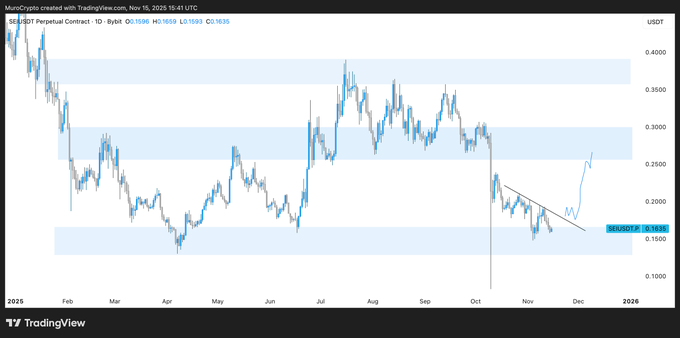

SEI Retests Long-Term Support Structure

SEI moves within a narrow trading structure as price retests a familiar support zone that shaped earlier trading cycles. Market activity stays controlled, and traders watch its response to the descending resistance overhead.

SEI returns to an established support region that has influenced price behavior through much of 2025. The token sits near the lower accumulation band, a zone that has reacted during previous downturns. This area once again guides buyer decisions as the market gauges stability.

Analyst Muro (@MuroCrypto) notes the retest aligns with broader altcoin structures. Many assets show similar patterns, pressing into earlier demand zones before forming potential recovery bases. SEI’s positioning mirrors this trend as price interacts with levels that shaped past rebounds.

The support region between $0.14 and $0.16 has produced multiple reactive bounces. SEI trades around $0.1652 today, staying close to the upper boundary of this zone. The market watches whether this level can sustain participation long enough for a renewed challenge of its descending structure.

Diagonal Resistance Limits Breakout Attempts

A clear descending trendline shapes SEI’s recent trading range. This diagonal barrier has directed lower highs from early October into mid-November. It defines the current compression pattern and signals restrained momentum across each recovery attempt.

SEI continues to react to this resistance on every upward move. These muted bounces reflect softer liquidity and cautious positioning across the altcoin landscape. Buyers remain active near support yet struggle to create sustained pressure above this line.

Muro’s chart outlines a potential path should SEI close beyond the trendline. A breakout could initiate an early expansion phase, with the next target cluster between $0.22 and $0.25. That zone served as heavy supply across mid-year trading and may reappear as a key reaction area.

Intraday Activity Shows Controlled Volatility

SEI trades between $0.161-$0.1664 during the latest session, with a mild 0.5% gain. The intraday structure shows frequent swings that return to mid-range levels as short-term traders respond to brief pullbacks. This pattern supports stability but limits directional conviction.

Market cap sits near $1.05 billion, keeping liquidity steady while leaving room for reactive swings during active sessions. The $68 million daily volume signals engagement yet remains below levels seen during stronger phases. The gradual cooling in volume reflects measured participation.

Circulating supply remains fully liquid at 6.37 billion SEI, allowing price action to track shifts in demand. The token holds its floor near $0.16 as buyers step in during short dips. Consistent reactions at this level keep SEI within its tight band as the market awaits a trendline test.