SEI Forms Accumulation Zone After Prolonged Correction

SEI is trading at around $0.183 following a period of decline, and traders are looking at a significant accumulation zone at about $0.15.

A subsequent rally to a level of above $0.24 may verify a reversal to the bull, aiming at resistance at around $0.37.

Trading volumes surge over 50% on Binance, showing renewed market participation and improved short-term sentiment.

SEI is becoming critical at a low of about $0.15, which is attracting market attention owing to the traders predicting a potential rebound phase after several months of corrective price action. Technical signals indicate that the selling pressure is slowing down and this is an indication of a possible mid-term recovery.

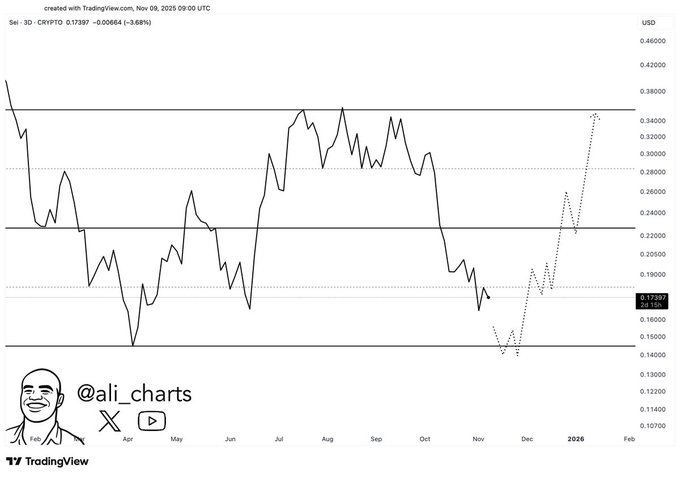

Market analyst Ali (@ali_charts) shared a technical chart suggesting that SEI could be forming a base near $0.15 before a potential 165% rally toward $0.37. The analysis outlines a descending pattern that may be approaching exhaustion, reflecting a market transition from distribution to accumulation. The structure indicates that price compression and declining volatility often precede stronger reversals.

The $0.15 level aligns with historical support that previously marked recovery points during earlier downturns. Over the past months, SEI has maintained a series of lower highs and lower lows, but recent narrowing movements point to fading bearish momentum. This confluence of support and reduced volatility positions the $0.15–$0.16 range as a logical entry point for investors awaiting confirmation of a trend shift.

Should SEI level at this support zone, traders may observe the development of a double-bottom formation, a typical reversal indicator to prove that sellers are losing their grip. A slow price increase beyond $0.18 would reinforce this situation, and possibly trigger a short-term recuperation period up to $0.22-$0.24.

Market Structure Shows Early Signs of Stabilization

As of writing data indicates SEI is trading around $0.183 with daily volume exceeding $166 million. The token has increased by an average of 1.67 percent and 17.75% within the past 24 and 7 days respectively. These developments demonstrate slight recovery impetus after significant falls in a large part of 2025. Although its short-term results are good, SEI is still at a loss of 60.95% year to date due to the market caution.

Exchange activity shows Binance and Bybit leading SEI/USDT trading, with Binance alone posting over $80 million in daily turnover — a 53% increase from the previous session. Such volume surges often indicate renewed market participation as traders position ahead of potential reversals. Consistent pricing across top exchanges also reflects stable liquidity, reducing volatility risk during active sessions.

The increased trading activity coincides with improving sentiment among participants. Long/short ratios on Binance show a favorable bias toward long positions, with most traders expecting near-term upside. This optimism, while encouraging, also raises short-term correction risks should the market encounter resistance near the $0.19–$0.24 zone.

Bullish Reversal Scenario and Technical Roadmap

For SEI to confirm a full reversal, price must sustain above $0.24 — the neckline of its current base formation. A decisive breakout at that level could validate a mid-term trend reversal and potentially pave the way for a rally toward $0.34–$0.37. This target aligns with prior resistance levels from SEI’s mid-year highs, suggesting a technical retracement of the preceding decline.

The chart shared by Ali projects a structured recovery rather than an immediate surge, with gradual progression marked by higher lows and periodic rejections. Such a formation often reflects organic recovery as market confidence rebuilds after extended drawdowns. Traders may observe moderate resistance around $0.19 before stronger movement develops above $0.24.

From a technical standpoint, the $0.15 area remains the key risk management zone for traders. The bigger recovery picture will still be true as long as SEI is structured at a point beyond this threshold. A continuity of the trading volume, the positive sentiment and the stabilization at higher than $0.18 could be the basis of the next higher leg to the estimated target of $0.37.