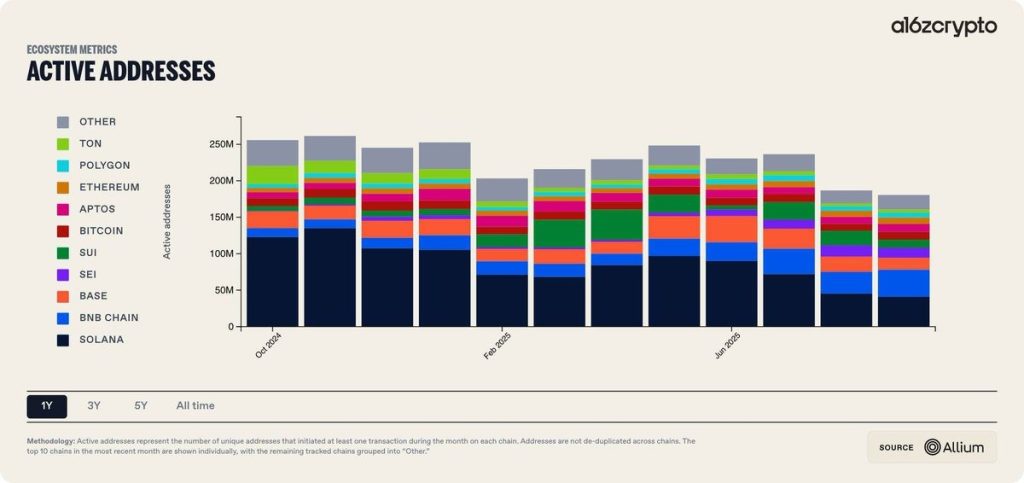

Sei demonstrated significant user activity in September 2025, recording over 13.1 million monthly active addresses. This figure surpasses notable networks such as Ethereum, Polygon, and Aptos, highlighting growing user engagement and network demand. This surge in activity is further supported by robust decentralized exchange (DEX) volume, which exceeded $10 billion in the third quarter.

The increase in usage has propelled SEI to the fifth position globally in terms of active addresses, according to data compiled by Allium. While BNB Chain and NEAR continue to lead in this metric, Sei's consistent growth indicates its increasing relevance in the market.

In anticipation of the upcoming Giga upgrade, Sei Labs has been optimizing node performance by evaluating various storage backends to enhance network speed. Benchmarks indicate that RocksDB achieved a 10–40x reduction in latency for indexing-heavy historical queries, leading to a significant improvement in node responsiveness.

The Giga upgrade is set to introduce sub-400ms transaction finality and a throughput capacity of 5 gigagas per second, with the aim of supporting over 200,000 transactions per second. As these technical advancements align with the observed bullish chart patterns, SEI is well-positioned to benefit from the ongoing altcoin market cycle.